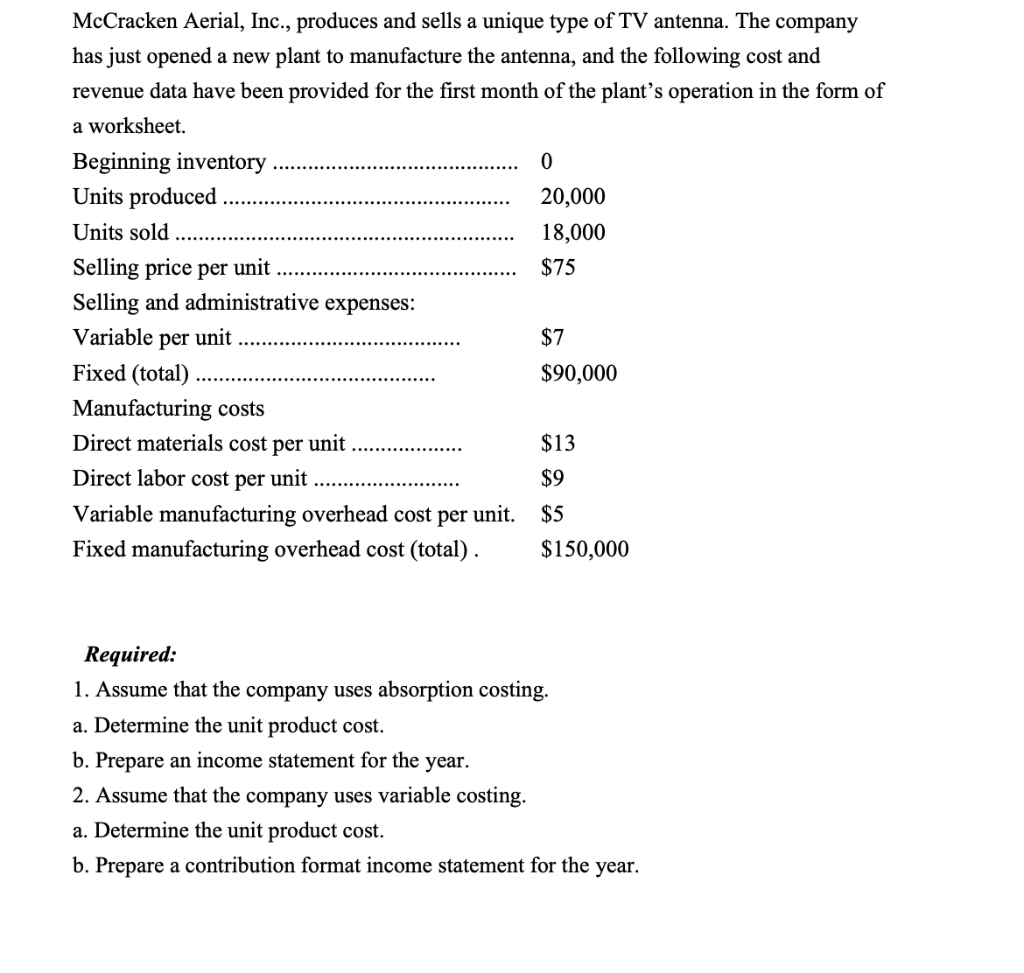

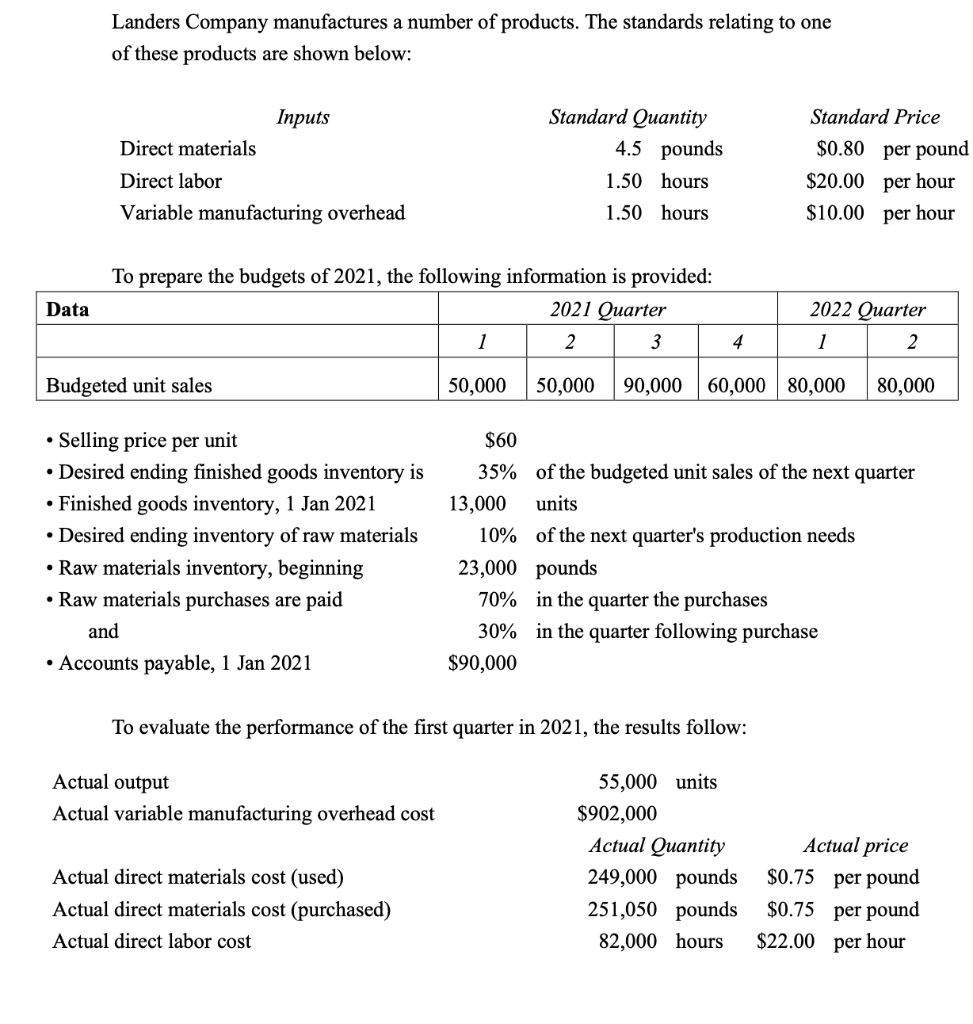

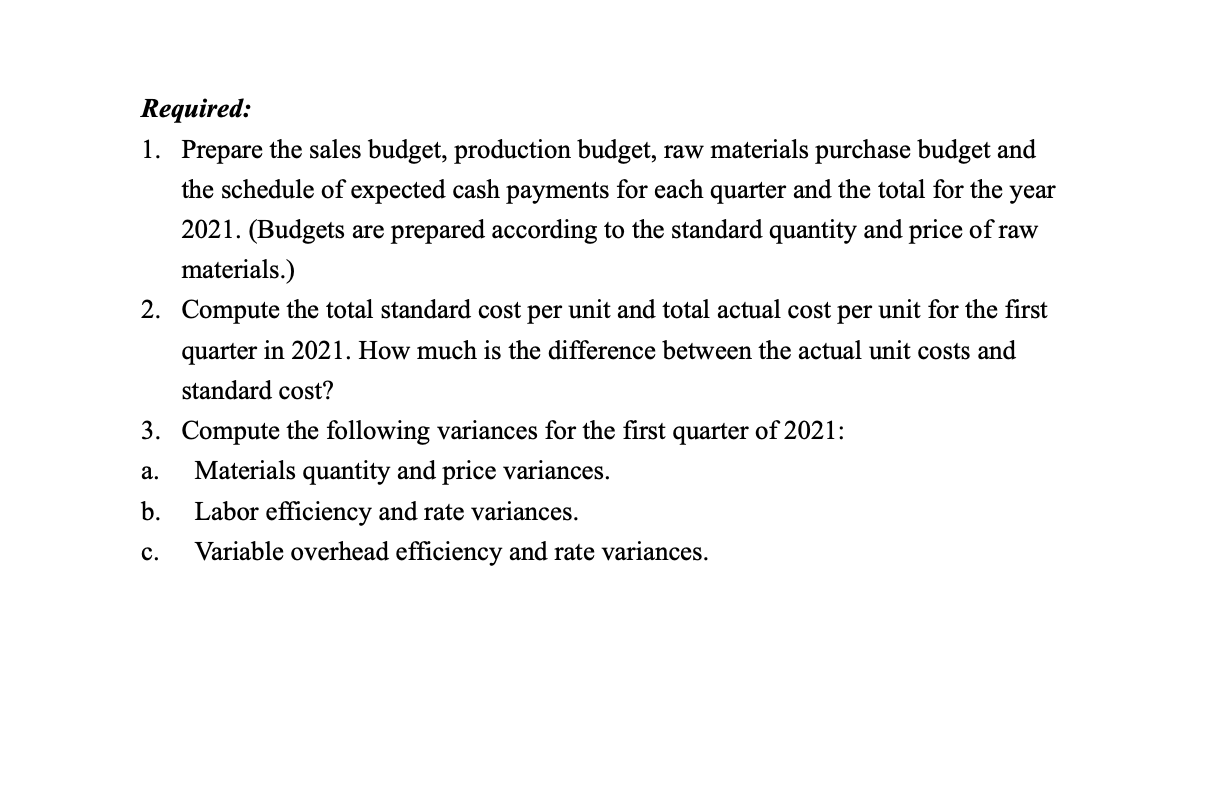

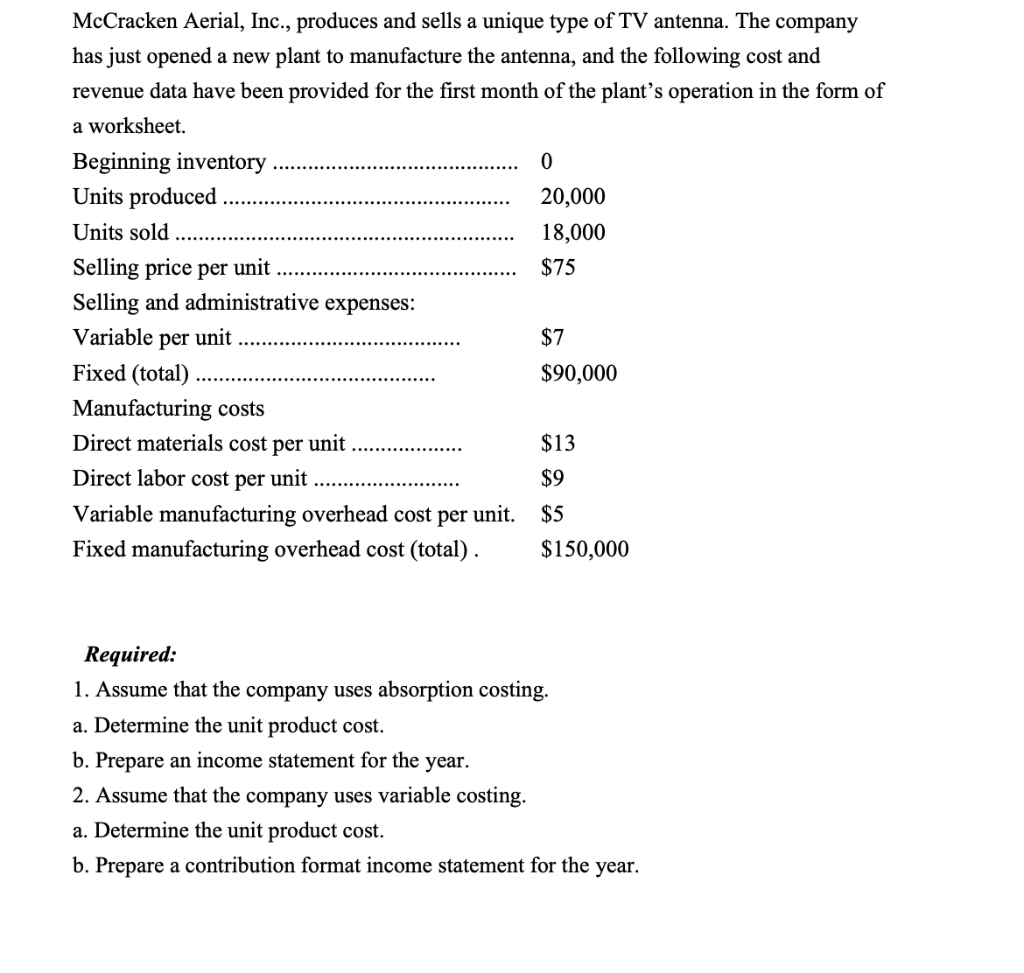

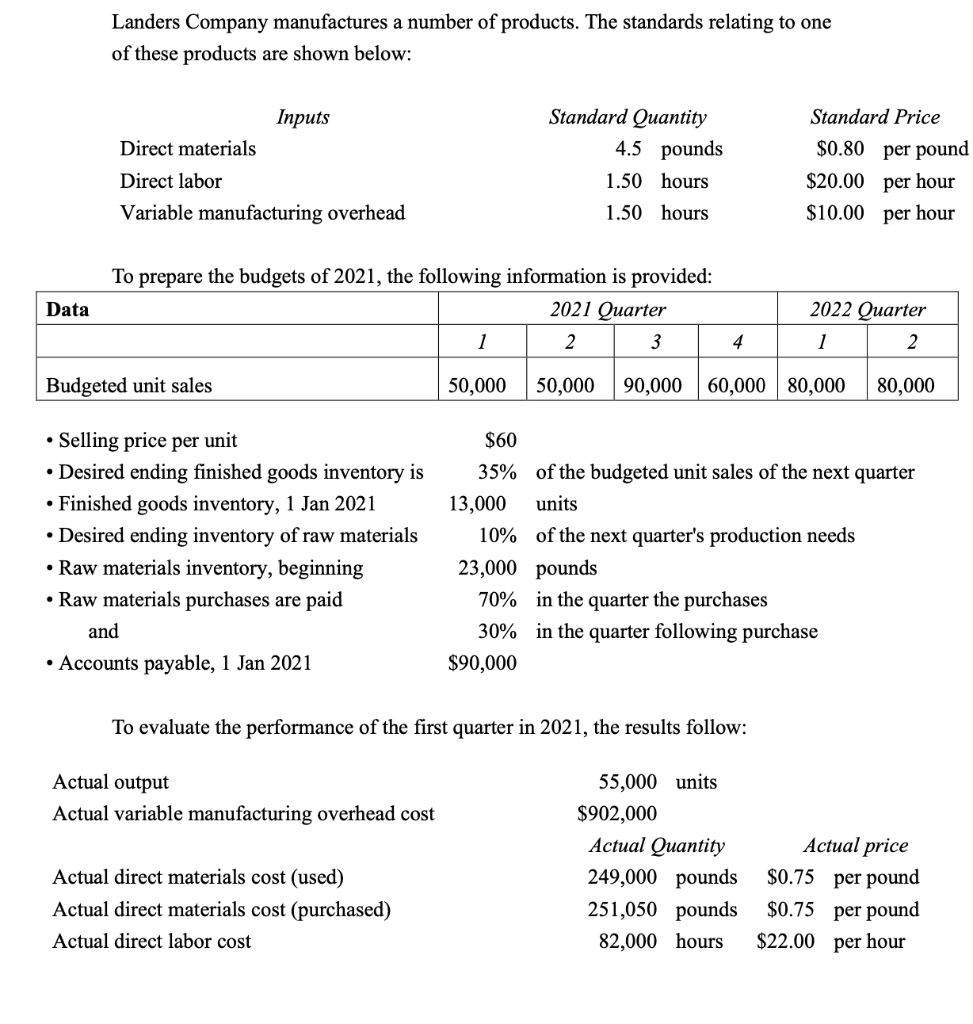

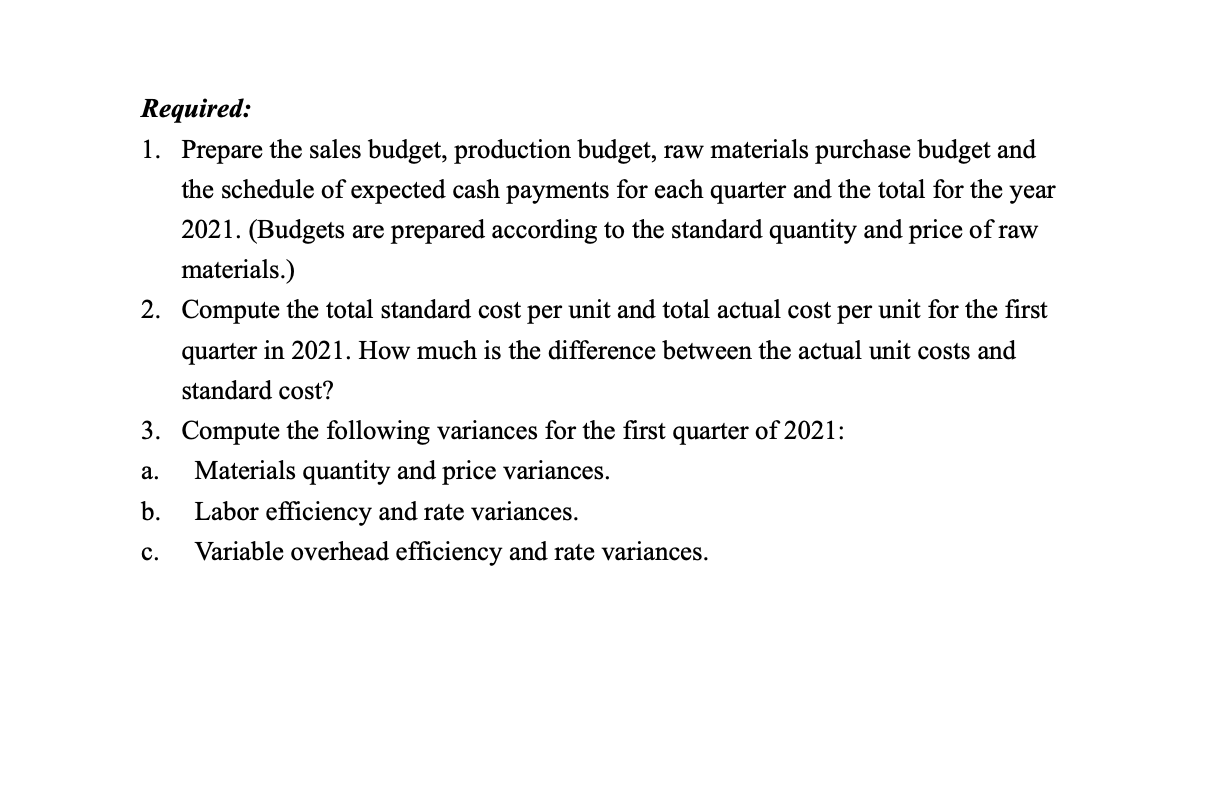

McCracken Aerial, Inc., produces and sells a unique type of TV antenna. The company has just opened a new plant to manufacture the antenna, and the following cost and revenue data have been provided for the first month of the plant's operation in the form of a worksheet. Beginning inventory 0 Units produced 20,000 Units sold 18,000 Selling price per unit $75 Selling and