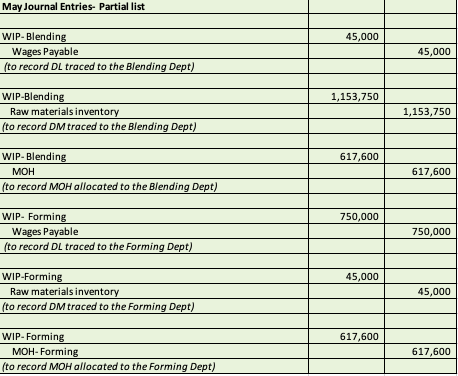

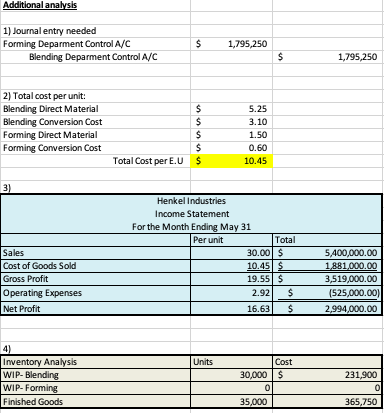

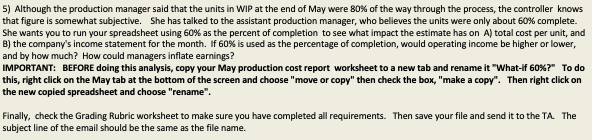

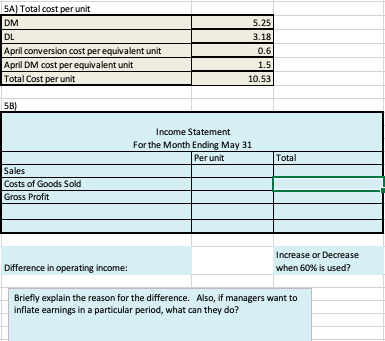

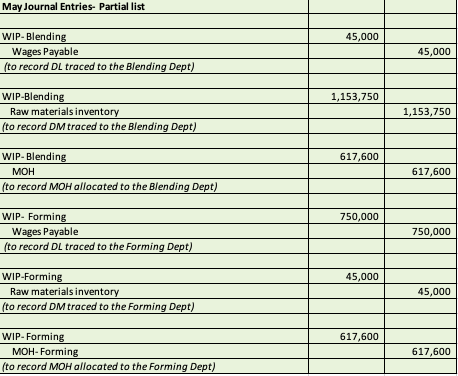

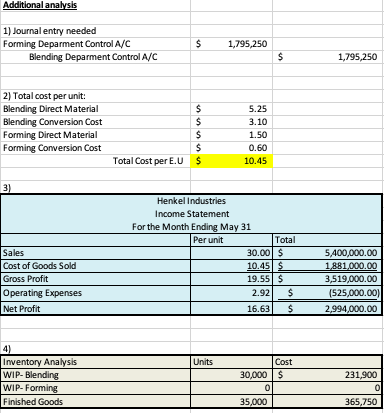

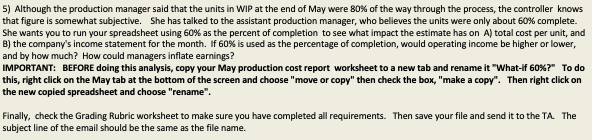

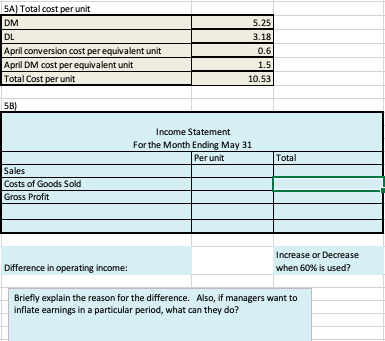

May Journal Entries- Partial list 45,000 WIP-Blending Wages Payable (to record DL traced to the Blending Dept) 45,000 1,153,750 WIP-Blending Raw materials inventory (to record DM traced to the Blending Dept) 1,153,750 617,600 WIP-Blending MOH (to record MOH allocated to the Blending Dept) 617,600 750,000 WIP Forming Wages Payable (to record DL traced to the Forming Dept) 750,000 45,000 WIP-Forming Raw materials inventory (to record DM traced to the Forming Dept) 45,000 617,600 WIP-Forming MOH-Forming (to record MOH allocated to the Forming Dept) 617,600 Additional analysis 1) Journal entry needed Forming Deparment Control A/C Blending Deparment Control A/C $ $ 1,795,250 $ 1,795,250 2) Total cost per unit: Blending Direct Material Blending Conversion Cost Forming Direct Material Forming Conversion Cost $ $ $ $ Total Cost per E.U $ 5.25 3.10 1.50 0.60 10.45 3) Sales Cost of Goods Sold Gross Profit Operating Expenses Net Profit Henkel Industries Income Statement For the Month Ending May 31 Per unit Total 30.00 $ 10.45 $ 19.55$ 2.92 $ 16.63 $ 5,400,000.00 1.881,000.00 3,519,000.00 (525,000.00) 2,994,000.00 Units 4) Inventory Analysis WIP-Blending WIP-Forming Finished Goods Cost 30,000 $ 0 35,000 231,900 0 365,750 5) Although the production manager said that the units in WIP at the end of May were 80% of the way through the process, the controller knows that figure is somewhat subjective. She has talked to the assistant production manager, who believes the units were only about 60% complete. She wants you to run your spreadsheet using 60% as the percent of completion to see what impact the estimate has on A) total cost per unit, and B) the company's income statement for the month. If 60% is used as the percentage of completion, would operating income be higher or lower, and by how much? How could managers inflate earnings? IMPORTANT: BEFORE doing this analysis, copy your May production cost report worksheet to a new tab and rename it "What-if 60%?" To do this, right click on the May tab at the bottom of the screen and choose "move or copy" then check the box, "make a copy". Then right click on the new copied spreadsheet and choose "rename". Finally, check the Grading Rubric worksheet to make sure you have completed all requirements. Then save your file and send it to the TA. The subject line of the email should be the same as the file name. 5A) Total cost per unit DM DL April conversion cost per equivalent unit April DM cost per equivalent unit Total Cost per unit 5.25 3.18 0.6 1.5 10.53 5B) Income Statement For the Month Ending May 31 Per unit Total Sales Costs of Goods Sold Gross Profit Difference in operating income: