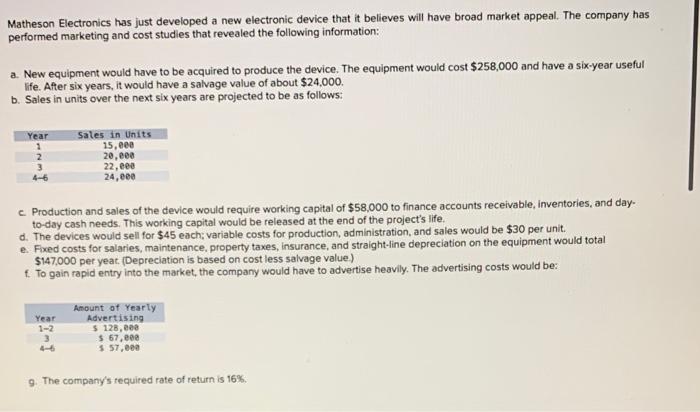

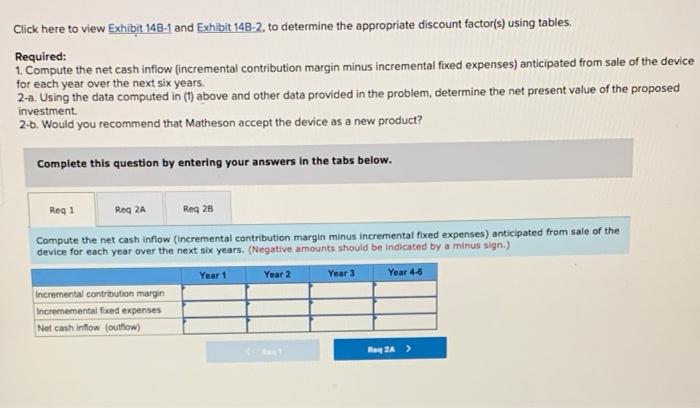

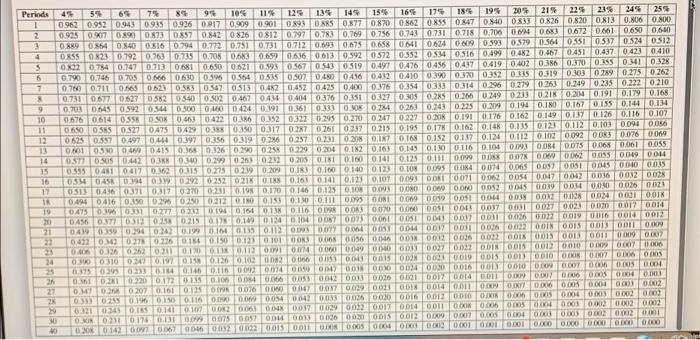

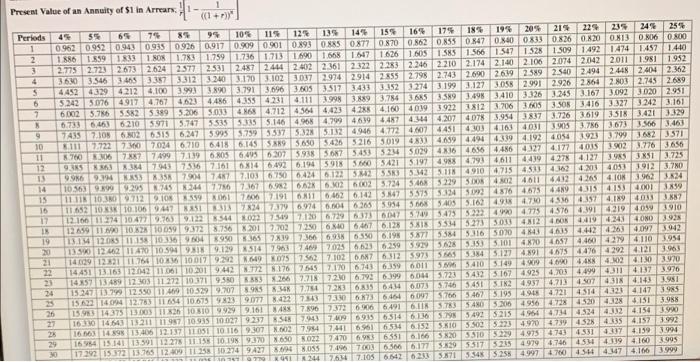

Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost $258,000 and have a six-year useful life. After six years, it would have a salvage value of about $24,000 b. Sales in units over the next six years are projected to be as follows: Year 1 2 3 4-6 Sales in Units 15, eee 20, een 22, eee 24,000 c Production and sales of the device would require working capital of $58,000 to finance accounts receivable, inventories, and day. to-day cash needs. This working capital would be released at the end of the project's life, d. The devices would sell for $45 each: variable costs for production, administration, and sales would be $30 per unit. e. Fixed costs for salaries, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $147,000 per year. (Depreciation is based on cost less salvage value) To gain rapid entry into the market, the company would have to advertise heavily. The advertising costs would be: Year 1-2 Amount of Yearly Advertising $ 128,000 $ 67,000 $ 57.ee 9. The company's required rate of return is 16% Click here to view Exhibit 148-1 and Exhibit 148-2. to determine the appropriate discount factor(s) using tables. Required: 1. Compute the net cash inflow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next six years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment 2-6. Would you recommend that Matheson accept the device as a new product? Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Compute the net cash inflow (incremental contribution margin minus incremental foed expenses) anticipated from sale of the device for each year over the next six years. (Negative amounts should be indicated by a minus sign.) Year 1 Year 2 Year 3 Year 4-6 Incremental contribution margin Incrememental foed expenses Net cash inflow (outflow) Reg 2A > 59 EN 1 SSRO LESO Periods 1 2 3 4 5 6 7 SSWO 8 OLEO SOCO ! 9 10 11 12 13 14 OSOTOVO SOCO SSOO SSD ZUTO MOTO NUOSTO 6600 100 6100 STOOORTO SHOO COOLSTO STO 49 55 79 91 10% 12 135 15 165 175 18' 195 20% 214 225 239 24% 255 0.9630952 0.943 0915 0.926 0917 0.9090901 0.893 O 850 877 0.870 0.862 0855 0.8470840 0.833 0.826 0.820 0.813 0.806 0.800 0925 0907 08 0.873057 0.42 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.2009 0.6 0.672 0.661 0.650 06-10 0.89 08540 8400316 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 06 0.624 0.009 0.593 0.579 0.364 0351 0.524 0512 0423 0.792 0.763 0:735 0.705 0.63 0.659 0636 0013059205720352 0534 0.516 0.499 0,482 0467 0451 0437 042 0410 02 0.784 0.147 0713 0.681 0.650 0.021 0.598 0.567 05:43 0519 0.497 04160456 0.437 04190402 0.386 0.370 0.355 0.341 0.324 0.790 0.746 0705 0.666 0610 0.56 0.564 0.335 0507 0.40 0.456 0.432 0410090 0.300.352 03350319 0.03 