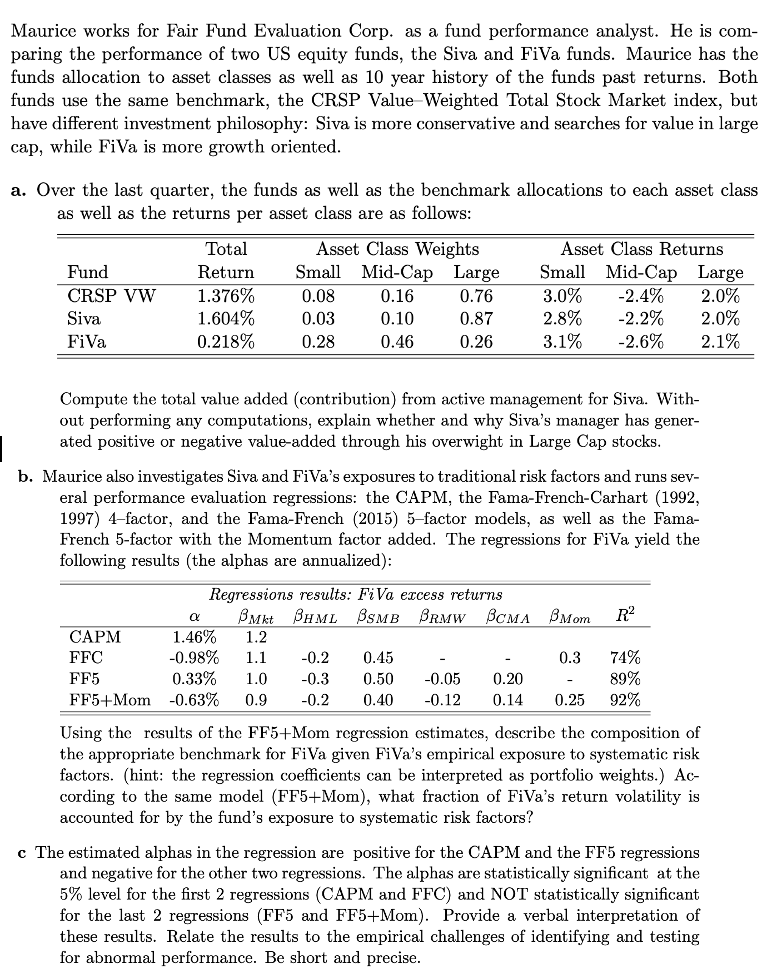

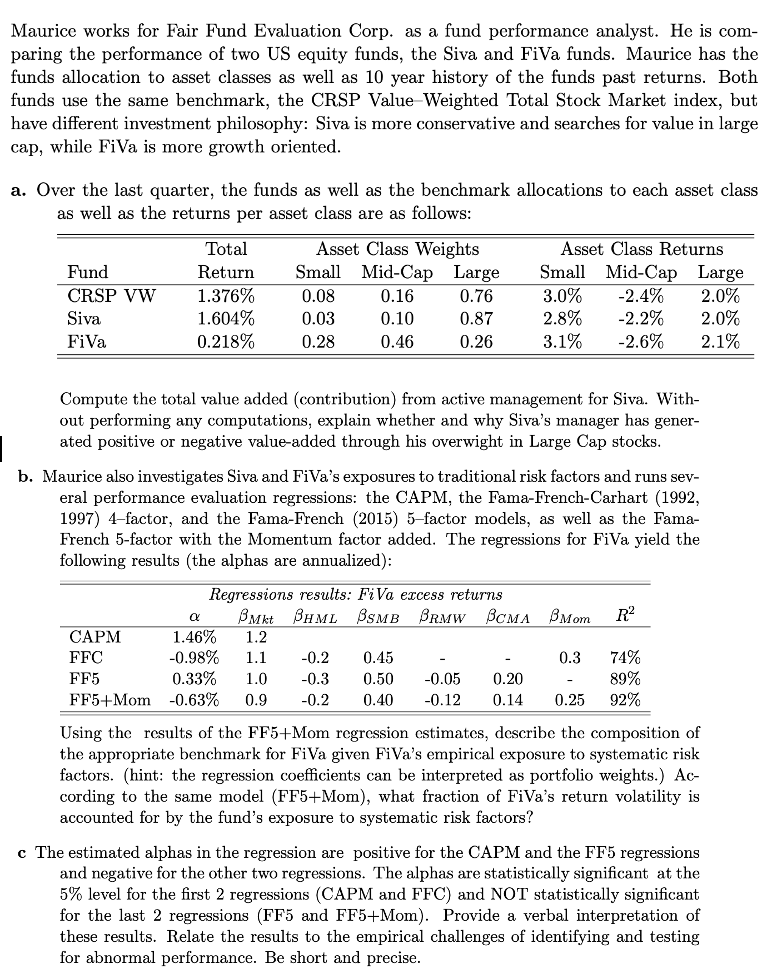

Maurice works for Fair Fund Evaluation Corp. as a fund performance analyst. He is com- paring the performance of two US equity funds, the Siva and FiVa funds. Maurice has the funds allocation to asset classes as well as 10 year history of the funds past returns. Both funds use the same benchmark, the CRSP Value Weighted Total Stock Market index, but have different investment philosophy: Siva is more conservative and searches for value in large cap, while FiVa is more growth oriented. a. Over the last quarter, the funds as well as the benchmark allocations to each asset class as well as the returns per asset class are as follows: Fund CRSP VW Siva Fiva Total Return 1.376% 1.604% 0.218% Asset Class Weights Small Mid-Cap Large 0.08 0.16 0.76 0.03 0.10 0.87 0.28 0.46 0.26 Asset Class Returns Small Mid-Cap Large 3.0% -2.4% 2.0% 2.8% -2.2% 2.0% 3.1% -2.6% 2.1% Compute the total value added (contribution) from active management for Siva. With- out performing any computations, explain whether and why Siva's manager has gener- ated positive or negative value-added through his overwight in Large Cap stocks. b. Maurice also investigates Siva and FiVa's exposures to traditional risk factors and runs sev- eral performance evaluation regressions: the CAPM, the Fama-French-Carhart (1992, 1997) 4-factor, and the Fama-French (2015) 5-factor models, as well as the Fama- French 5-factor with the Momentum factor added. The regressions for Fiva yield the following results (the alphas are annualized): Regressions results: FiVa excess returns BMkt SHML BSMB BRMW BCMA BMom R CAPM 1.46% 1.2 FFC -0.98% 1.1 -0.2 0.45 0.3 74% FF5 0.33% 1.0 -0.3 0.50 -0.05 0.20 89% FF5+Mom -0.63% 0.9 -0.2 0.40 0.14 0.25 92% C -0.12 Using the results of the FF5+Mom regression estimates, describe the composition of the appropriate benchmark for FiVa given FiVa's empirical exposure to systematic risk factors. (hint: the regression coefficients can be interpreted as portfolio weights.) AC- cording to the same model (FF5+Mom), what fraction of FiVa's return volatility is accounted for by the fund's exposure to systematic risk factors? c The estimated alphas in the regression are positive for the CAPM and the FF5 regressions and negative for the other two regressions. The alphas are statistically significant at the 5% level for the first 2 regressions (CAPM and FFC) and NOT statistically significant for the last 2 regressions (FF5 and FF5+Mom). Provide a verbal interpretation of these results. Relate the results to the empirical challenges of identifying and testing for