Answered step by step

Verified Expert Solution

Question

1 Approved Answer

may please solve question by table with solution way to understand how get the answer ( not excel ) Question 2 A Biotech firm plans

may please solve question by table with solution way to understand how get the answer ( not excel )

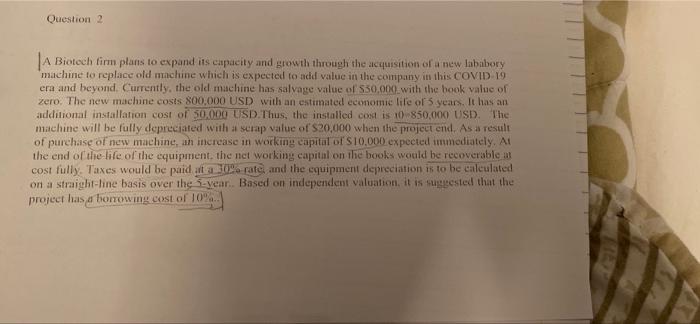

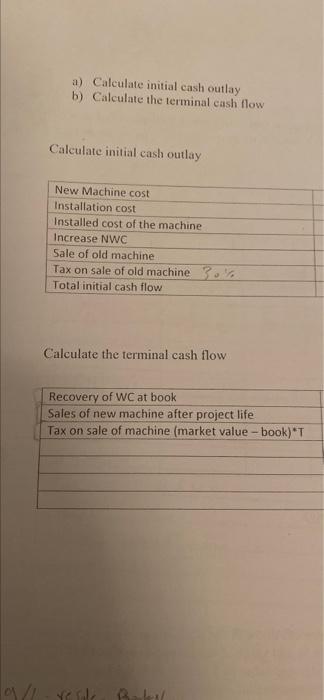

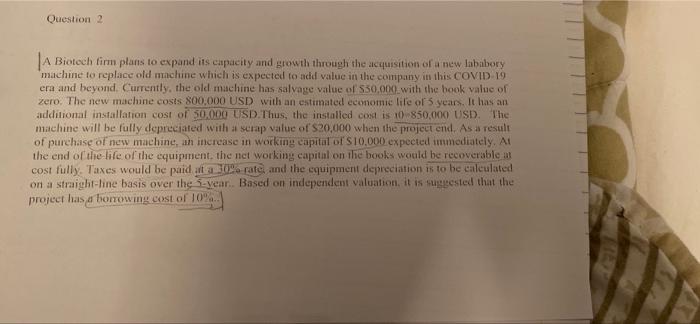

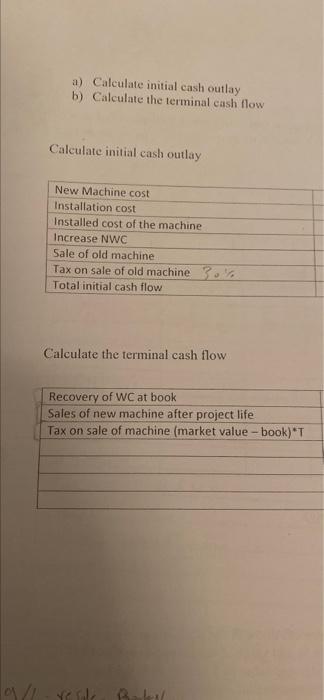

Question 2 A Biotech firm plans to expand its capacity and growth through the acquisition of a new lababoy machine to replace old machine which is expected to add value in the company in this COVID-19 era and beyond. Currently, the old machine has salvage value of $30.000 with the book value of zero. The new machine costs 800,000 USD with an estimated economie life of 5 years. It has an additional installation cost of 50.000 USD. Thus, the installed cost is 10 850.000 USD The machine will be fully depreciated with a scrap value of $20,000 when the project end. As a result of purehase of new machine, an increase in working capital of $10,000 expected immediately. At the end of the life of the equipment, the networking capital on the books would be recoverablem cost fully. Taxes would be paid at a rate, and the equipment depreciation is to be calculated on a straight-line basis over the year. Based on independent valuation, it is suggested that the project has a borrowing cost of 10% a) Calculate initial cash outlay b) Calculate the terminal cash flow Calculate initial cash outlay New Machine cost Installation cost Installed cost of the machine Increase NWC Sale of old machine Tax on sale of old machine 30% Total initial cash flow Calculate the terminal cash flow Recovery of WC at book Sales of new machine after project life Tax on sale of machine (market value-book)*T 1/1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started