may use excel or word doument

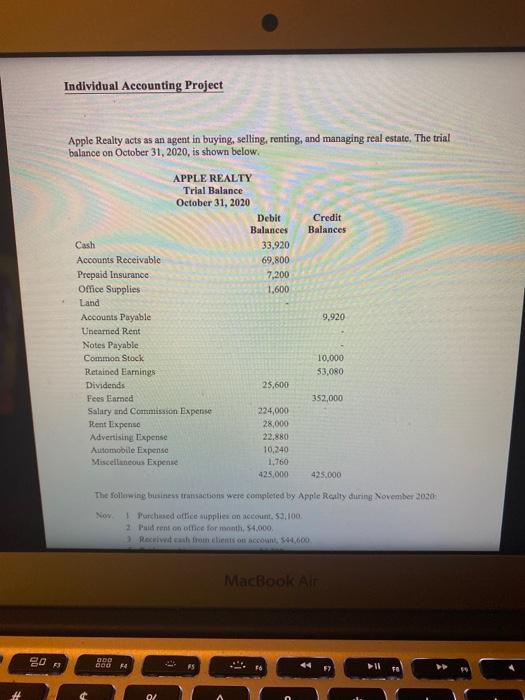

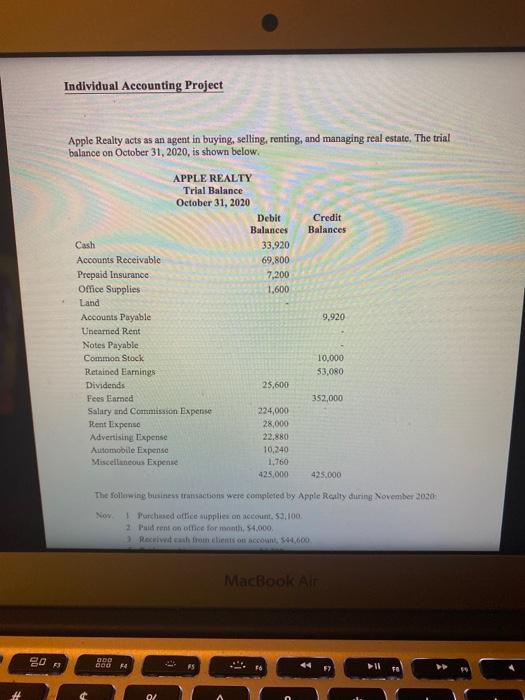

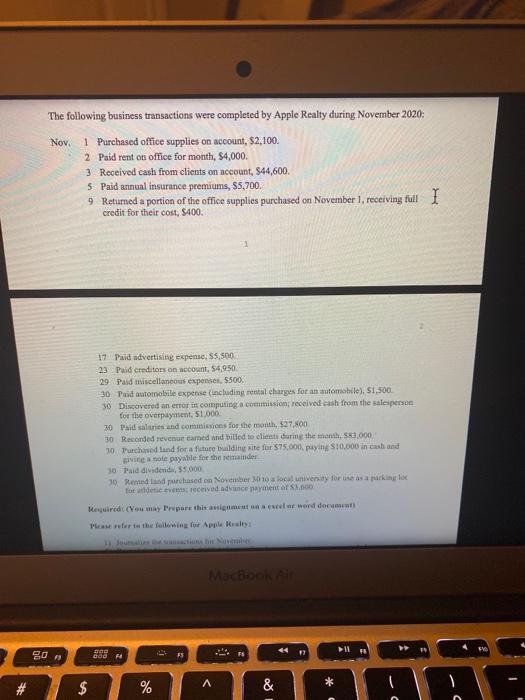

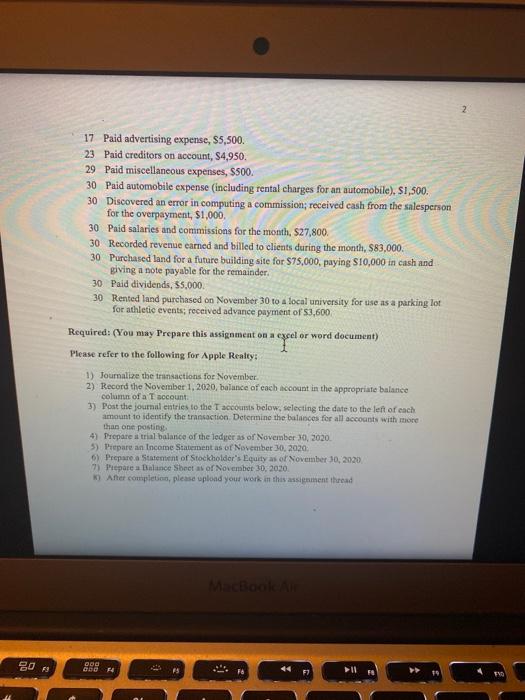

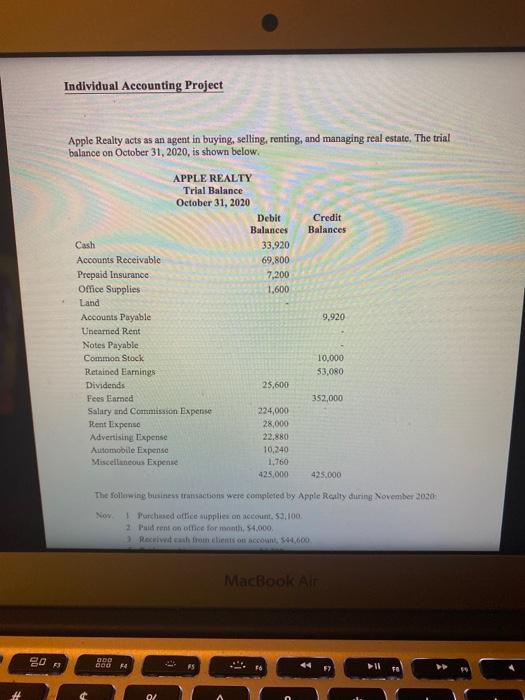

Individual Accounting Project Apple Realty acts as an agent in buying, selling, renting, and managing real estate. The trial balance on October 31, 2020, is shown below. APPLE REALTY Trial Balance October 31, 2020 Debit Credit Balances Balances Cash 33,920 Accounts Receivable 69,800 Prepaid Insurance 7,200 Office Supplies 1,600 Land Accounts Payable 9.920 Uncamed Rent Notes Payable Common Stock 10.000 Retained Earnings $3,080 Dividends 25,600 Fees Eamed 352,000 Salary and Commission Expense 224,000 Rent Expense 28,000 Advertising Toxpense 22.880 Automobile Expense 10.240 Miscellaneous Expense 1.760 425,000 425.000 The following business transactions were completed by Apple Rally during November 200 Nov 1 Purchased artice supplies on account 53.100. 2 Parent on tee for month, 54.000 Rocwid cash clients on a 544,600 MacBook Air 80s OCO 000 F4 PS 56 4 0/ The following business transactions were completed by Apple Realty during November 2020: Nov. 1 Purchased office supplies on account, $2,100. 2 Paid rent on office for month, $4,000 3 Received cash from clients on account, 544,600. 5 Paid annual insurance premiums, $5,700. 9 Returned a portion of the office supplies purchased on November 1, receiving full I credit for their cost, $400. 17. Paid advertising expense, $5,500 23 Paid creditors on account, S4,950 29 Paid miscellaneous expenses, 5500 30 Paid automobile expense (including rental charges for an automobile), 51,500 30 Discovered an error in computing a commission received cash from the salesperson for the overpayment. $1.000 30 Maid salaries and commissions for the month, $27,500 30 Recorded revenue cared and billed to client during the month $23.000, 30 Purchased and for a future building site for 575.000, paying $10.000 in cash and giving mode payable for the remainder 30 Paid dividenda, 55.000 30. Remed ind purchased on November to a local university for use as a parking love for det events received advance payment ar Requiredi (Vou may Prepare this amalar word de Prefer to the following for Apple Huay MacBook Al > 20 DOG cod F 13 1 # $ % & 2 17 Paid advertising expense, S5,500 23 Paid creditors on account, S4,950. 29 Paid miscellaneous expenses, $500. 