Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Maxy Ltd is contemplating the acquisition of Bafsco Incorporated. The values of the two companies as separate entities are GH30m and GH110m respectively. Maxy estimates

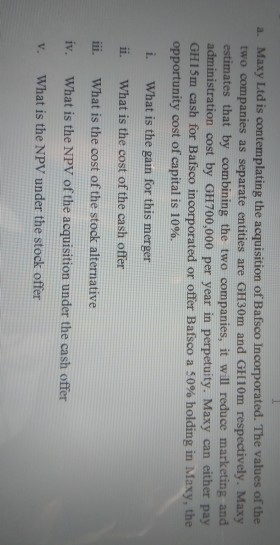

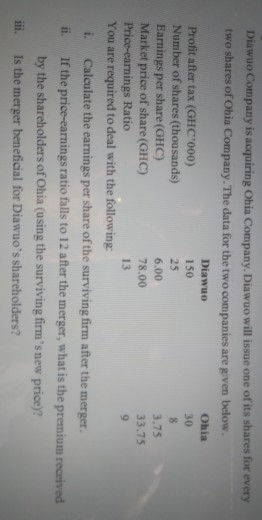

Maxy Ltd is contemplating the acquisition of Bafsco Incorporated. The values of the two companies as separate entities are GH30m and GH110m respectively. Maxy estimates that by combining the two companies, it will reduce marketing and administration cost by GH700,000 per year in perpetuity. Maxy can either pay GH 15m cash for Bafsco incorporated or offer Bafsco a 50% holding in Maxy, the opportunity cost of capital is 10%. a. i. What is the gain for this merger ii. What is the cost of the cash offer ii. What is the cost of the stock alternative iv. What is the NPV of the acquisition under the cash offer v. What is the NPV under the stock offer Diawuo Company is acquiring Ohia Company. Diawuo will issue one of its shares for every two shares of Ohia Company.The data for the two companies are given below. Diawuo 150 25 6.00 78.00 13 Ohia 30 Profit after tax (GHC'000) Number of shares (thousands) Earnings per share (GHC) Market price of share (GHC) Price-earnings Ratio 3.75 33.75 You are required to deal with the following i. Calculate the earnings per share of the surviving firm after the merger. i. If the price-earnings ratio falls to 12 after the merger, what is the premium received by the shareholders of Ohia (using the surviving firm'snew price)? Is the merger beneficial for Diawuo's shareholders

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started