Answered step by step

Verified Expert Solution

Question

1 Approved Answer

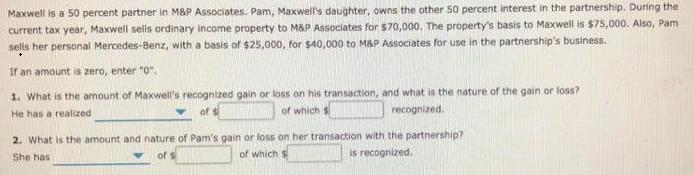

Maxwell is a 50 percent partner in M&P Associates. Pam, Maxwell's daughter, owns the other 50 percent interest in the partnership. During the current

Maxwell is a 50 percent partner in M&P Associates. Pam, Maxwell's daughter, owns the other 50 percent interest in the partnership. During the current tax year, Maxwell sells ordinary income property to M&P Associates for $70,000. The property's basis to Maxwell is $75,000. Also, Pam selis her personal Mercedes-Benz, with a basis of $25,000, for $40,000 to MAP Associates for use in the partnership's business. If an amount is zero, enter "0". 1. What is the amount of Maxwell's recognized gain or loss on his transaction, and what is the nature of the gain or loss? of which $ He has a realized of s recognized. 2. What is the amount and nature of Pam's gain or loss on her transaction with the partnership? of which $ She has of s is recognized.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Maxwell has realized a Loss of 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635dca77d34ef_178891.pdf

180 KBs PDF File

635dca77d34ef_178891.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started