30 Paid automobile expense (including rental charges for an automobile), S1,500. 30 Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $1,000 30 Paid salaries and commissions for the month, $27,800. 30 Recorded revenue earned and billed to clients during the month, S83,000. 30 Purchased land for a future building site for $75,000, paying $10,000 in cash and giving a note payable for the remainder 30 Paid dividends, S5,000. 30 Rented land purchased on November 30 to a local university for use as a parking lot for athletic events; received advance payment of $3,600 Required: (You may Prepare this assignment on a excel or word document) Please refer to the following for Apple Realty 1) Journalize the transactions for November 2) Record the November 1, 2020, balance of each count in the appropriate balance column of a T sccount 3) Post the journal entries to the accounts below, selecting the date to the left of each amount to identify the transaction. Determine the balances for all accounts with more than one posting 4) Prepare a trial balance of the of Nove 30, 2020 5) Prepare an Income Statement as of November 30, 2020 6) Prepare a statement of Stockholder's Equity as of November 30, 2020 Prepare a Balance Sheet as of November 30, 2030 After completion, please upload your work in this assignment thread Book ODO Individual Accounting Project Apple Realty acts as an agent in buying, selling, renting, and managing real estate. The trial balance on October 31, 2020, is shown below. APPLE REALTY Trial Balance October 31, 2020 Debit Credit Balances Balances Cash 33,920 Accounts Receivable 69,800 Prepaid Insurance 7,200 Office Supplies 1,600 Land Accounts Payable 9.920 Uncamed Rent Notes Payable Common Stock 10.000 Retained Earnings $3,080 Dividends 25,600 Fees Eamed 352,000 Salary and Commission Expense 224,000 Rent Expense 28,000 Advertising Toxpense 22.880 Automobile Expense 10.240 Miscellaneous Expense 1.760 425,000 425.000 The following business transactions were completed by Apple Rally during November 200 Nov 1 Purchased artice supplies on account 53.100. 2 Parent on tee for month, 54.000 Rocwid cash clients on a 544,600 MacBook Air 80s OCO 000 F4 PS 56 4 0/ The following business transactions were completed by Apple Realty during November 2020: Nov. 1 Purchased office supplies on account, $2,100. 2 Paid rent on office for month, $4,000 3 Received cash from clients on account, 544,600. 5 Paid annual insurance premiums, $5,700. 