Question

Mayfair Company completed the following transactions and uses a perpetual inventory system. June 4 Sold $650 of merchandise on credit (that had cost $400) to

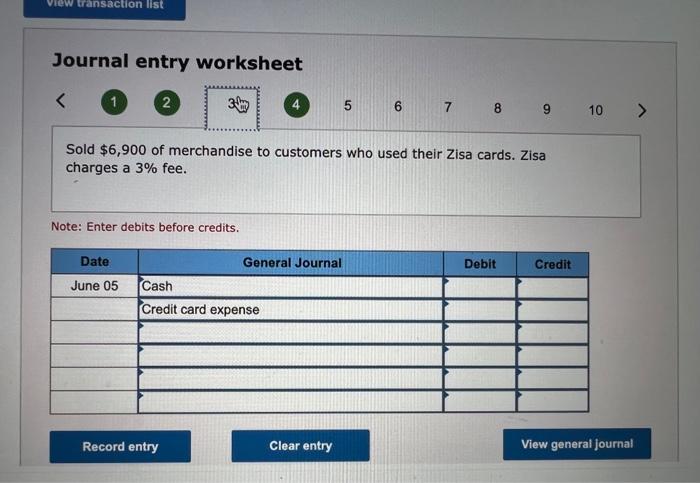

Mayfair Company completed the following transactions and uses a perpetual inventory system.

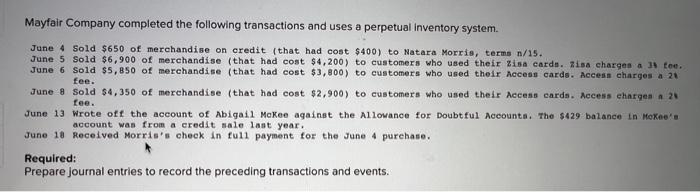

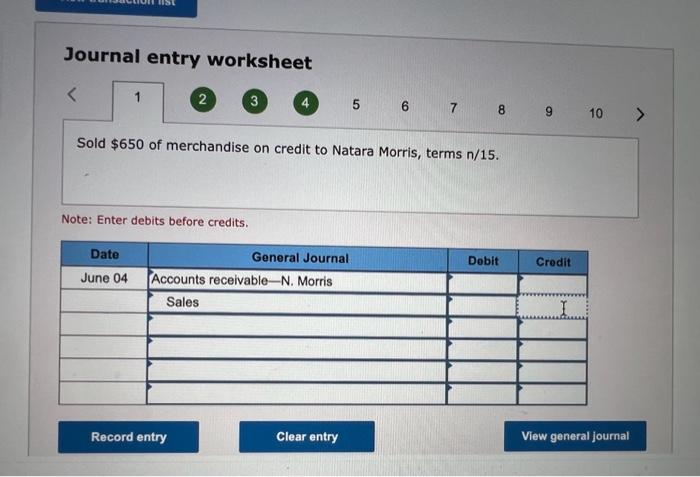

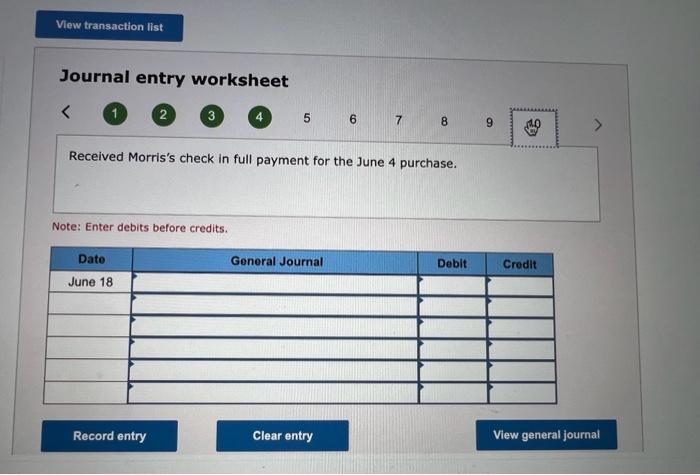

June 4 | Sold $650 of merchandise on credit (that had cost $400) to Natara Morris, terms n/15. |

