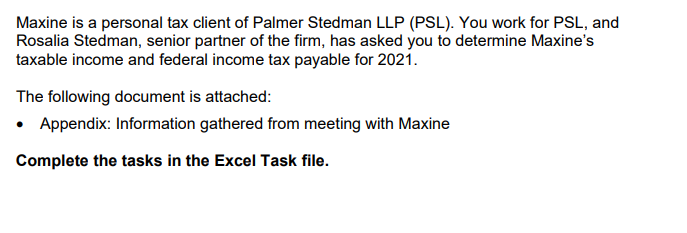

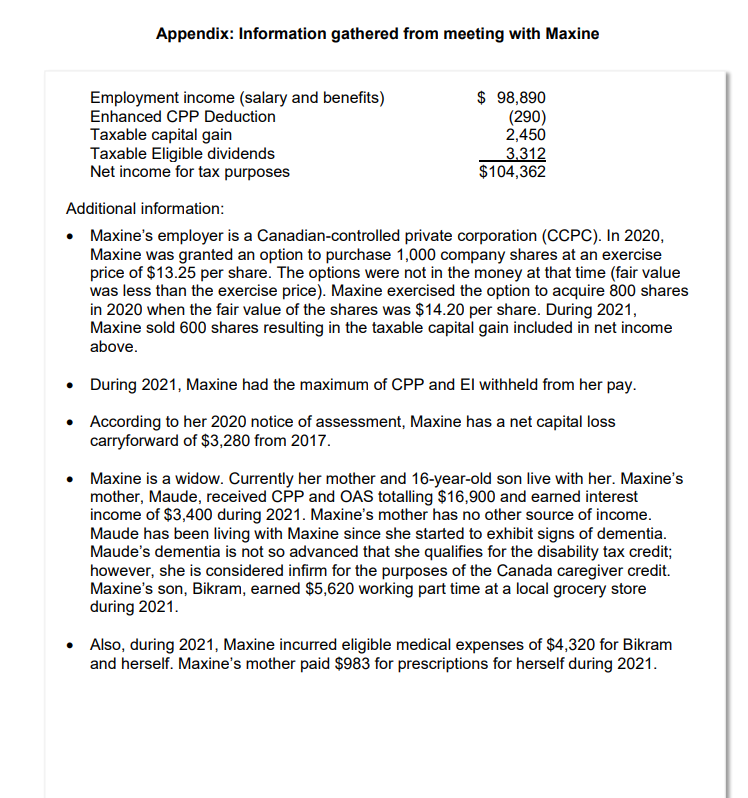

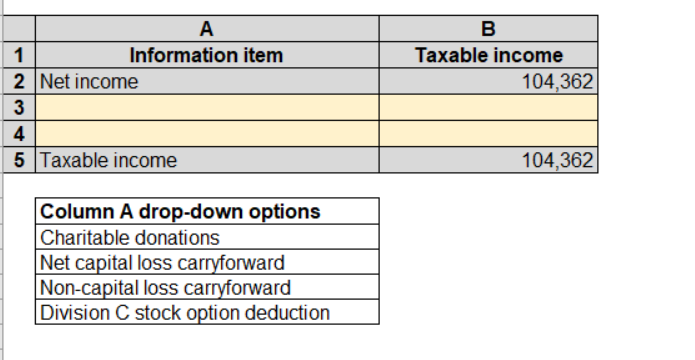

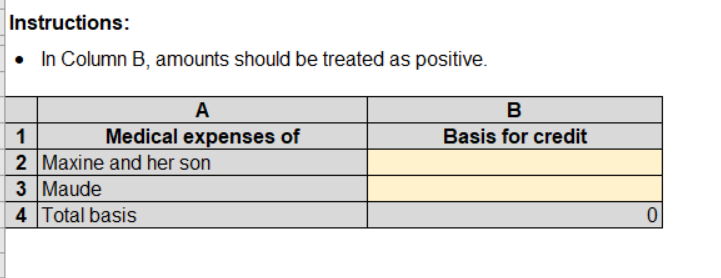

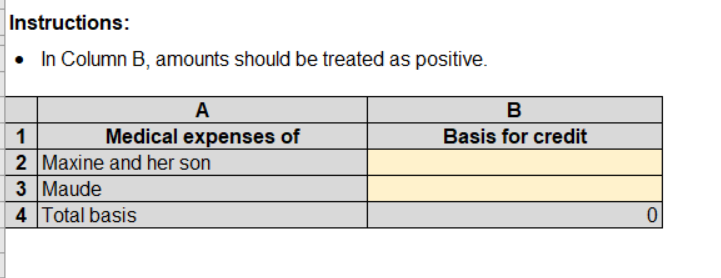

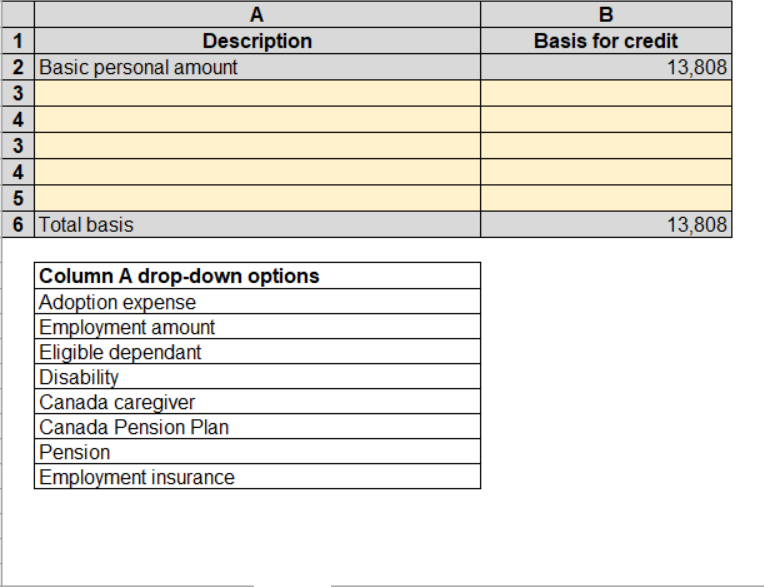

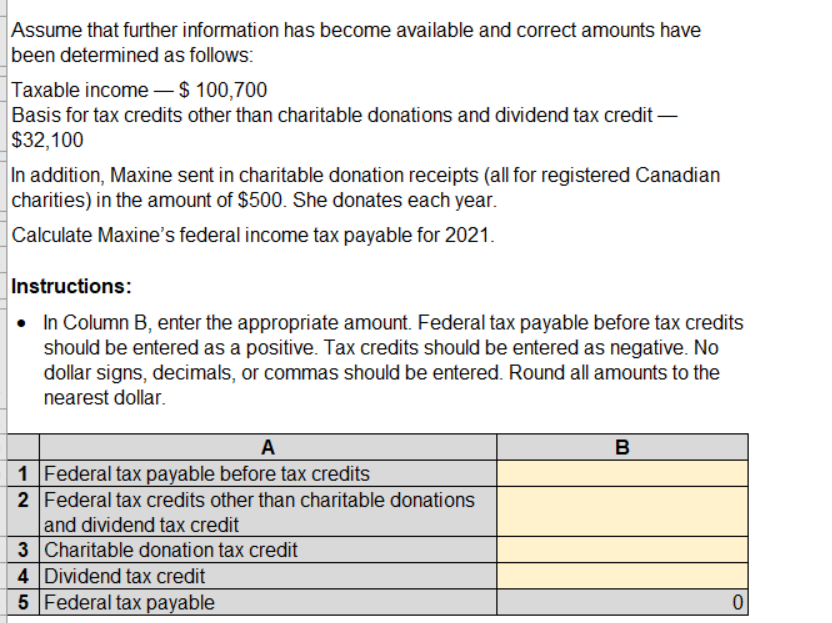

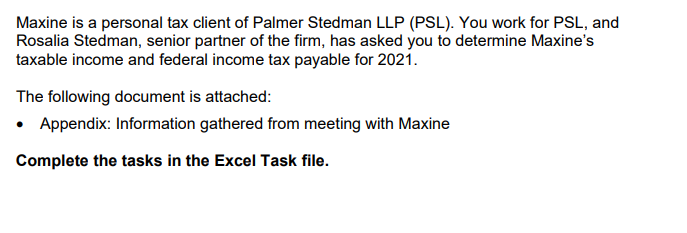

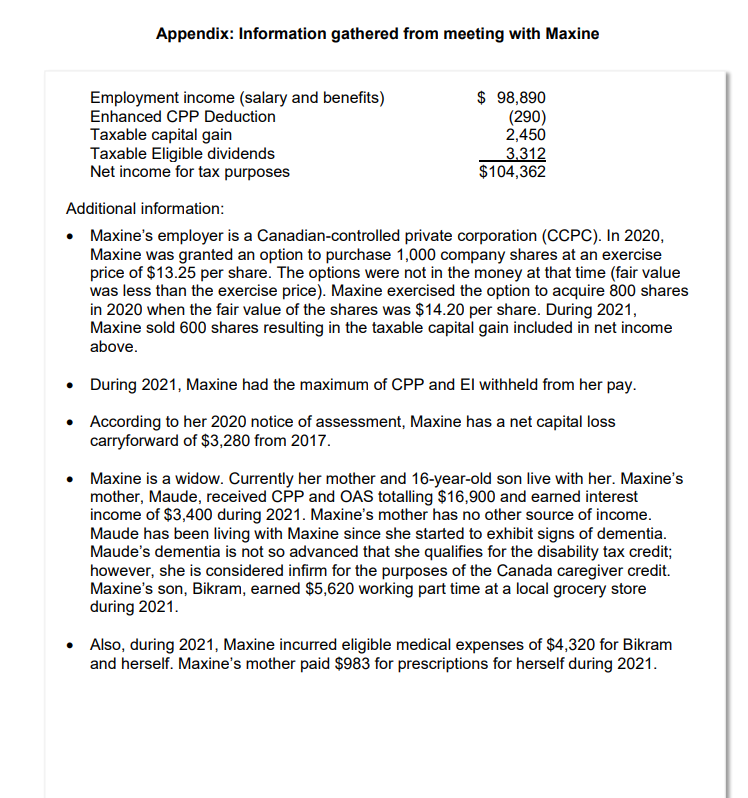

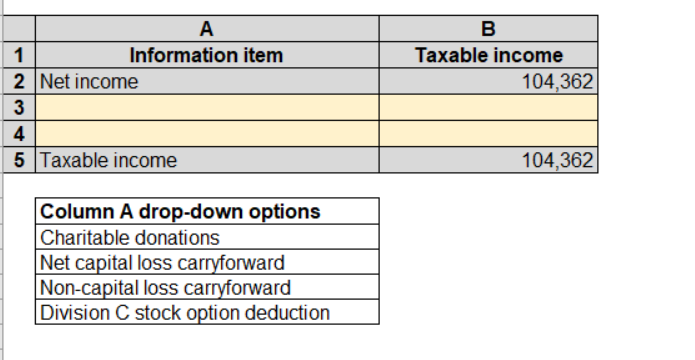

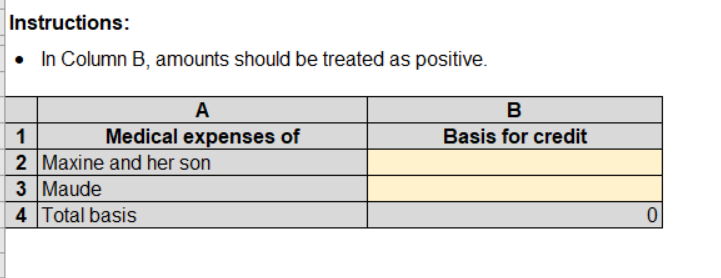

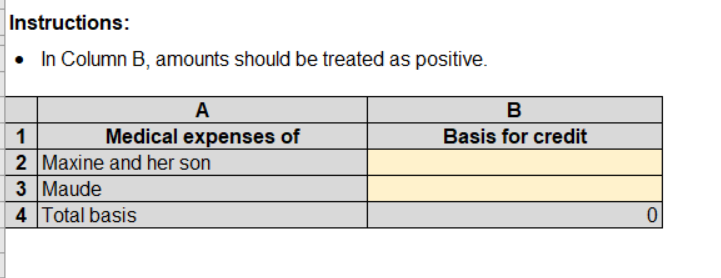

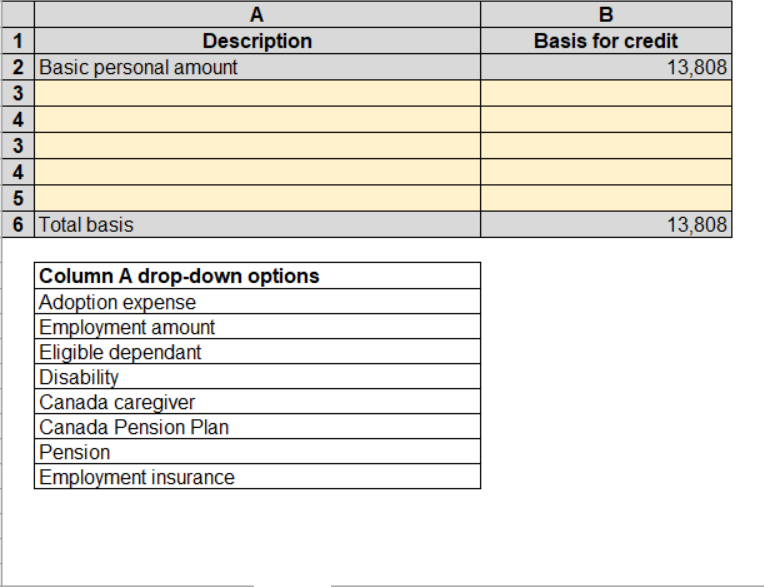

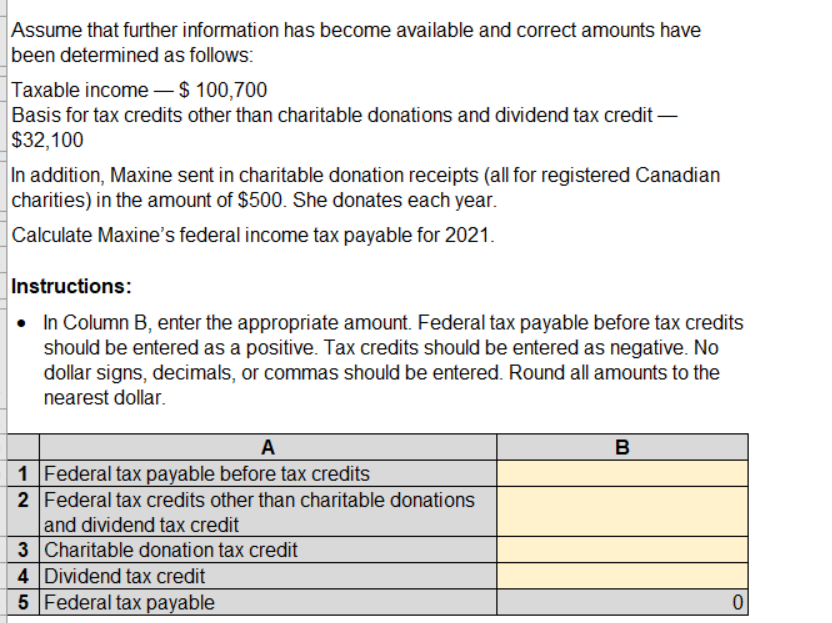

Maxine is a personal tax client of Palmer Stedman LLP (PSL). You work for PSL, and Rosalia Stedman, senior partner of the firm, has asked you to determine Maxine's taxable income and federal income tax payable for 2021. The following document is attached: Appendix: Information gathered from meeting with Maxine Complete the tasks in the Excel Task file. Appendix: Information gathered from meeting with Maxine $ 98,890 Employment income (salary and benefits) Enhanced CPP Deduction Taxable capital gain (290) 2,450 3,312 Taxable Eligible dividends Net income for tax purposes $104,362 Additional information: Maxine's employer is a Canadian-controlled private corporation (CCPC). In 2020, Maxine was granted an option to purchase 1,000 company shares at an exercise price of $13.25 per share. The options were not in the money at that time (fair value was less than the exercise price). Maxine exercised the option to acquire 800 shares in 2020 when the fair value of the shares was $14.20 per share. During 