Increase or Decrease when 60% is used? Briefly explain the reason for the difference. Also, if managers want to inflate earnings in a particular period, what can they do? May Journal Entries- Partial list 45,000 WIP-Blending Wages Payable (to record DL traced to the Blending Dept) 45,000 1,153,750 WIP-Blending Raw materials inventory (to record DM traced to the Blending Dept) 1,153,750 617,600 WIP-Blending MOH (to record MOH allocated to the Blending Dept) 617,600 750,000 WIP Forming Wages Payable (to record DL traced to the Forming Dept) 750,000 45,000 WIP-Forming Raw materials inventory (to record DM traced to the Forming Dept) 45,000 617,600 WIP-Forming MOH-Forming (to record MOH allocated to the Forming Dept) 617,600 Additional analysis 1) Journal entry needed Forming Deparment Control A/C Blending Deparment Control A/C $ $ 1,795,250 $ 1,795,250 2) Total cost per unit: Blending Direct Material Blending Conversion Cost Forming Direct Material Forming Conversion Cost $ $ $ $ Total Cost per E.U $ 5.25 3.10 1.50 0.60 10.45 3) Sales Cost of Goods Sold Gross Profit Operating Expenses Net Profit Henkel Industries Income Statement For the Month Ending May 31 Per unit Total 30.00 $ 10.45 $ 19.55$ 2.92 $ 16.63 $ 5,400,000.00 1.881,000.00 3,519,000.00 (525,000.00) 2,994,000.00 Units 4) Inventory Analysis WIP-Blending WIP-Forming Finished Goods Cost 30,000 $ 0 35,000 231,900 0 365,750 5) Although the production manager said that the units in WIP at the end of May were 80% of the way through the process, the controller knows that figure is somewhat subjective. She has talked to the assistant production manager, who believes the units were only about 60% complete. She wants you to run your spreadsheet using 60% as the percent of completion to see what impact the estimate has on A) total cost per unit, and B) the company's income statement for the month. If 60% is used as the percentage of completion, would operating income be higher or lower, and by how much? How could managers inflate earnings? IMPORTANT: BEFORE doing this analysis, copy your May production cost report worksheet to a new tab and rename it "What-if 60%?" To do this, right click on the May tab at the bottom of the screen and choose "move or copy" then check the box, "make a copy". Then right click on the new copied spreadsheet and choose "rename". Finally, check the Grading Rubric worksheet to make sure you have completed all requirements. Then save your file and send it to the TA. The subject line of the email should be the same as the file name. 5A) Total cost per unit DM DL April conversion cost per equivalent unit April DM cost per equivalent unit Total Cost per unit 5.25 3.18 0.6 1.5 10.53 5B) Income Statement For the Month Ending May 31 Per unit Total Sales Costs of Goods Sold Gross Profit Difference in operating income: Increase or Decrease when 60% is used? Briefly explain the reason for the difference. Also, if managers want to inflate earnings in a particular period, what can they do