0290275 0.262 0.750 0.711 0.665 0.623 0.53 0.567 0513042 0.452 0425 0400 0376 0.354 0.339 0.314 0.296 0279 0263 0.249 0.235 0.222 0.210 0.731 0677 0.627 0520540 0.500 04670444 04040.376 0.151 0.127 0.25 0.265 0.2490 233 0.215 0.20 0.191 0.179 0.168 0.70 0.450.592 0.544 0.300 0.160 0/424 0.91 0361 0333 OOK 0 24 0.263 0.243 0325 0.209 0.19 0.18 0.167 0.155 0.144 1 0.676 0614 0.558 OSOK 0463 0422 036 0352 0.22 0.295 0.20 0.347 0227 0.20 0.1910.176 0.162 0.149 0.17 0.126 0.116 0.107 0650 OSS 0.527 0475 0429 01 10 0317 0.27 0.261 02370215 0.195 0.17 0.162.10.135 07200.1120103 0.094 0056 0.625 0.557 0.497 0.464 0.3970356 0.319 0286 0.257 0.231 0.3087 0.16 0.152 0.17 0.1240112 0103 0.092 DOR3 0.076 0.069 04670415 03640126 0202 0229 0204 0.12 0.16 0.145 0.130 0 116 0.104 00 OOR 4 0075 0.068 0.001 OST 044203 030 029 020 0212 02050181 0.100.141 0.125 0.111 01555074810417 TO 162 0315 0.275 0.29 UM 0.13 0100 100.123 TOTON 0040074 005 0045 0.161 0141 0.125 0.07 0.093 000071 002 00560047 0042003600N2002 051 046 0371 031702700281 0.19 0.10 0.16 0.125 0.108 0.00 OOO OO OOO 00320045 0039 0.01 0.000 0.025 0.02 04 04160.150 0212 DINO 0.15 TO 0.111 293 ON 009 009 0.051 0044 0024001 OOK 030131 0.2770 01940 1640 0.116 0.03 000 000 0037 0456 OTROS 025 021500144 0.134 0.1040057 0051 OM DIT OO 006 OD 0019 0600140012 040 33902980220.19 0164 0.15 0.1200000000000000060033 0011 00150010011 0009 041200276 0230 DIAS 0.120101 OOR3 0.0005 004 000012636 000 DOIS 0015 00130011 0009 0002 00012002200000.11300009 00 00 00 003 DIO 0100342 097 0.15 0.12002 0020000500013 ODNO 0019 05 OOOOOOOO006 03150040.116 0110 0074009004 OOO 0034 00200016 00 OOO OD 0.100 00 00 0.05 004200 0026 021 DO 0014 DOL O ODOS OH 0001 OM 0.009 OX 0302551 0.15001100 0005 004 003 002 0030 ODI OD ODIO ODON 0.003 01002000 010 YOO 0061 000170629 0000170014 DI COOK O 000 0.00 0.00 0.002 OUR 0.231 0176 BIO OITS 0.057O014 00 0000 0020 560120 000 020 1420 6067 0.000000 0000 0 SE 16 11 REDITO ISOLADOMOSYOSO ISO OSZOWO SLYO NETOLEDO ROO PODA100 000 COOL200 TO ONDO 190000 19 20 21 22 23 34 25 2 22 2x LOTO TO OTO CIOCIDO SOTO WD TO CINTO 1000 SELOORINTOTO LODHOOD MOSTO 1910 COCOWO TOP09RIODO 1000 OKTO COOOOO WO MOTO SEXTO COD TO HOSTEDITED SODO TOTODATO SONO TOTOOSID UUDIO ID 10 TOTOXIO TODO TOTO M - Present Value of an Annuity of $1 in Arrears ((1+r))" + I 59 1 CE E OVE SVE 3337 1661 6NSE SOWE NOSE CLES 40 OL TORT SNE 6 WR HC61966 CS VSE 106 WTS GETS PWE ME Periods 45 55 79 85 95 1045 115 123 135 145 154 16% 179 1894 1995 20% 215 224 235 24% 25% 1 0962 0.9920943 0935 0926 0.917 0.9090901 089 085 0877 0.870 0.862 0.855 0.847 0.8400833 0.836 0.x20 OXI3 0.06 ONDO 2 1886 1.859 1 NON 1.783 1.759 1.736 1.713 1690 1.668 162 1626 1605 1385 1 566 1.5471525 1509 1492 1474 1.457 1.440 2.775 2.723 2673 2.624 2577 2331 2487 2.444 2.40223612322 223 2246 2210 2174 2.140 2.100 2.074 2.042 2011 1981 