Answered step by step

Verified Expert Solution

Question

1 Approved Answer

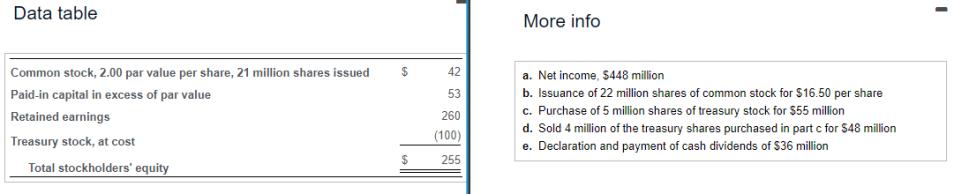

Data table Common stock, 2.00 par value per share, 21 million shares issued Paid-in capital in excess of par value Retained earnings Treasury stock,

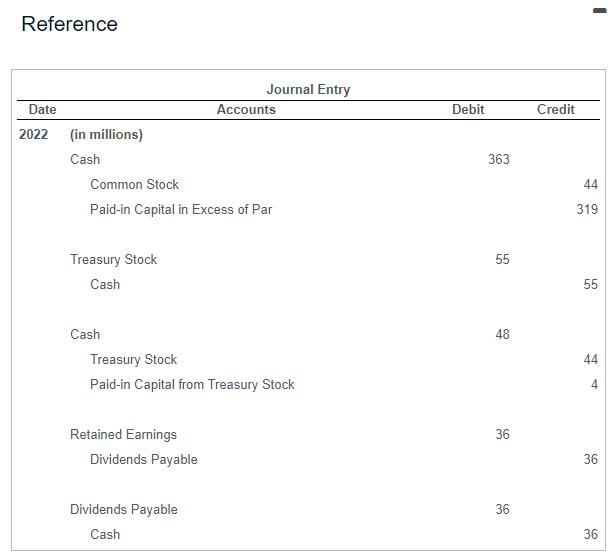

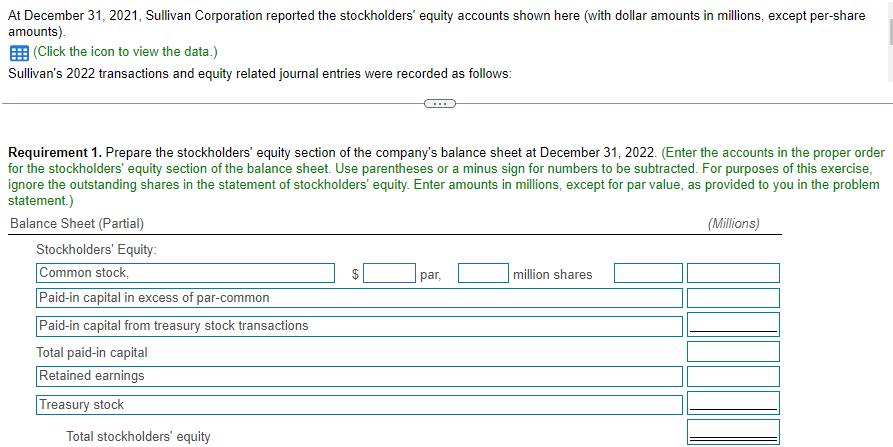

Data table Common stock, 2.00 par value per share, 21 million shares issued Paid-in capital in excess of par value Retained earnings Treasury stock, at cost Total stockholders' equity $ 42 53 260 (100) 255 More info a. Net income, $448 million b. Issuance of 22 million shares of common stock for $16.50 per share c. Purchase of 5 million shares of treasury stock for $55 million d. Sold 4 million of the treasury shares purchased in part c for $48 million e. Declaration and payment of cash dividends of $36 million I Reference Date 2022 (in millions) Cash Treasury Stock Cash Common Stock Paid-in Capital in Excess of Par Cash Retained Earnings Journal Entry Treasury Stock Paid-in Capital from Treasury Stock Dividends Payable Accounts Dividends Payable Cash Debit 363 55 48 36 36 Credit I 44 319 55 44 4 36 36 At December 31, 2021, Sullivan Corporation reported the stockholders' equity accounts shown here (with dollar amounts in millions, except per-share amounts). (Click the icon to view the data.) Sullivan's 2022 transactions and equity related journal entries were recorded as follows: Requirement 1. Prepare the stockholders' equity section of the company's balance sheet at December 31, 2022. (Enter the accounts in the proper order for the stockholders' equity section of the balance sheet. Use parentheses or a minus sign for numbers to be subtracted. For purposes of this exercise, ignore the outstanding shares in the statement of stockholders' equity. Enter amounts in millions, except for par value, as provided to you in the problem statement.) Balance Sheet (Partial) (Millions) Stockholders' Equity: Common stock, Paid-in capital in excess of par-common Paid-in capital from treasury stock transactions Total paid-in capital Retained earnings Treasury stock Total stockholders' equity $ par, million shares

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started