2021, Maxine sold 600 shares resulting in the taxable capital gain included in net income above. During 2021, Maxine had the maximum of CPP and El withheld from her pay. According to her 2020 notice of assessment, Maxine has a net capital loss carryforward of $3,280 from 2017. Maxine is a widow. Currently her mother and 16-year-old son live with her. Maxine's mother, Maude, received CPP and OAS totalling $16,900 and earned interest income of $3,400 during 2021. Maxine's mother has no other source of income. Maude has been living with Maxine since she started to exhibit signs of dementia. Maude's dementia is not so advanced that she qualifies for the disability tax credit; however, she is considered infirm for the purposes of the Canada caregiver credit. Maxine's son, Bikram, earned $5,620 working part time at a local grocery store during 2021. Also, during 2021, Maxine incurred eligible medical expenses of $4,320 for Bikram and herself. Maxine's mother paid $983 for prescriptions for herself during 2021. A 1 Information item 2 Net income 3 4 5 Taxable income Column A drop-down options Charitable donations Net capital loss carryforward Non-capital loss carryforward Division C stock option deduction B Taxable income 104,362 104,362 Instructions: In Column B, amounts should be treated as positive. A B 1 Medical expenses of Basis for credit 2 Maxine and her son 3 Maude 4 Total basis 0 Instructions: In Column B, amounts should be treated as positive. A B 1 Medical expenses of Basis for credit 2 Maxine and her son 3 Maude 4 Total basis 0 A Description 1 2 Basic personal amount 3 4 3 4 5 