Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MC Inc. is considering a proposal to invest $210,000 in new production equipment which will be depreciated on a straight-line bases (7-year life, no

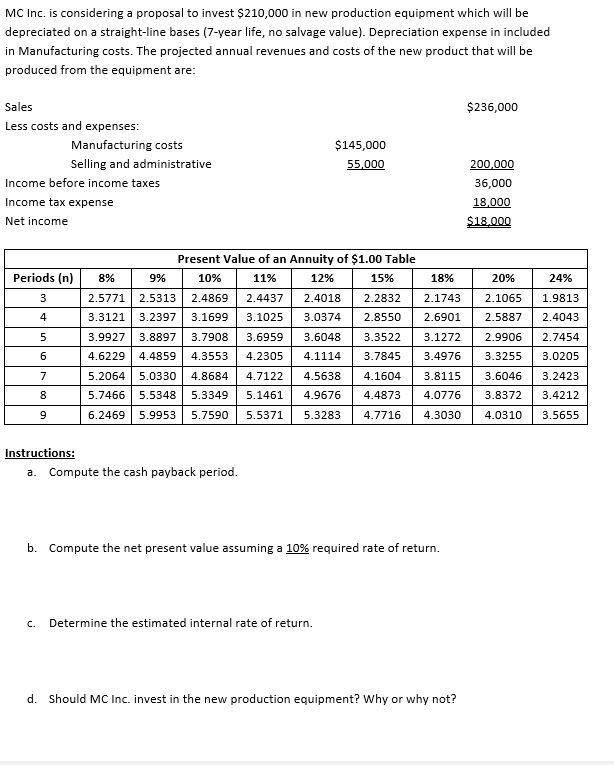

MC Inc. is considering a proposal to invest $210,000 in new production equipment which will be depreciated on a straight-line bases (7-year life, no salvage value). Depreciation expense in included in Manufacturing costs. The projected annual revenues and costs of the new product that will be produced from the equipment are: Sales $236,000 Less costs and expenses: Manufacturing costs $145,000 Selling and administrative 55,000 200,000 Income before income taxes 36,000 Income tax expense 18,000 Net income $18,000 Present Value of an Annuity of $1.00 Table Periods (n) 8% 9% 10% 11% 12% 15% 18% 20% 24% 3 2.5771 2.5313 2.4869 2.4437 2.4018 2.2832 2.1743 2.1065 1.9813 4 3.3121 3.2397 3.1699 3.1025 3.0374 2.8550 2.6901 2.5887 2.4043 3.9927 3.8897 3.7908 3.6959 3.6048 3.3522 3.1272 2.9906 2.7454 4.6229 4.4859 4.3553 4.2305 4.1114 3.7845 3.4976 3.3255 3.0205 7 5.2064 5.0330 4.8684 4.7122 4.5638 4.1604 3.8115 3.6046 3.2423 8 5.7466 5.5348 5.3349 5.1461 4.9676 4.4873 4.0776 3.8372 3.4212 6.2469 5.9953 5.7590 5.5371 5.3283 4.7716 4.3030 4.0310 3.5655 Instructions: a. Compute the cash payback period. b. Compute the net present value assuming a 10% required rate of return. c. Determine the estimated internal rate of return. d. Should MC Inc. invest in the new production equipment? Why or why not?

Step by Step Solution

★★★★★

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Depreciation 210000 7 30000 Net income 18000 Net Cash Inflow ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started