Answered step by step

Verified Expert Solution

Question

1 Approved Answer

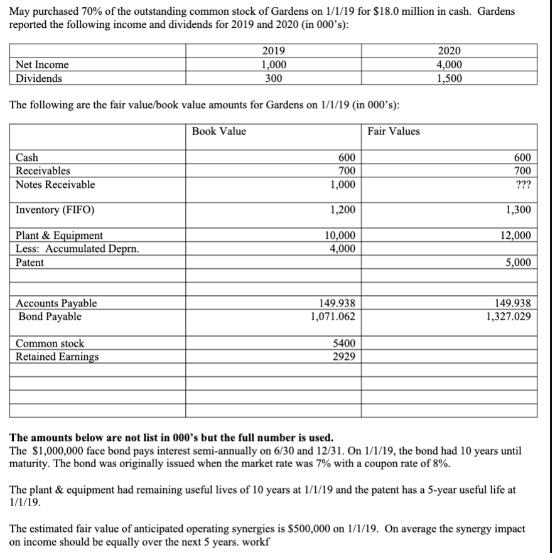

May purchased 70% of the outstanding common stock of Gardens on 1/1/19 for $18.0 million in cash. Gardens reported the following income and dividends

May purchased 70% of the outstanding common stock of Gardens on 1/1/19 for $18.0 million in cash. Gardens reported the following income and dividends for 2019 and 2020 (in 000's): Net Income Dividends 2019 1,000 300 The following are the fair value/book value amounts for Gardens on 1/1/19 (in 000's): Book Value Fair Values 2020 4,000 1,500 Cash Receivables 600 600 700 700 Notes Receivable 1,000 ??? Inventory (FIFO) 1,200 1,300 Plant & Equipment 10,000 12,000 Less: Accumulated Deprn. 4,000 Patent 5,000 Accounts Payable Bond Payable Common stock Retained Earnings 149.938 1,071.062 149.938 1,327.029 5400 2929 The amounts below are not list in 000's but the full number is used. The $1,000,000 face bond pays interest semi-annually on 6/30 and 12/31. On 1/1/19, the bond had 10 years until maturity. The bond was originally issued when the market rate was 7% with a coupon rate of 8%. The plant & equipment had remaining useful lives of 10 years at 1/1/19 and the patent has a 5-year useful life at 1/1/19. The estimated fair value of anticipated operating synergies is $500,000 on 1/1/19. On average the synergy impact on income should be equally over the next 5 years. workf

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the consolidated net income for May and Gardens for 2019 and 2020 we need to follow the...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started