Answered step by step

Verified Expert Solution

Question

1 Approved Answer

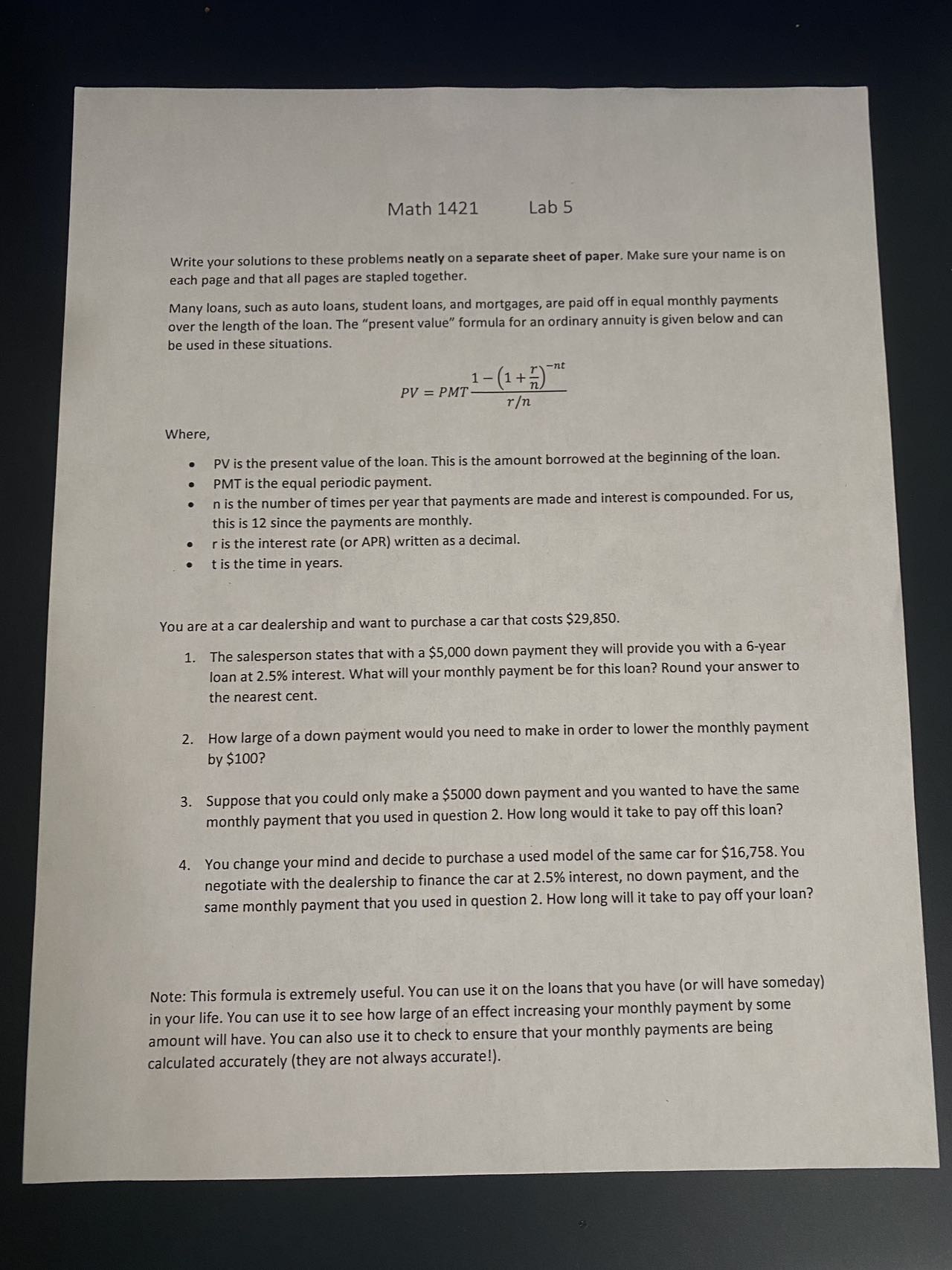

Math 1421 Lab 5 Write your solutions to these problems neatly on a separate sheet of paper. Make sure your name is on each

Math 1421 Lab 5 Write your solutions to these problems neatly on a separate sheet of paper. Make sure your name is on each page and that all pages are stapled together. Many loans, such as auto loans, student loans, and mortgages, are paid off in equal monthly payments over the length of the loan. The "present value" formula for an ordinary annuity is given below and can be used in these situations. Where, -nt 1-(1+ PV=PMT- r/n PV is the present value of the loan. This is the amount borrowed at the beginning of the loan. PMT is the equal periodic payment. n is the number of times per year that payments are made and interest is compounded. For us, this is 12 since the payments are monthly. r is the interest rate (or APR) written as a decimal. It is the time in years. You are at a car dealership and want to purchase a car that costs $29,850. 1. The salesperson states that with a $5,000 down payment they will provide you with a 6-year loan at 2.5% interest. What will your monthly payment be for this loan? Round your answer to the nearest cent. 2. How large of a down payment would you need to make in order to lower the monthly payment by $100? 3. Suppose that you could only make a $5000 down payment and you wanted to have the same monthly payment that you used in question 2. How long would it take to pay off this loan? 4. You change your mind and decide to purchase a used model of the same car for $16,758. You negotiate with the dealership to finance the car at 2.5% interest, no down payment, and the same monthly payment that you used in question 2. How long will it take to pay off your loan? Note: This formula is extremely useful. You can use it on the loans that you have (or will have someday) in your life. You can use it to see how large of an effect increasing your monthly payment by some amount will have. You can also use it to check to ensure that your monthly payments are being calculated accurately (they are not always accurate!).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started