1952 4 3546 3.31232403.120 3.102 3037 29742914 255 27952.7432690 2619 2.389 2540 2.494 2.448 2.404 2.362 5 4452 4329 4212 4.100 3.999 3.791 3.696 3.603 3517 3433 3.152 3.274 31993.127 3058 2.991 2.9262.864 2.803 2.745 2.689 6 5.242 50764917 4.761 4623 4486 4.355 4.231 4.111 3.8893.784 365 3.498 34103.126 3.2453167 3.092 3020 2951 7 6002 5.76 5.52 5.389 5.2065033 4 NA 4.712 4564 4,423 4.254.100 40191922 1812 3706 1416 3.322 9 2423.161 6.738 6.463 6210 5971 5.747 5535 5.146 4.968 4.799 4619 4467 4.14 4207 4078 3.9543837 3.726 3619 3518 3421 3329 9 74357.100 602 6515 6,247 5.9955.7593537 5.32 151324946 4.772 4607 4451 4303 41014031 05 3.7K63673 3.506463 10 17722 7034 6.210 6.4186.145589 5.650 465216 S019 48334459 4494 43394192 1923 3799 3652 3571 11 70 06 7x77499 7.119 608 62956207 5.938 567 5453 152345029436 465644864327 4.1774015 3.902 3.776 3456 12 384 7943 751617161 1464926.194 5918 5421 5.197 4988 4.793 4.611443942784127 3953XS13.725 15 7670675064246.122 SMS SR 53425 115 49104715 4511 4162 403119123.70 14 1036399 9.2957457224477 73672 DAN 6. 02 5.72437462 52295 4102461164124265 4.10 15 9.105 3559 3061 76067191 6.142 S475575 5512490 48764.675 4495 41534001 16 11652 10 10 1069447 337347379 6974 6,604 6203505456 54055.163 4918 4710 45164352 4.189 4083 352 12160121410477.763 9.122 544 3002759 710 6.739 6377 59 5475 5232904775 4576 4.391 4219400 3910 IN 127659 110 10100999372 8.756 2017037250610 6,467 6.124 SKIS 53345273503348124043419 4243 ONO 3935 19 131141OS 11.158 1033694 8950 7239 7366 598 65506.198 SAT? 5584 516 500 443 442 426140973042 20 15124211470 10.5 9 9.129514 793 7462 20256.6362593929 5625 40057 4.450421941103.954 21 1469 12321 1.766 1010017922 649 075175271020763125973 5665 4675 476 4 292 41203863 22 14451 13 163 1204211061 10.2019.442 172 17676457.00 6.7436359 6011 5.410 5.149 4209 4 4.4K 20 1451489 1123 11 272 10.371 9.580 SR 26677187206.7926.399 0.0445.723542 5.1674925 4.703 4490 4.137 3.976 24 15 247 13299 12.550 11105299.707 89858.368 7.7147.236.35 64146.073574545 5.1K24.937 4.7834507 43184.143 1.951 150 1494 12 753 1654 10.675923907784227343 6097 S75.462 5.195 4.9 4221 4323 4147 395 26 15 14 375 13:00 1326 10 50 929 9.161 78963726900 6491 6.11 5.73 540 SY 4956 4723 450 5.088 16014642132111957 10 935 100279237 BASER 79 74969156.514 6136 5.195492 4524 4132 4.154 25 16.1489 1406 12137 11051101169307 X 27.94 6534 6.152 5.KIO 5.500 5.223 4970 4.794525 4335 4157 3992 29 16 15.141135011227511.15 10.19 9.370 7470 . 6351 6.166 320551032294975 4743 4159 1994 1722 15.372 13.745 120 125 102789427 7496 700 6.506 6.177 SK1955175205 4.979 4.76 451 4.119 4.100 3995 96470566420.23358715345255 4.997 4700 4544 4.347 4.1016 3999 ZIELONCOLI 2919TIVO ISTA SEV ESES PRES TOS LIS TON COT OLEOST? WWS 4311 PIS POLONEL NE ISIT 0001 OSOITETSLENSSI PELT 196SICS LE 19 L TIL 1959 IES! LEFT TOSOS SSOWE ELLO ht ITE 16