Answered step by step

Verified Expert Solution

Question

1 Approved Answer

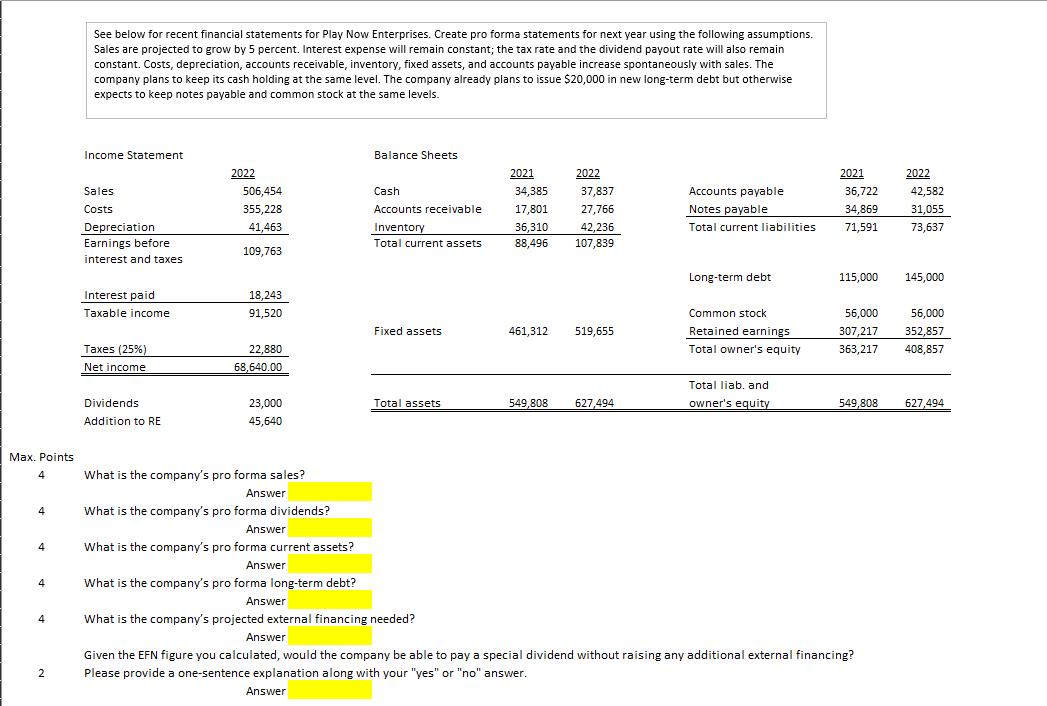

Max. Points 4 4 4 4 4 2 See below for recent financial statements for Play Now Enterprises. Create pro forma statements for next

Max. Points 4 4 4 4 4 2 See below for recent financial statements for Play Now Enterprises. Create pro forma statements for next year using the following assumptions. Sales are projected to grow by 5 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, depreciation, accounts receivable, inventory, fixed assets, and accounts payable increase spontaneously with sales. The company plans to keep its cash holding at the same level. The company already plans to issue $20,000 in new long-term debt but otherwise expects to keep notes payable and common stock at the same levels. Income Statement Sales Costs Depreciation Earnings before interest and taxes Interest paid Taxable income Taxes (25%) Net income Dividends Addition to RE 2022 506,454 355,228 41,463 109,763 18,243 91,520 22,880 68,640.00 23,000 45,640 Balance Sheets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets 2021 34,385 17,801 36,310 88,496 461,312 2022 37,837 27,766 42,236 107,839 519,655 549,808 627,494 Accounts payable Notes payable Total current liabilities Long-term debt Common stock Retained earnings Total owner's equity Total liab. and owner's equity 2021 36,722 34,869 71,591 115,000 2022 42,582 31,055 73,637 What is the company's pro forma sales? Answer What is the company's pro forma dividends? Answer What is the company's pro forma current assets? Answer What is the company's pro forma long-term debt? Answer What is the company's projected external financing needed? Answer Given the EFN figure you calculated, would the company be able to pay a special dividend without raising any additional external financing? Please provide a one-sentence explanation along with your "yes" or "no" answer. Answer 145,000 56,000 56,000 352.857 307,217 363,217 408,857 549,808 627,494

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Income statement is the statement which is prepared to know about the net income of the busin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started