Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Max-It Ltd. manufactures and sells digital data storage devices. Demand for the previous year was 87,500 units. Currently, the devices are sold at $38.00

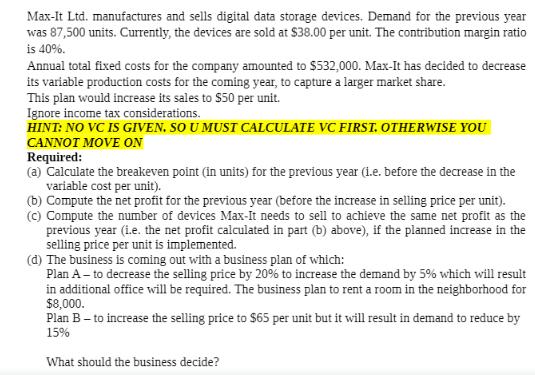

Max-It Ltd. manufactures and sells digital data storage devices. Demand for the previous year was 87,500 units. Currently, the devices are sold at $38.00 per unit. The contribution margin ratio is 40%. Annual total fixed costs for the company amounted to $532,000. Max-It has decided to decrease its variable production costs for the coming year, to capture a larger market share. This plan would increase its sales to $50 per unit. Ignore income tax considerations. HINT: NO VC IS GIVEN. SO U MUST CALCULATE VC FIRST. OTHERWISE YOU CANNOT MOVE ON Required: (a) Calculate the breakeven point (in units) for the previous year (i.e. before the decrease in the variable cost per unit). (b) Compute the net profit for the previous year (before the increase in selling price per unit). (c) Compute the number of devices Max-It needs to sell to achieve the same net profit as the previous year (i.e. the net profit calculated in part (b) above), if the planned increase in the selling price per unit is implemented. (d) The business is coming out with a business plan of which: Plan A- to decrease the selling price by 20% to increase the demand by 5% which will result in additional office will be required. The business plan to rent a room in the neighborhood for $8,000. Plan B - to increase the selling price to $65 per unit but it will result in demand to reduce by 15% What should the business decide?

Step by Step Solution

★★★★★

3.43 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To answer the questions lets first calculate the information we need step by step Given data Previous years demand 87500 units Selling price per unit 3800 Contribution margin ratio 40 Annual total fix...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started