Answered step by step

Verified Expert Solution

Question

1 Approved Answer

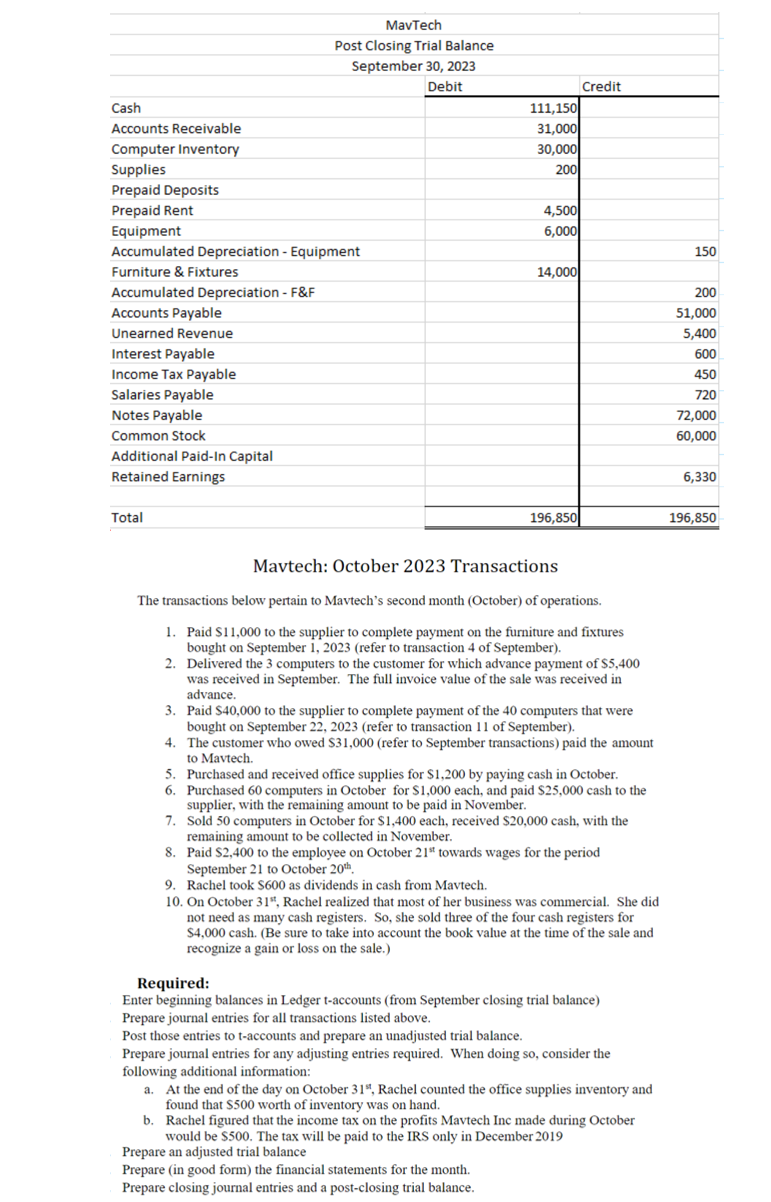

Mavtech: October 2 0 2 3 Transactions The transactions below pertain to Mavtech s second month ( October ) of operations. 1 . Paid $

Mavtech: October Transactions

The transactions below pertain to Mavtechs second month October of operations.

Paid $ to the supplier to complete payment on the furniture and fixtures

bought on September refer to transaction of September

Delivered the computers to the customer for which advance payment of $

was received in September. The full invoice value of the sale was received in

advance.

Paid $ to the supplier to complete payment of the computers that were

bought on September refer to transaction of September

The customer who owed $refer to September transactions paid the amount

to Mavtech.

Purchased and received office supplies for $ by paying cash in October.

Purchased computers in October for $ each, and paid $ cash to the

supplier, with the remaining amount to be paid in November.

Sold computers in October for $ each, received $ cash, with the

remaining amount to be collected in November.

Paid $ to the employee on October st towards wages for the period

September to October th

Rachel took $ as dividends in cash from Mavtech.

On October st Rachel realized that most of her business was commercial. She did not need as many cash registers. So she sold three of the four cash registers for $ cash. Be sure to take into account the book value at the time of the sale and recognize a gain or loss on the sale.

Required:

Enter beginning balances in Ledger taccounts from September closing trial balance

Prepare journal entries for all transactions listed above.

Post those entries to taccounts and prepare an unadjusted trial balance.

Prepare journal entries for any adjusting entries required. When doing so consider the following additional information:

a At the end of the day on October st Rachel counted the office supplies inventory and found that $ worth of inventory was on hand.

b Rachel figured that the income tax on the profits Mavtech Inc made during October would be $ The tax will be paid to the IRS only in December

Prepare an adjusted trial balance

Prepare in good form the financial statements for the month.

Prepare closing journal entries and a postclosing trial balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started