Question

MBA Investments Ltd (MBAIL) is a large merchandising firm based in Dar es Salaam and having retail branches throughout East Africa. Your client, Mr Peter

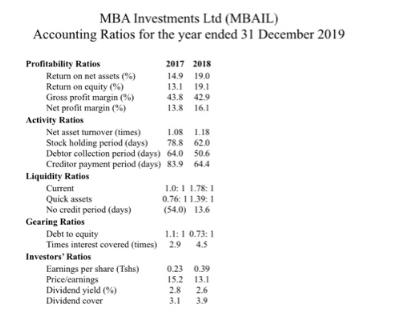

MBA Investments Ltd (MBAIL) is a large merchandising firm based in Dar es Salaam and having retail branches throughout East Africa. Your client, Mr Peter Magambo has asked you to evaluate MBAIL's performance with a view to assessing its future prospects so that he decides whether to invest in the company or not. Assume you have decided to assess MBAIL through its accounting ratios and to give you a basis for comparison you decide to assess the 2019 results against those for 2018 and a summary of the ratios is given below.

Required:

Comment on the performance of MBAIL and assess its future prospects.

MBA Investments Ltd (MBAIL) Accounting Ratios for the year ended 31 December 2019 Profitability Ratios Return on net assets () Return on equity (%) Gross profit margin () Net profit margin () 2017 2018 14.9 19.0 13.1 19.1 43.8 429 13.8 16.1 Activity Ratios Net asset tumover (times) Stock holding period (days) Debtor collection period (days) 64.0 50.6 Creditor payment period (days) 83.9 64.4 Liquidity Ratios 1.O8 LI8 78.8 620 1.0:1 1.78:1 0.76: 11.39:1 Current Quick assets No credit period (days) Gearing Ratios Debt to equity Times interest covered (times) 29 4.5 (54.0) 13.6 1.1:1 0.73:1 Investors' Ratios Eamings per share (Tshs) Price/earnings Dividend yield (%) 0.23 0.39 15.2 13.1 2.6 28 3.9 3.1 Dividend cover

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Profitability The firms profitability has improved in 2018 appreciably though the gross margin has ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started