Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MATH 1095 CASE STUDY A mortgage for $150 000 is amortized over twenty-five years with an interest rate of 5.35% compounded semiannually. 1. Find

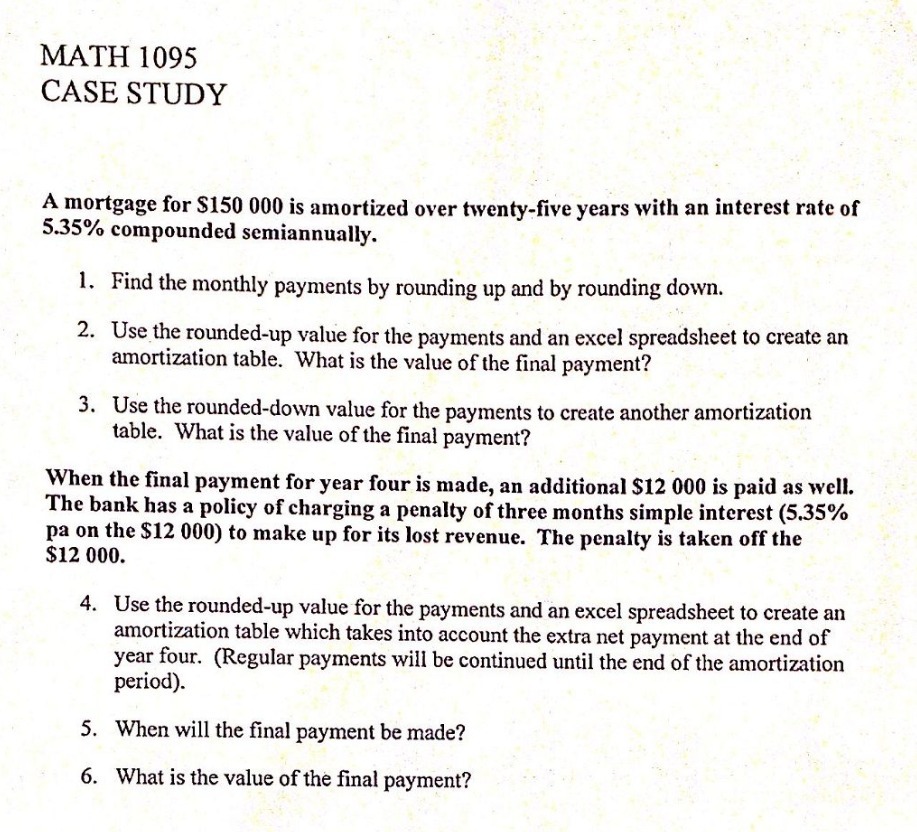

MATH 1095 CASE STUDY A mortgage for $150 000 is amortized over twenty-five years with an interest rate of 5.35% compounded semiannually. 1. Find the monthly payments by rounding up and by rounding down. 2. Use the rounded-up value for the payments and an excel spreadsheet to create an amortization table. What is the value of the final payment? 3. Use the rounded-down value for the payments to create another amortization table. What is the value of the final payment? When the final payment for year four is made, an additional $12 000 is paid as well. The bank has a policy of charging a penalty of three months simple interest (5.35% pa on the $12 000) to make up for its lost revenue. The penalty is taken off the $12 000. 4. Use the rounded-up value for the payments and an excel spreadsheet to create an amortization table which takes into account the extra net payment at the end of year four. (Regular payments will be continued until the end of the amortization period). 5. When will the final payment be made? 6. What is the value of the final payment?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started