6 Total basis Column A drop-down options Adoption expense Employment amount Eligible dependant Disability Canada caregiver Canada Pension Plan Pension Employment insurance B Basis for credit 13,808 13,808 Assume that further information has become available and correct amounts have been determined as follows: Taxable income - $ 100,700 Basis for tax credits other than charitable donations and dividend tax credit - $32,100 In addition, Maxine sent in charitable donation receipts (all for registered Canadian charities) in the amount of $500. She donates each year. Calculate Maxine's federal income tax payable for 2021. Instructions: In Column B, enter the appropriate amount. Federal tax payable before tax credits should be entered as a positive. Tax credits should be entered as negative. No dollar signs, decimals, or commas should be entered. Round all amounts to the nearest dollar. A B 1 Federal tax payable before tax credits 2 Federal tax credits other than charitable donations and dividend tax credit 3 Charitable donation tax credit 4 Dividend tax credit 5 Federal tax payable 0 Maxine is a personal tax client of Palmer Stedman LLP (PSL). You work for PSL, and Rosalia Stedman, senior partner of the firm, has asked you to determine Maxine's taxable income and federal income tax payable for 2021. The following document is attached: Appendix: Information gathered from meeting with Maxine Complete the tasks in the Excel Task file. Appendix: Information gathered from meeting with Maxine $ 98,890 Employment income (salary and benefits) Enhanced CPP Deduction Taxable capital gain (290) 2,450 3,312 Taxable Eligible dividends Net income for tax purposes $104,362 Additional information: Maxine's employer is a Canadian-controlled private corporation (CCPC). In 2020, Maxine was granted an option to purchase 1,000 company shares at an exercise price of $13.25 per share. The options were not in the money at that time (fair value was less than the exercise price). Maxine exercised the option to acquire 800 shares in 2020 when the fair value of the shares was $14.20 per share. During 2021, Maxine sold 600 shares resulting in the taxable capital gain included in net income above. During 2021, Maxine had the maximum of CPP and El withheld from her pay. According to her 2020 notice of assessment, Maxine has a net capital loss carryforward of $3,280 from 2017. Maxine is a widow. Currently her mother and 16-year-old son live with her. Maxine's mother, Maude, received CPP and OAS totalling $16,900 and earned interest income of $3,400 during 2021. Maxine's mother has no other source of income. Maude has been living with Maxine since she started to exhibit signs of dementia. Maude's dementia is not so advanced that she qualifies for the disability tax credit; however, she is considered infirm for the purposes of the Canada caregiver credit. Maxine's son, Bikram, earned $5,620 working part time at a local grocery store during 2021. Also, during 2021, Maxine incurred eligible medical expenses of $4,320 for Bikram and herself. Maxine's mother paid $983 for prescriptions for herself during 2021. A 1 Information item 2 Net income 3 4 5 Taxable income Column A drop-down options