Answered step by step

Verified Expert Solution

Question

1 Approved Answer

may someone help me this please! i will give a thumb up. thank you 1) Cambridge, Inc. is preparing its master budget for the quarter

may someone help me this please! i will give a thumb up. thank you

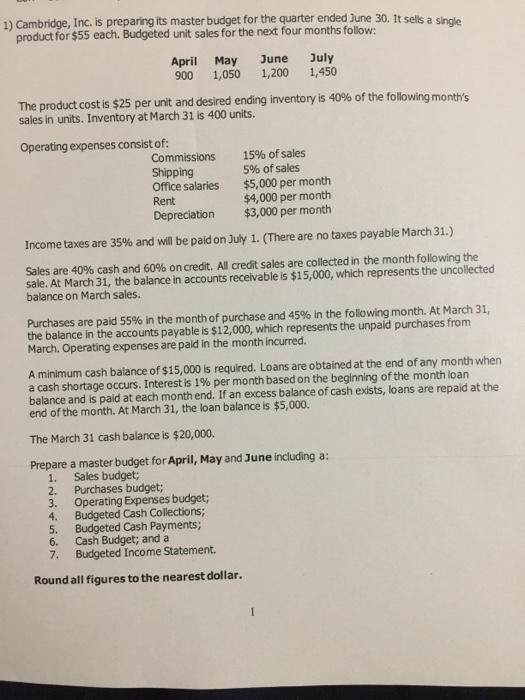

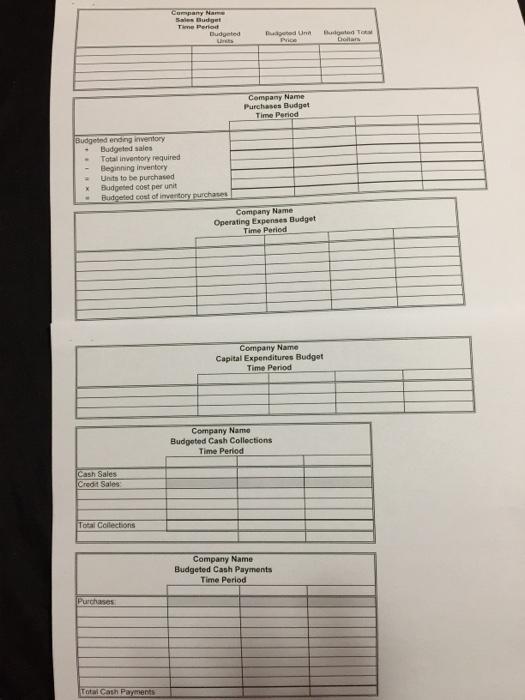

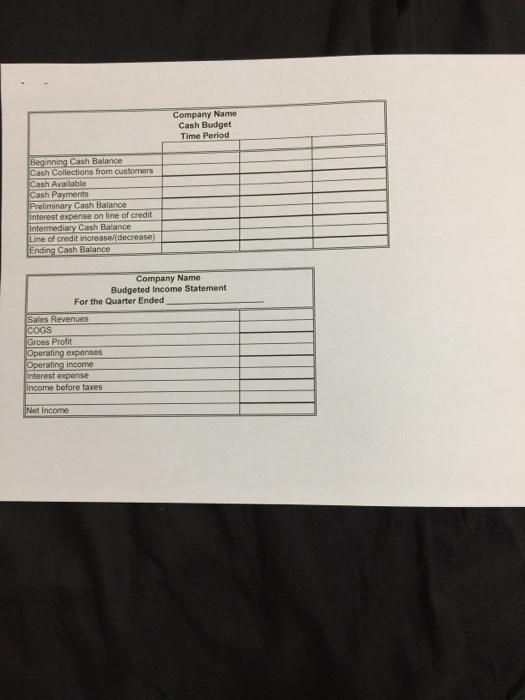

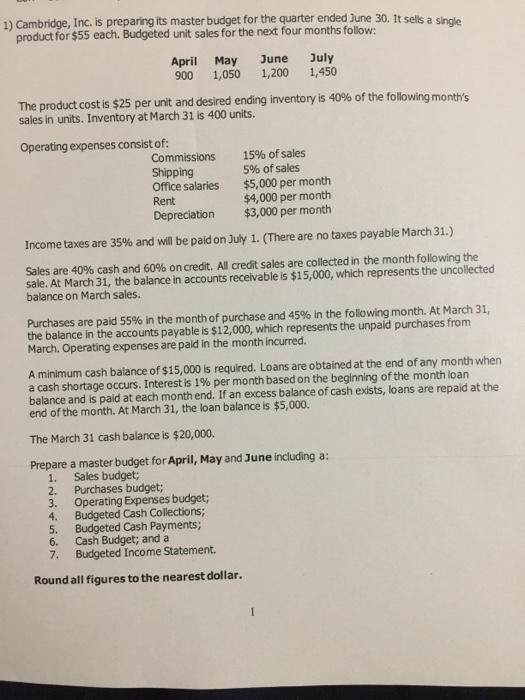

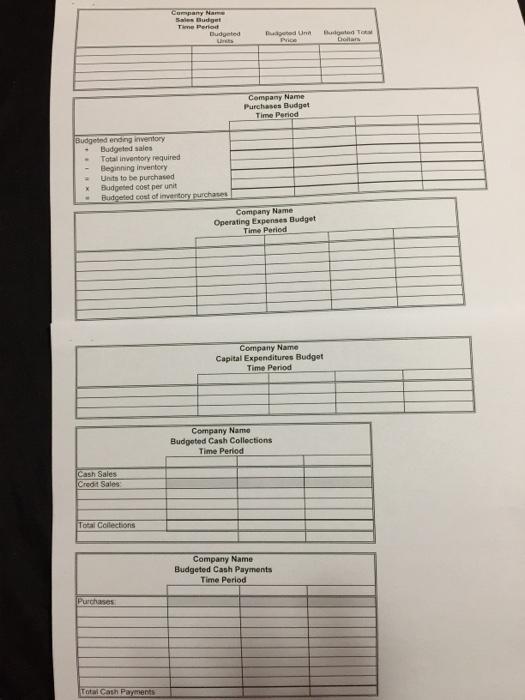

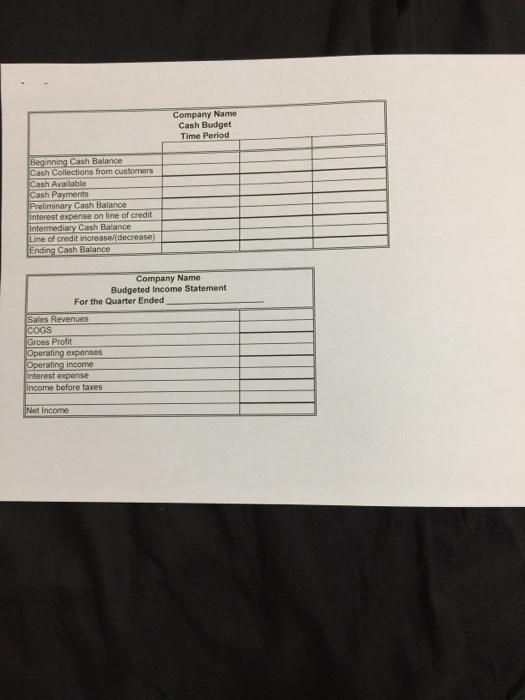

1) Cambridge, Inc. is preparing its master budget for the quarter ended June 30. It sells a single product for $55 each. Budgeted unit sales for the next four months follow: April May June July 900 1,050 1,200 1,450 The product cost is $25 per unit and desired ending inventory is 40% of the following month's sales in units. Inventory at March 31 is 400 units. Operating expenses consist of: Commissions 15% of sales Shipping 5% of sales Office salaries $5,000 per month Rent $4,000 per month Depreciation $3,000 per month Income taxes are 35% and will be paid on July 1. (There are no taxes payable March 31.) Sales are 40% cash and 60% on credit. All credit sales are collected in the month following the sale. At March 31, the balance in accounts receivable is $15,000, which represents the uncollected balance on March sales. Purchases are paid 55% in the month of purchase and 45% in the following month. At March 31, the balance in the accounts payable is $12,000, which represents the unpaid purchases from March. Operating expenses are paid in the month incurred. A minimum cash balance of $15,000 is required. Loans