Question

Matthews & Bros. is a local landscape construction company. In analyzing financial performance, the cost accountant compares actual results with a flexible budget. The standard

Matthews & Bros. is a local landscape construction company. In analyzing financial performance, the cost accountant compares actual results with a flexible budget. The standard direct labor rates used in the flexible budget are established each year at the time the annual plan is formulated and held constant for the entire year.

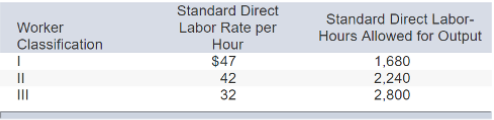

The standard direct labor rates in effect for the current fiscal year and the standard hours allowed for the actual output of work for July are shown in the following schedule:

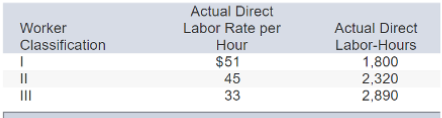

The wage rates for each labor class increased under the terms of a new contract. The standard wage rates were not revised to reflect the new contract. The actual direct labor-hours worked and the actual direct labor rates per hour experienced for the month of July were as follows:

Required:

Calculate the dollar amount of the total direct labor variance for July for Matthews & Bros. and break down the total variance into the following components:

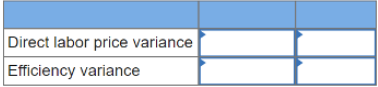

a. Direct labor price and efficiency variances. (Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.)

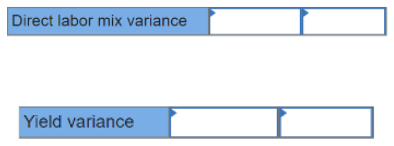

b. Direct labor mix and yield variances. (Do not round intermediate calculations. Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.)

Worker Classification I == ||| Standard Direct Labor Rate per Hour $47 42 32 Standard Direct Labor- Hours Allowed for Output 1,680 2,240 2,800 Worker Classification I Actual Direct Labor Rate per Hour $51 45 33 Actual Direct Labor-Hours 1,800 2,320 2,890 Direct labor price variance Efficiency variance Direct labor mix variance Yield variance

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Calculate the direct labour price variance as ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started