Charitable donations Net capital loss carryforward Non-capital loss carryforward Division C stock option deduction B Taxable income 104,362 104,362 Instructions: In Column B, amounts should be treated as positive. A B 1 Medical expenses of Basis for credit 2 Maxine and her son 3 Maude 4 Total basis 0 Instructions: In Column B, amounts should be treated as positive. A B 1 Medical expenses of Basis for credit 2 Maxine and her son 3 Maude 4 Total basis 0 A Description 1 2 Basic personal amount 3 4 3 4 5 6 Total basis Column A drop-down options Adoption expense Employment amount Eligible dependant Disability Canada caregiver Canada Pension Plan Pension Employment insurance B Basis for credit 13,808 13,808 Assume that further information has become available and correct amounts have been determined as follows: Taxable income - $ 100,700 Basis for tax credits other than charitable donations and dividend tax credit - $32,100 In addition, Maxine sent in charitable donation receipts (all for registered Canadian charities) in the amount of $500. She donates each year. Calculate Maxine's federal income tax payable for 2021. Instructions: In Column B, enter the appropriate amount. Federal tax payable before tax credits should be entered as a positive. Tax credits should be entered as negative. No dollar signs, decimals, or commas should be entered. Round all amounts to the nearest dollar. A B 1 Federal tax payable before tax credits 2 Federal tax credits other than charitable donations and dividend tax credit 3 Charitable donation tax credit 4 Dividend tax credit 5 Federal tax payable 0