9 Returned a portion of the office supplies purchased on November 1, receiving full I credit for their cost, $400. 17. Paid advertising expense, $5,500 23 Paid creditors on account, S4,950 29 Paid miscellaneous expenses, 5500 30 Paid automobile expense (including rental charges for an automobile), 51,500 30 Discovered an error in computing a commission received cash from the salesperson for the overpayment. $1.000 30 Maid salaries and commissions for the month, $27,500 30 Recorded revenue cared and billed to client during the month $23.000, 30 Purchased and for a future building site for 575.000, paying $10.000 in cash and giving mode payable for the remainder 30 Paid dividenda, 55.000 30. Remed ind purchased on November to a local university for use as a parking love for det events received advance payment ar Requiredi (Vou may Prepare this amalar word de Prefer to the following for Apple Huay MacBook Al > 20 DOG cod F 13 1 # $ % & 2 17 Paid advertising expense, S5,500 23 Paid creditors on account, S4,950. 29 Paid miscellaneous expenses, $500. 30 Paid automobile expense (including rental charges for an automobile), S1,500. 30 Discovered an error in computing a commission; received cash from the salesperson for the overpayment, $1,000 30 Paid salaries and commissions for the month, $27,800. 30 Recorded revenue earned and billed to clients during the month, S83,000. 30 Purchased land for a future building site for $75,000, paying $10,000 in cash and giving a note payable for the remainder 30 Paid dividends, S5,000. 30 Rented land purchased on November 30 to a local university for use as a parking lot for athletic events; received advance payment of $3,600 Required: (You may Prepare this assignment on a excel or word document) Please refer to the following for Apple Realty 1) Journalize the transactions for November 2) Record the November 1, 2020, balance of each count in the appropriate balance column of a T sccount 3) Post the journal entries to the accounts below, selecting the date to the left of each amount to identify the transaction. Determine the balances for all accounts with more than one posting 4) Prepare a trial balance of the of Nove 30, 2020 5) Prepare an Income Statement as of November 30, 2020 6) Prepare a statement of Stockholder's Equity as of November 30, 2020 Prepare a Balance Sheet as of November 30, 2030 After completion, please upload your work in this assignment thread Book ODO