Answered step by step

Verified Expert Solution

Question

1 Approved Answer

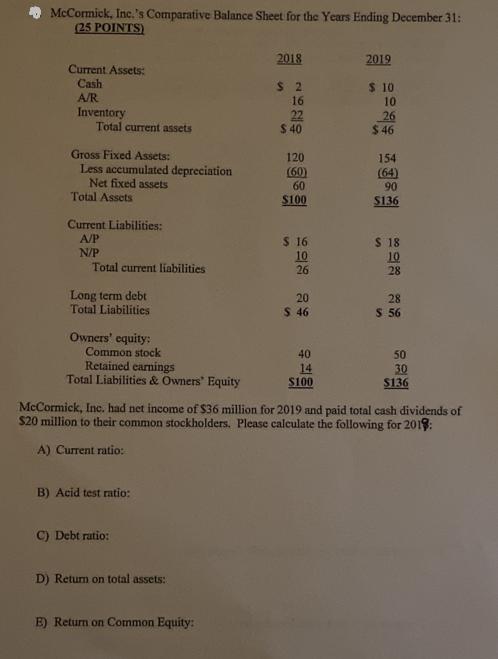

McCormick, Inc.'s Comparative Balance Sheet for the Years Ending December 31: (25 POINTS) Current Assets: Cash A/R Inventory Total current assets Gross Fixed Assets:

McCormick, Inc.'s Comparative Balance Sheet for the Years Ending December 31: (25 POINTS) Current Assets: Cash A/R Inventory Total current assets Gross Fixed Assets: Less accumulated depreciation Net fixed assets Total Assets Current Liabilities: A/P N/P Total current liabilities Long term debt Total Liabilities Owners' equity: Common stock Retained earnings Total Liabilities & Owners' Equity B) Acid test ratio: C) Debt ratio: D) Return on total assets: 2018 E) Return on Common Equity: $2 16 22 $40 120 (60) 60 $100 $ 16 10 26 20 S 46 40 14 $100 2019 $ 10 10 26 $46 154 (64) 90 $136 $ 18 10 28 McCormick, Inc. had net income of $36 million for 2019 and paid total cash dividends of $20 million to their common stockholders. Please calculate the following for 2018: A) Current ratio: 28 $ 56 50 30 $136

Step by Step Solution

★★★★★

3.51 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a Current ratio Current assets Current liabilities 46 28 164 b Acide test ratio Total ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started