Answered step by step

Verified Expert Solution

Question

1 Approved Answer

may you please show me where the 5.6503 comes from, I understand it has something to do with the discount factor Iublems dle royalholloway.ac.uk Youtube

may you please show me where the 5.6503 comes from, I understand it has something to do with the discount factor

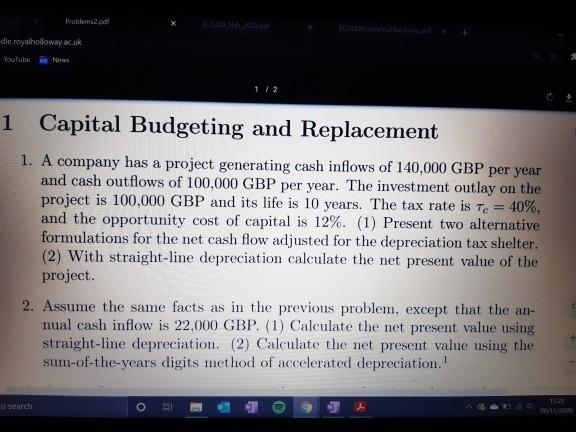

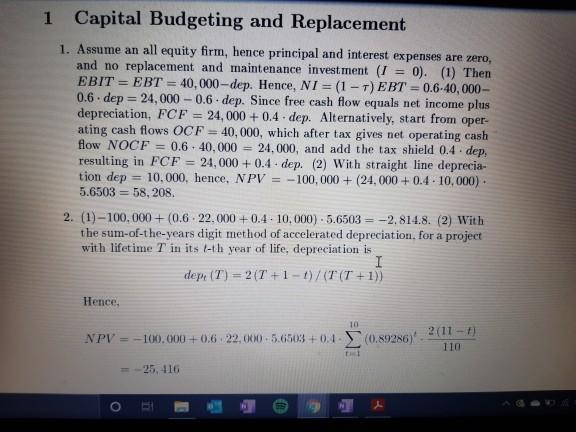

Iublems dle royalholloway.ac.uk Youtube 1 Capital Budgeting and Replacement 1. A company has a project generating cash inflows of 140,000 GBP per year and cash outflows of 100,000 GBP per year. The investment outlay on the project is 100,000 GBP and its life is 10 years. The tax rate is Te = 40%. and the opportunity cost of capital is 12%. (1) Present two alternative formulations for the net cash flow adjusted for the depreciation tax shelter. (2) With straight-line depreciation calculate the net present value of the project. 2. Assume the same facts as in the previous problem, except that the an- nual cash inflow is 22.000 GBP. (1) Calculate the net present value using straight-line depreciation. (2) Calculate the net present value using the sum-of-the-years digits method of accelerated depreciation.! o search 1 Capital Budgeting and Replacement 1. Assume an all equity firm, hence principal and interest expenses are zero, and no replacement and maintenance investment (I 0). (1) Then EBIT = EBT = 40,000-dep. Hence, NI = (1 - T)EBT = 0.6-40.000- 0.6. dep = 24,000 - 0.6. dep. Since free cash flow equals net income plus depreciation, FCF = 24,000+ 0.4. dep. Alternatively, start from oper- ating cash flows OCF = 40,000, which after tax gives net operating cash flow NOCE = 0.6.40.000 = 24,000, and add the tax shield 0.4. dep, resulting in FCF = 24,000+ 0.4. dep. (2) With straight line deprecia- tion dep = 10.000, hence, NPV - 100,000+ (24.000+ 0.4.10,000). 5.6503 = 58,208. 2. (1)-100,000+ (0.6. 22.000+0.4. 10,000)-5.6503 = -2,814.8. (2) With the sum-of-the-years digit method of accelerated depreciation, for a project with lifetime T in its t-th year of life, depreciation is I de IP (T) = 2 ( T+1-t) / (T ( T+1)) Hence, NPV = -100.000 +0.622.00-5.6503 +0.1. (0.89286) 2 (11-1 110 1 25, 416

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started