Answered step by step

Verified Expert Solution

Question

1 Approved Answer

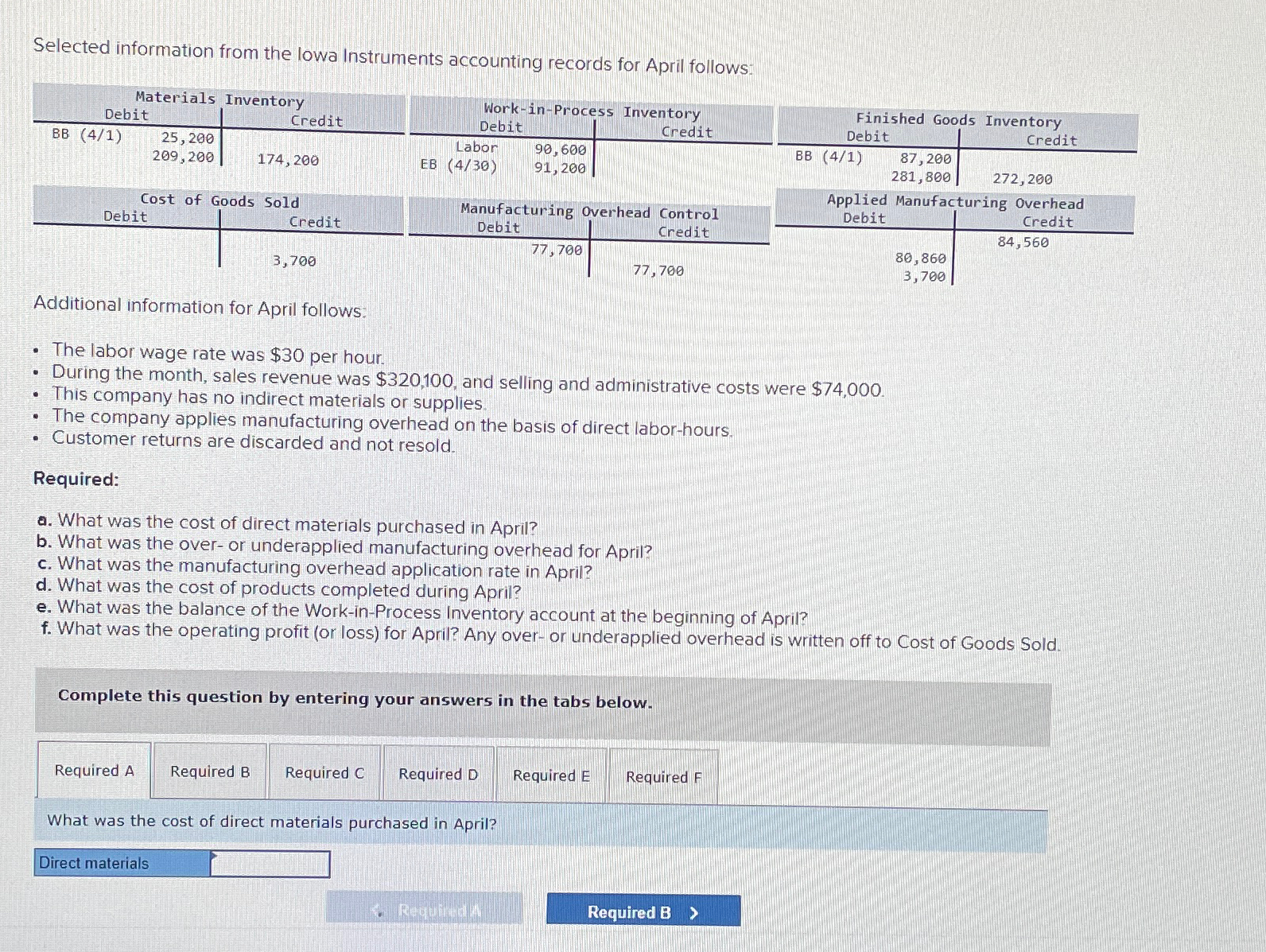

Materials Inventory Selected information from the lowa Instruments accounting records for April follows: Work-in-Process Inventory Debit Credit Debit BB (4/1) 25,200 209,200 Labor 174,

Materials Inventory Selected information from the lowa Instruments accounting records for April follows: Work-in-Process Inventory Debit Credit Debit BB (4/1) 25,200 209,200 Labor 174, 200 EB (4/30) 90,600 91,200 Cost of Goods Sold Debit Credit Manufacturing Overhead Control Debit Credit 77,700 3,700 77,700 Finished Goods Inventory Credit Debit Credit BB (4/1) 87,200 281,800 272,200 Applied Manufacturing Overhead Debit Credit 84,560 80,860 3,700 Additional information for April follows: The labor wage rate was $30 per hour. " During the month, sales revenue was $320,100, and selling and administrative costs were $74,000. This company has no indirect materials or supplies. The company applies manufacturing overhead on the basis of direct labor-hours. Customer returns are discarded and not resold. Required: a. What was the cost of direct materials purchased in April? b. What was the over- or underapplied manufacturing overhead for April? c. What was the manufacturing overhead application rate in April? d. What was the cost of products completed during April? e. What was the balance of the Work-in-Process Inventory account at the beginning of April? f. What was the operating profit (or loss) for April? Any over- or underapplied overhead is written off to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required A Required B Required C Required D Required E Required F What was the cost of direct materials purchased in April? Direct materials Required A Required B >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started