Answered step by step

Verified Expert Solution

Question

1 Approved Answer

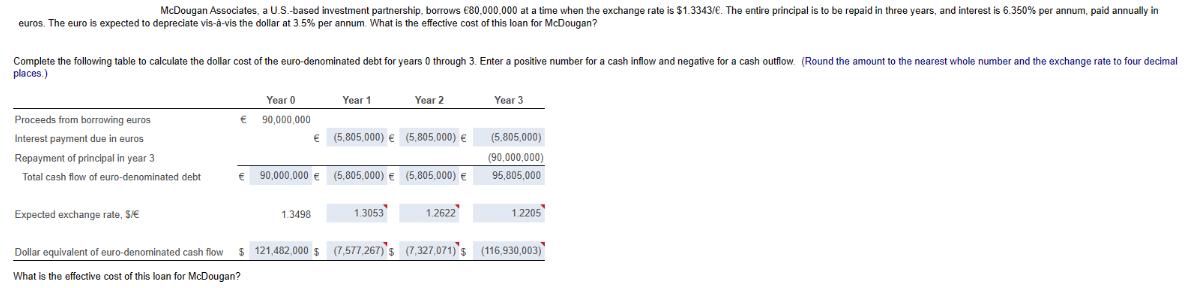

McDougan Associates, a U.S.-based investment partnership, borrows 80.000.000 at a time when the exchange rate is $1.3343/. The entire principal is to be repaid

McDougan Associates, a U.S.-based investment partnership, borrows 80.000.000 at a time when the exchange rate is $1.3343/. The entire principal is to be repaid in three years, and interest is 6.350% per annum, paid annually in euros. The euro is expected to depreciate vis--vis the dollar at 3.5% per annum. What is the effective cost of this loan for McDougan? Complete the following table to calculate the dollar cost of the euro-denominated debt for years 0 through 3. Enter a positive number for a cash inflow and negative for a cash outflow. (Round the amount to the nearest whole number and the exchange rate to four decimal places.) Proceeds from borrowing euros Year 0 90,000,000 Year 1 Year 2 Year 3 Interest payment due in euros (5,805,000) (5,805,000) Repayment of principal in year 3. Total cash flow of euro-denominated debt 90,000,000 (5,805.000) (5.805.000) (5.805,000) (90,000,000) 95,805,000 Expected exchange rate, S/ 1.3498 1.3053 1.2622 1.2205 Dollar equivalent of euro-denominated cash flow $ 121,482,000 $ (7,577.267)'s (7,327,071) $ (116,930,003) What is the effective cost of this loan for McDougan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the effective cost of the loan for McDougan we need to determine the present value of t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663de41b5940e_961293.pdf

180 KBs PDF File

663de41b5940e_961293.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started