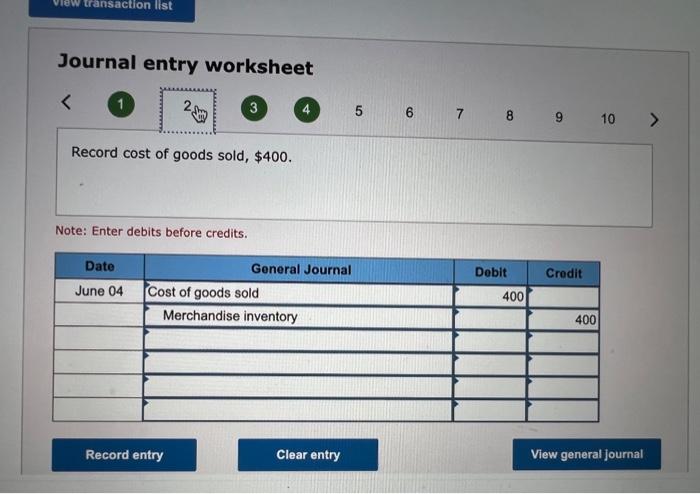

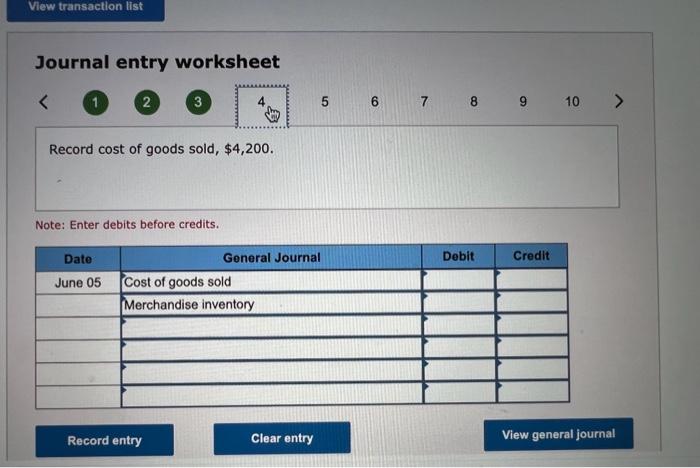

June 5 | Sold $6,900 of merchandise (that had cost $4,200) to customers who used their Zisa cards. Zisa charges a 3% fee. |

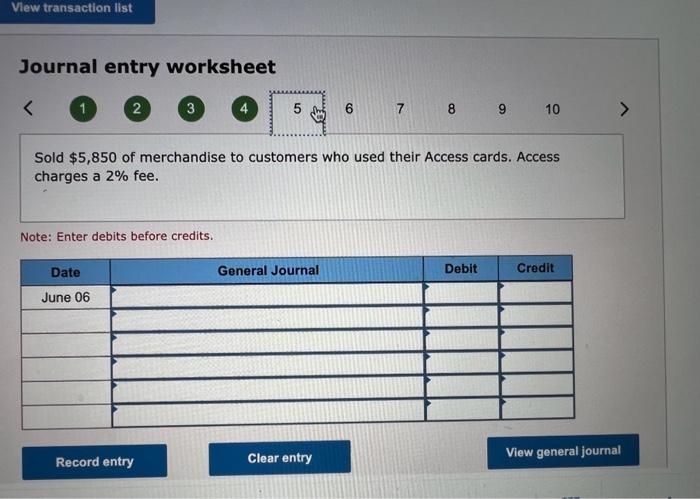

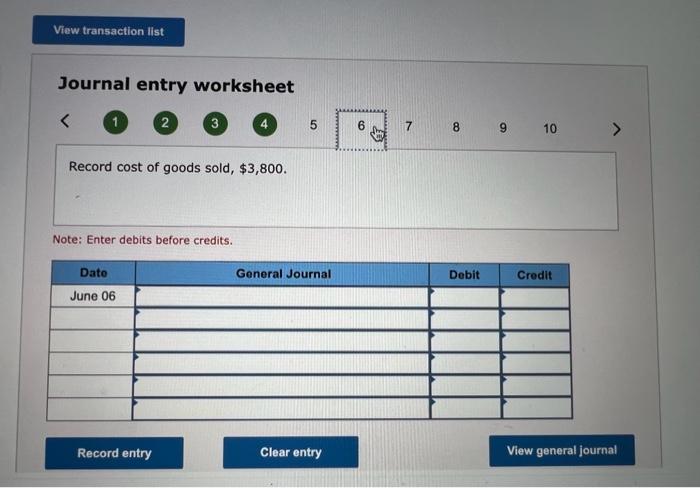

June 6 | Sold $5,850 of merchandise (that had cost $3,800) to customers who used their Access cards. Access charges a 2% fee. |

