Question

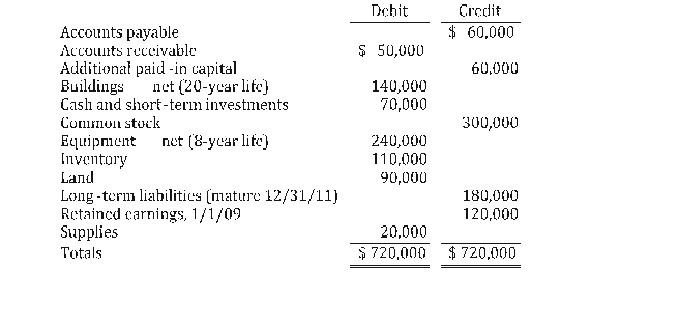

Matthews Co. obtained all of the common stock of Jackson Co. on January 1, 2009. As of that date, Jackson had the following trial balance:

Matthews Co. obtained all of the common stock of Jackson Co. on January 1, 2009. As of that date, Jackson had the following trial balance:

During 2009, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2010, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2009, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years. Matthews decided to use the equity method for this investment.

Required:

(A.) Prepare consolidation worksheet entries for December 31, 2009.

(B.) Prepare consolidation worksheet entries for December 31, 2010.

Accounts payable Accounts receivable Additional paid-in capital Buildings ne:t (20-y-ar lit] Casli and short-terin investments Comifiion stuck Eyleipnicht net (8-year lite) Inventory Land Long-term liabilities (nature 12/31/11) Retained carnings, 1/1/09 Supplies Totals Dchit Credit $ 60,000 $ 50,000 60.000 140,000 70,000 300,000 240,000 110,000 90,000 180,000 120,000 20,000 $ 720,000 $720,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started