abnormal performance. Be short and precise. Maurice works for Fair Fund Evaluation Corp. as a fund performance analyst. He is com- paring the performance of two US equity funds, the Siva and FiVa funds. Maurice has the funds allocation to asset classes as well as 10 year history of the funds past returns. Both funds use the same benchmark, the CRSP Value Weighted Total Stock Market index, but have different investment philosophy: Siva is more conservative and searches for value in large cap, while FiVa is more growth oriented. a. Over the last quarter, the funds as well as the benchmark allocations to each asset class as well as the returns per asset class are as follows: Fund CRSP VW Siva Fiva Total Return 1.376% 1.604% 0.218% Asset Class Weights Small Mid-Cap Large 0.08 0.16 0.76 0.03 0.10 0.87 0.28 0.46 0.26 Asset Class Returns Small Mid-Cap Large 3.0% -2.4% 2.0% 2.8% -2.2% 2.0% 3.1% -2.6% 2.1% Compute the total value added (contribution) from active management for Siva. With- out performing any computations, explain whether and why Siva's manager has gener- ated positive or negative value-added through his overwight in Large Cap stocks. b. Maurice also investigates Siva and FiVa's exposures to traditional risk factors and runs sev- eral performance evaluation regressions: the CAPM, the Fama-French-Carhart (1992, 1997) 4-factor, and the Fama-French (2015) 5-factor models, as well as the Fama- French 5-factor with the Momentum factor added. The regressions for Fiva yield the following results (the alphas are annualized): Regressions results: FiVa excess returns BMkt SHML BSMB BRMW BCMA BMom R CAPM 1.46% 1.2 FFC -0.98% 1.1 -0.2 0.45 0.3 74% FF5 0.33% 1.0 -0.3 0.50 -0.05 0.20 89% FF5+Mom -0.63% 0.9 -0.2 0.40 0.14 0.25 92% C -0.12 Using the results of the FF5+Mom regression estimates, describe the composition of the appropriate benchmark for FiVa given FiVa's empirical exposure to systematic risk factors. (hint: the regression coefficients can be interpreted as portfolio weights.) AC- cording to the same model (FF5+Mom), what fraction of FiVa's return volatility is accounted for by the fund's exposure to systematic risk factors? c The estimated alphas in the regression are positive for the CAPM and the FF5 regressions and negative for the other two regressions. The alphas are statistically significant at the 5% level for the first 2 regressions (CAPM and FFC) and NOT statistically significant for the last 2 regressions (FF5 and FF5+Mom). Provide a verbal interpretation of these results. Relate the results to the empirical challenges of identifying and testing for abnormal performance. Be short and precise