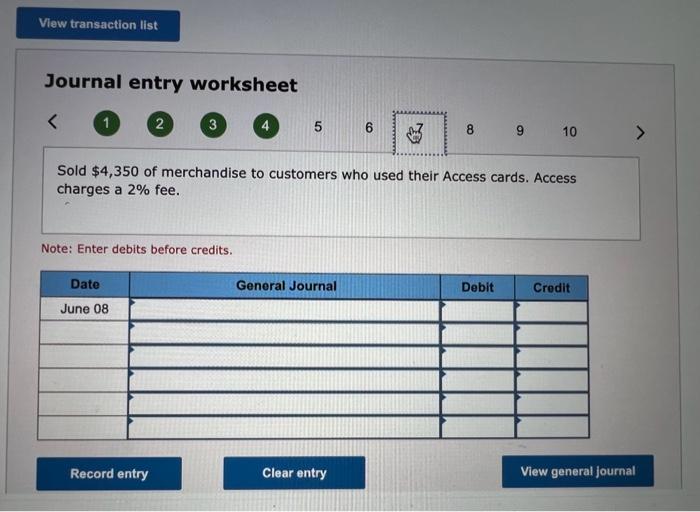

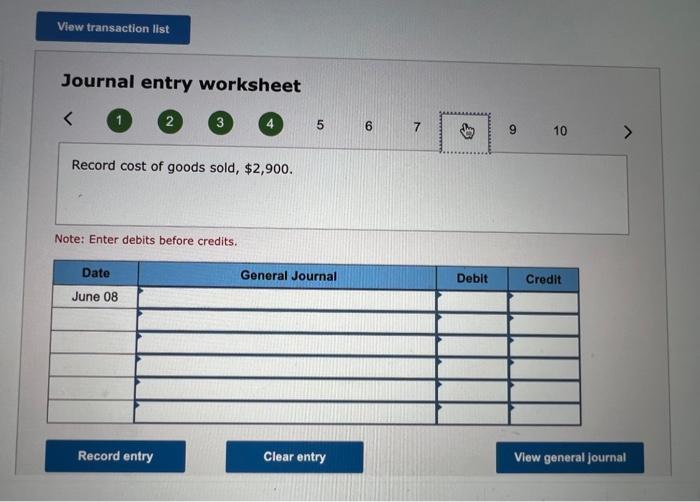

June 8 | Sold $4,350 of merchandise (that had cost $2,900) to customers who used their Access cards. Access charges a 2% fee. |

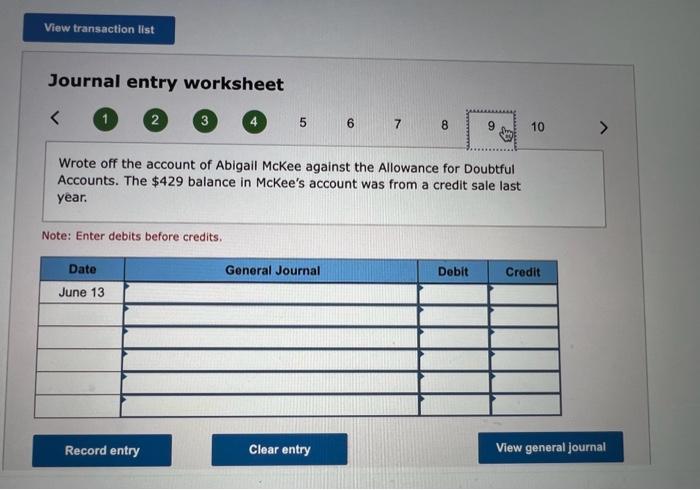

June 13 | Wrote off the account of Abigail McKee against the Allowance for Doubtful Accounts. The $429 balance in McKees account was from a credit sale last year. |

June 18 | Received Morriss check in full payment for the June 4 purchase. |

Required: Prepare journal entries to record the preceding transactions and events.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started