Question

MAYIKA CLEAN Service started 2 years ago by Mai Yika. Because business has been exceptionally good, Mai decided on July 1, 2013 to expand operations

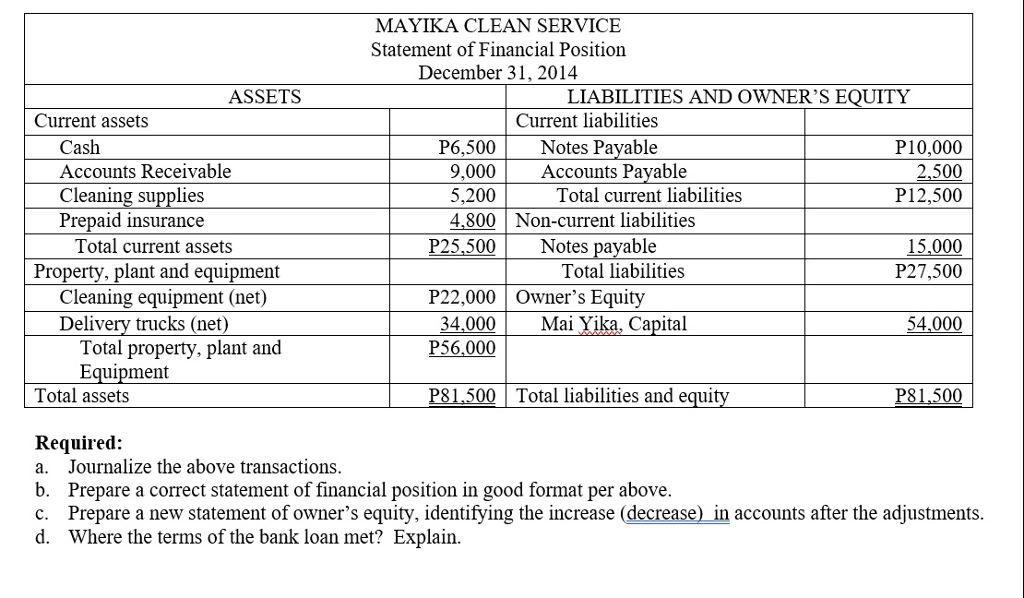

MAYIKA CLEAN Service started 2 years ago by Mai Yika. Because business has been exceptionally good, Mai decided on July 1, 2013 to expand operations by acquiring an additional truck and hiring two more assistants. To finance the expansion, Mai obtained on July 1, 2014 a P25,000, 10% bank loan, payable P10,000 on 1 July 2015, and the balance on 1 July 2016. The terms of the loan require the borrower to have P10,000 more current assets than current liabilities as at 31 December 2014. If these terms are not met, the bank loan will be refinanced at 15% interest. As at 31 December 2014, the accountant for EVERCLEAN Service prepared the statement of financial position shown below. Mai presented the statement of financial position to the banks loan officer on 2 January 2014, confident that the business had met the terms of the loan. The loan officer was not impressed. She said, We need financial statements audited by a qualified accountant. A qualified accountant was hired and immediately realized that the statement of financial position had been prepared from a trial balance and not from an adjusted trial balance. The adjustment data at the reporting date consisted of the following: 1. Earned but not invoiced cleaning service were P5,700. 2. Cleaning supplies on hand were P2,800. 3. Prepaid insurance was a 3-year policy dated 1 January 2014. 4. December expenses incurred but unpaid as at 31 December 2014, P700. 5. Interest on the bank loan was not recorded. 6. The amounts for property, plant and equipment presented in the financial position were reported net of accumulated depreciation (cost less accumulated depreciation). These amounts were P4,000 for cleaning equipment and P5,000 for delivery trucks as at 1 January, 2014. Depreciation for 2014 was P2,000 for cleaning equipment and P5,000 for delivery trucks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started