Answered step by step

Verified Expert Solution

Question

1 Approved Answer

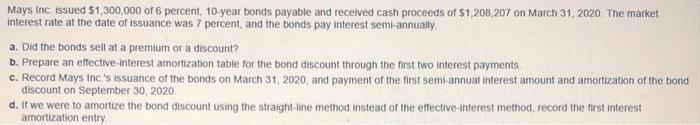

Mays Inc. issued $1,300,000 of 6 percent, 10-year bonds payable and received cash proceeds of $1,208,207 on March 31, 2020. The market interest rate

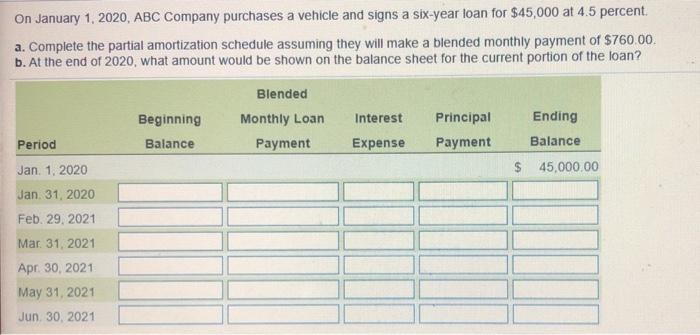

Mays Inc. issued $1,300,000 of 6 percent, 10-year bonds payable and received cash proceeds of $1,208,207 on March 31, 2020. The market interest rate at the date of issuance was 7 percent, and the bonds pay interest semi-annually a. Did the bonds sel at a premium or a discount? b. Prepare an effective-interest amortization table for the bond discount through the first two interest payments c. Record Mays Inc.'s issuance of the bonds on March 31, 2020, and payment of the first semi-annual interest amount and amortization of the bond discount on September 30, 2020. d. If we were to amortize the bond discount using the straight-line method instead of the effective-interest method, record the first interest amortization entry On January 1, 2020, ABC Company purchases a vehicle and signs a six-year loan for $45,000 at 4.5 percent. a. Complete the partial amortization schedule assuming they will make a blended monthly payment of $760.00. b. At the end of 2020, what amount would be shown on the balance sheet for the current portion of the loan? Blended Beginning Monthly Loan Interest Principal Ending Period Balance Payment Expense Payment Balance Jan. 1, 2020 $ 45,000.00 Jan. 31, 2020 Feb. 29, 2021 Mar. 31, 2021 Apr. 30, 2021 May 31, 2021 Jun. 30, 2021

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Part a The Bonds are issued at DISCOUNT as the Issue Price is lower than the Face value of Bond Disc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started