Answered step by step

Verified Expert Solution

Question

1 Approved Answer

MC03 3/4 will upvote Which of the following statements is correct? With liquidity ratios, it is assumed that the fixed assets will be converted to

MC03 3/4 will upvote

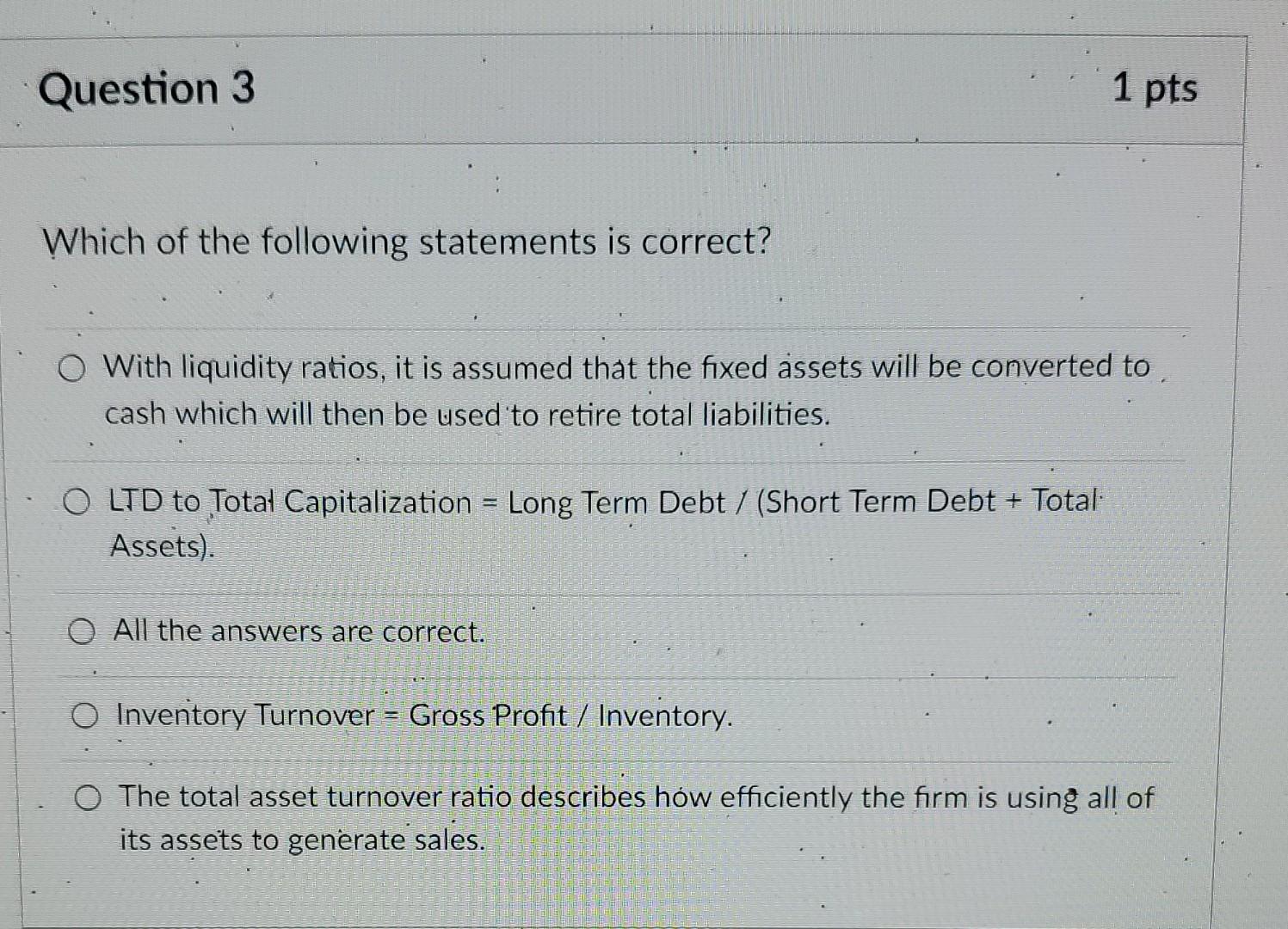

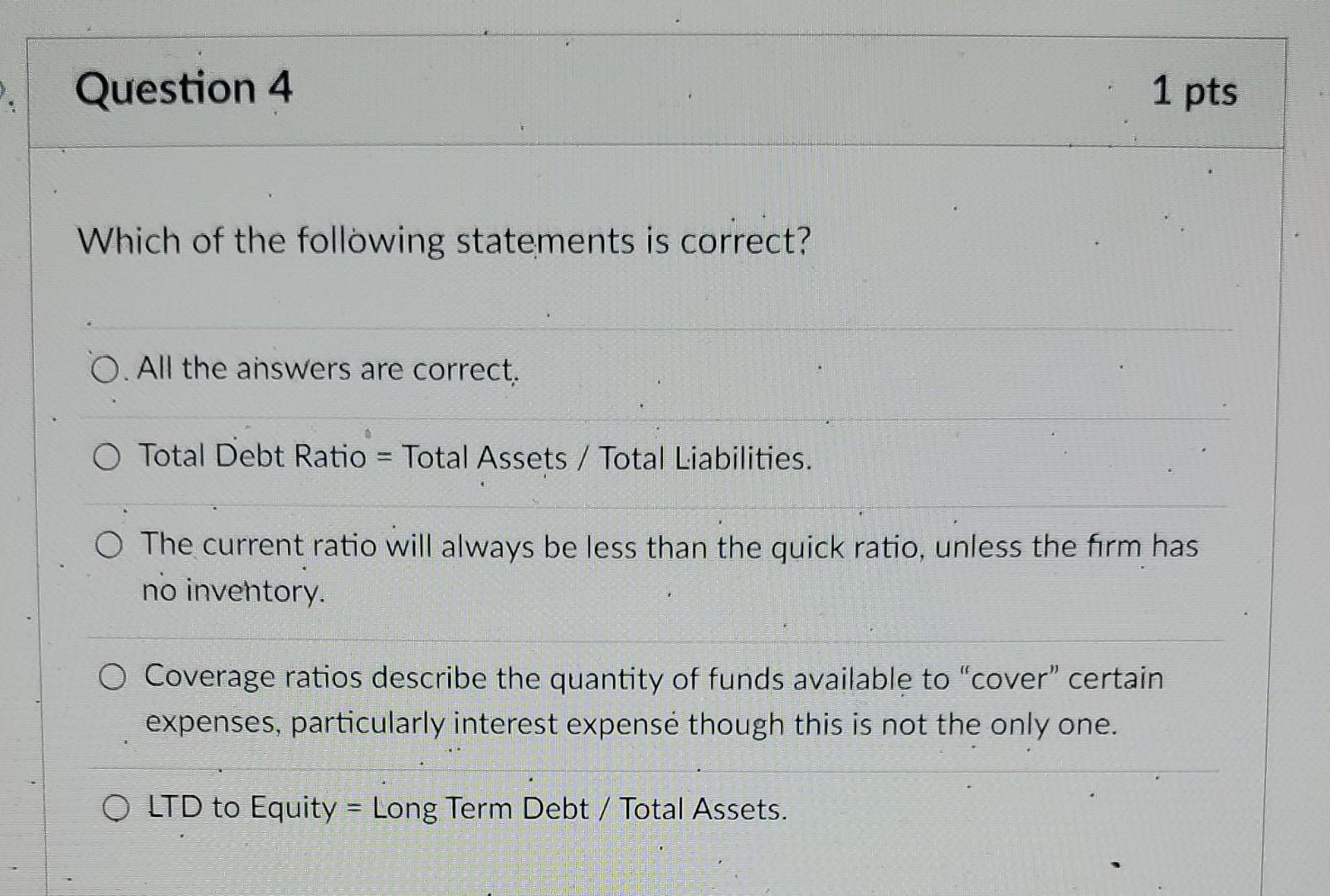

Which of the following statements is correct? With liquidity ratios, it is assumed that the fixed assets will be converted to cash which will then be used to retire total liabilities. LTD to Totat Capitalization = Long Term Debt / (Short Term Debt + Total Assets). All the answers are correct. Inventory Turnover = Gross Profit / Inventory. The total asset turnover ratio describes how efficiently the firm is using all of its assets to generate sales. Which of the following statements is correct? All the answers are correct. Total Debt Ratio = Total Assets / Total Liabilities. The current ratio will always be less than the quick ratio, unless the firm has no invehtory. Coverage ratios describe the quantity of funds available to "cover" certain expenses, particularly interest expense though this is not the only one. LTD to Equity = Long Term Debt / Total AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started