Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Matthews, Mitchell, and Michaels are partners in BG Land Development Company and share losses in a 5:4:1 ratio, respectively. The balance sheet on June

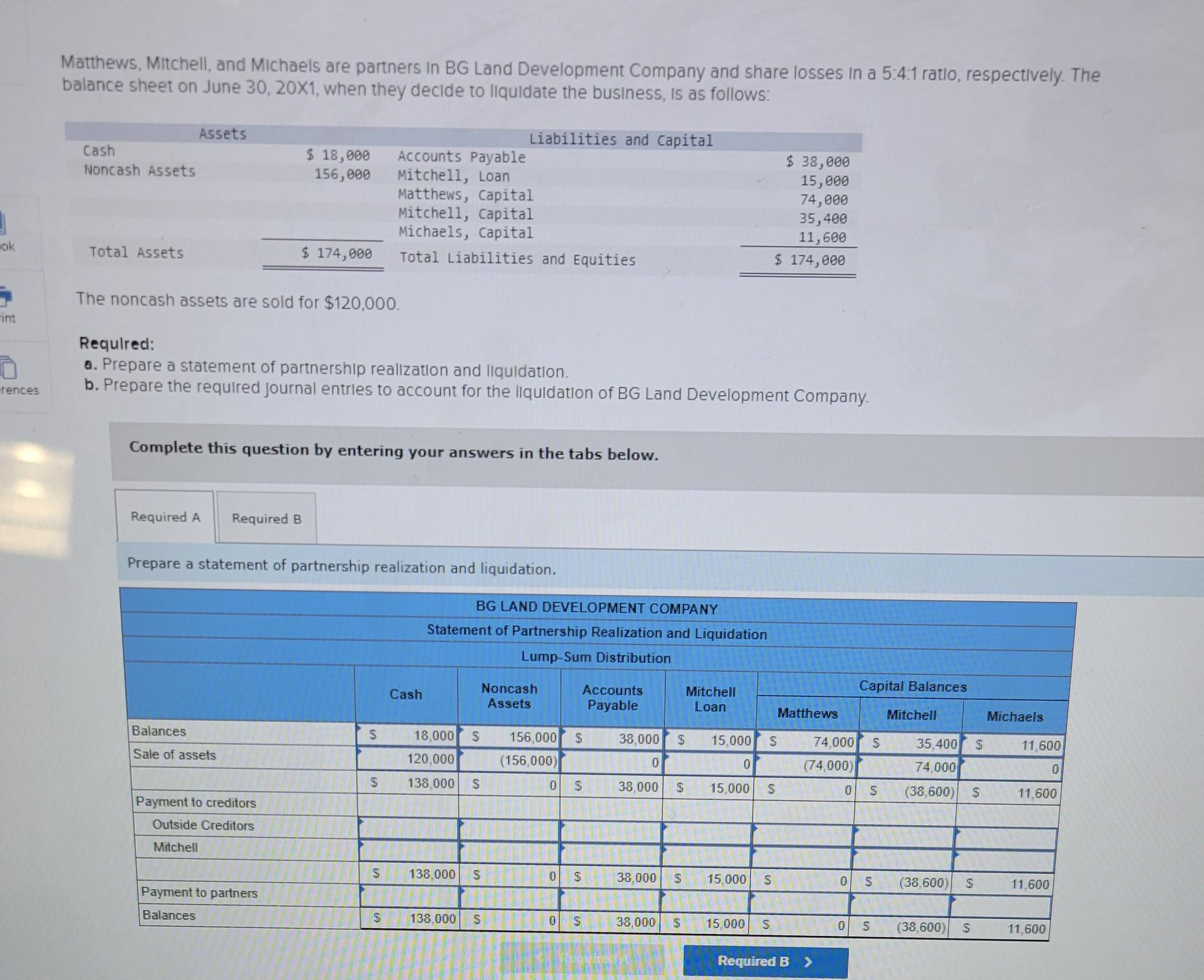

Matthews, Mitchell, and Michaels are partners in BG Land Development Company and share losses in a 5:4:1 ratio, respectively. The balance sheet on June 30, 20X1, when they decide to liquidate the business, is as follows: Assets Liabilities and Capital Cash Noncash Assets $ 18,000 156,000 Accounts Payable Mitchell, Loan $ 38,000 15,000 Matthews, Capital 74,000 Mitchell, Capital 35,400 Michaels, Capital 11,600 ok Total Assets $ 174,000 Total Liabilities and Equities $ 174,000 The noncash assets are sold for $120,000. int Required: rences a. Prepare a statement of partnership realization and liquidation. b. Prepare the required journal entries to account for the liquidation of BG Land Development Company. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a statement of partnership realization and liquidation. BG LAND DEVELOPMENT COMPANY Statement of Partnership Realization and Liquidation Lump-Sum Distribution Cash Noncash Assets Capital Balances Accounts Payable Mitchell Loan Matthews Mitchell Michaels Balances Sale of assets S 18,000 5 120,000 156,000 $ (156,000) 38,000 $ 15,000 S 0 0 74,000 S (74,000) $ 138,000 S 0 S 38,000 $ 15,000 S 0 S 35,400 S 74,000 (38,600) $ 11,600 0 11,600 Payment to creditors Outside Creditors Mitchell Payment to partners Balances 60 S 138,000 S 0 S 38,000 $ 15.000 S 0 S (38.600) S 11.600 S S 138,000 S D $ 38,000 S 15,000 S Required B > 0 S (38,600) $ 11,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started