administrative expenses: Variable per unit $7 Fixed (total) $90,000 Manufacturing costs Direct materials cost per unit $13 Direct labor cost per unit $9 Variable manufacturing overhead cost per unit. $5 Fixed manufacturing overhead cost (total). $150,000 Required: 1. Assume that the company uses absorption costing. a. Determine the unit product cost. b. Prepare an income statement for the year. 2. Assume that the company uses variable costing. a. Determine the unit product cost. b. Prepare a contribution format income statement for the year. Landers Company manufactures a number of products. The standards relating to one of these products are shown below: Inputs Direct materials Direct labor Variable manufacturing overhead Standard Quantity 4.5 pounds 1.50 hours 1.50 hours Standard Price $0.80 per pound $20.00 per hour $10.00 per hour Data To prepare the budgets of 2021, the following information is provided: 2021 Quarter 1 2 3 2022 Quarter 4 1 2 Budgeted unit sales 50,000 50,000 90,000 60,000 80,000 80,000 $60 Selling price per unit Desired ending finished goods inventory is Finished goods inventory, 1 Jan 2021 Desired ending inventory of raw materials Raw materials inventory, beginning Raw materials purchases are paid and Accounts payable, 1 Jan 2021 35% of the budgeted unit sales of the next quarter 13,000 units 10% of the next quarter's production needs 23,000 pounds 70% in the quarter the purchases 30% in the quarter following purchase $90,000 To evaluate the performance of the first quarter in 2021, the results follow: Actual output Actual variable manufacturing overhead cost 55,000 units $902,000 Actual Quantity 249,000 pounds 251,050 pounds 82,000 hours Actual direct materials cost (used) Actual direct materials cost (purchased) Actual direct labor cost Actual price $0.75 per pound $0.75 per pound $22.00 per hour Required: 1. Prepare the sales budget, production budget, raw materials purchase budget and the schedule of expected cash payments for each quarter and the total for the year 2021. (Budgets are prepared according to the standard quantity and price of raw materials.) 2. Compute the total standard cost per unit and total actual cost per unit for the first quarter in 2021. How much is the difference between the actual unit costs and standard cost? 3. Compute the following variances for the first quarter of 2021: Materials quantity and price variances. b. Labor efficiency and rate variances. Variable overhead efficiency and rate variances. a. c