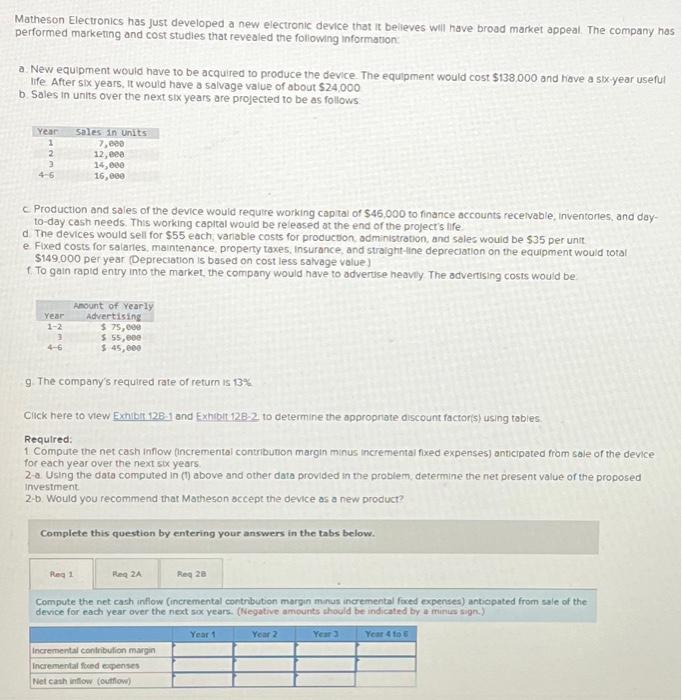

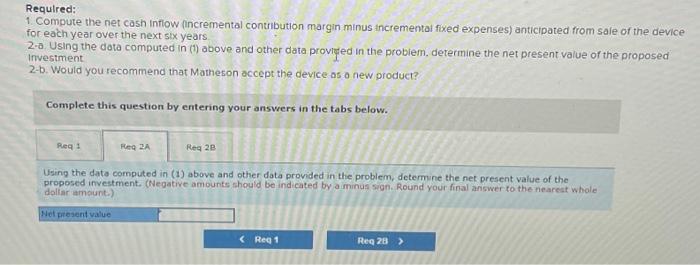

Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed markeung and cost studles that revealed the following information: a. New equipment would have to be acquired to produce the device. The equipment would cost $138,000 and have a six-year usefut ife After six years, it would have a salvage value of about $24,000 b. Sales in units over the next six years are projected to be as follows C. Production and sales of the device would require working capital of $46,000 to finance accounts recelvable, inventories, and doy-to-day cash needs. This working capital would be released at the end of the project's life d. The devices would sell for $55 each, variable costs for production administration, and sales would be $35 per unit e. Fixed costs for salartes, maintenance, property taxes, insurance, and straight-line depreciation on the equipment would total $149,000 per year (Depreciation is based on cost less salvage value) f. To gain rapid entry into the market, the company would have to advertise heavly The advertising costs would be 9. The company's required rate of return is 13% Cick here to view Exhibit 128-1 and Exhibit 128-2 to determine the appropriate discount factoris) using tables. Required: 1 Compute the net cash infiow (incrementai contribution margin minus incremental ixed expenses) anticipated from sale of the device for each year over the next scx years. 2-a. Using the data computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment. 2-b. Would you recommend that Matheson occept the device as a new product? Complete this question by entering your answers in the tabs below. Required: 1. Compute the net cash infiow (incremental contribution margin minus incremental fixed expenses) anticipated from sale of the device for each year over the next slx years 2-a. Using the data computed in (1) above and other data provifed in the problem, determine the net present value of the proposed investment 2-b. Would you recommend that Matheson accept the device as o new product? Complete this question by entering your answers in the tabs below. Using the date computed in (1) above and other data provided in the problem, determine the net present value of the proposed investment. (Negative amounts should be indicated by a iminus sign. Round your final answer to the nearest whole deliar ampunt.) Net present value