Answered step by step

Verified Expert Solution

Question

1 Approved Answer

maybi habe some help with question number 4? inprovided question 3 due onit being ised for question 4. 304 Chapter 21 Business Loans and Financing

maybi habe some help with question number 4? inprovided question 3 due onit being ised for question 4.

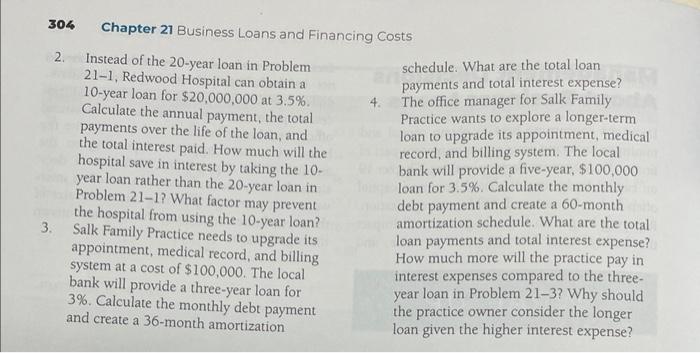

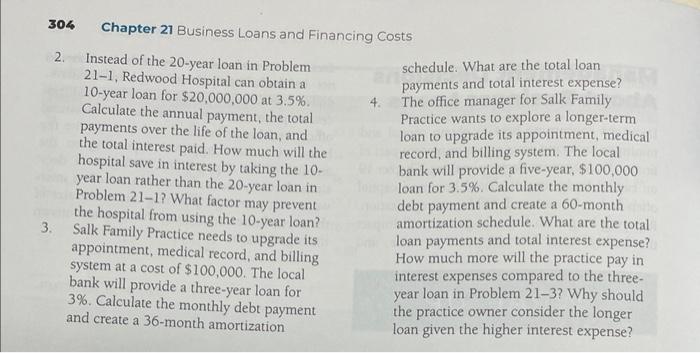

304 Chapter 21 Business Loans and Financing Costs 2. Instead of the 20-year loan in Problem schedule. What are the total loan 21-1, Redwood Hospital can obtain a payments and total interest expense? 10-year loan for $20,000,000 at 3.5%. 4. The office manager for Salk Family Calculate the annual payment, the total 4. Practice wants to explore a longer-term payments over the life of the loan, and Ioan to upgrade its appointment, medical thetotalinterestpaid.Howmuchwillthehospitalsaveininterestbytakingthe10-yearloanratherthanthe20-yearloaninProblem211?Whatfactormaypreventthehospitalfromusingthe10-yearloan?loalkFamilyPracticeneedstoupgradeitsrecord,andbillingsystem.Thelocalbankwillprovideafive-year,$100,000loanfor3.5%.Calculatethemonthlydebtpaymentandcreatea60-monthamortizationschedule.Whatarethetotalloaymentsandtotalinterestexpense? How much more will the practice pay in interest expenses compared to the threeyear loan in Problem 21-3? Why should the practice owner consider the longer loan given the higher interest expense? and create a 36-month amortization

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started