are obtained at the end of any month when a cash shortage occurs. Interest is 1% per month based on the beginning of the month loan balance and is paid at each month end. If an excess balance of cash exists, loans are repaid at the end of the month. At March 31, the loan balance is $5,000. The March 31 cash balance is $20,000. Prepare a master budget for April, May and June including a: 1. Sales budget; 2. Purchases budget; 3. Operating Expenses budget; 4. Budgeted Cash Collections; 5. Budgeted Cash Payments; Cash Budget; and a 7. Budgeted Income Statement. Round all figures to the nearest dollar. 6. 1 Company Nam Sales Budget Tine Period Budgeted una Price Do Company Name Purchases Budget Time Period Budgend ending inventory Budgeted sales Total inventory required Beginning inventory Units to be purchased Budgeted cost per unit Budgeted cost of inventory Purchases Company Name Operating Expenses Budget Time Period Company Name Capital Expenditures Budget Time Period Company Name Budgeted Cash Collections Time Period Cash Sales Credit Sales Total Collections Company Name Budgeted Cash Payments Time Period Purchases Total Cash Payments Company Name Cash Budget Time Period Beginning Cash Balance Cash Collections from customers Cash Available Cash Payments Preliminary Cash Balance Interest expense on line of credit Intermediary Cash Balance Line of credit increase/ decrease) Ending Cash Balance Company Name Budgeted Income Statement For the Quarter Ended Sales Revenues COGS Gross Profit Operating expenses Operating income interest expense Income before taxes Not Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started