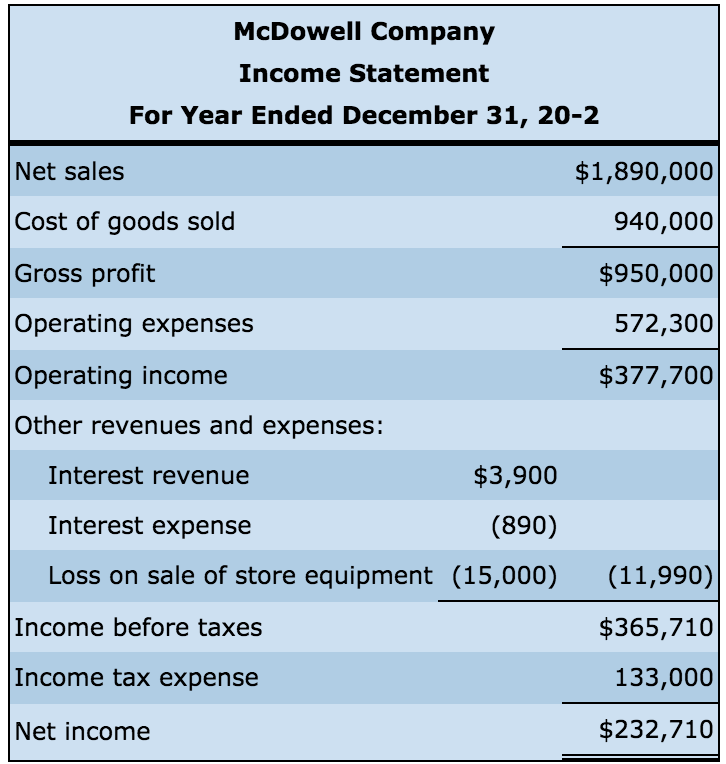

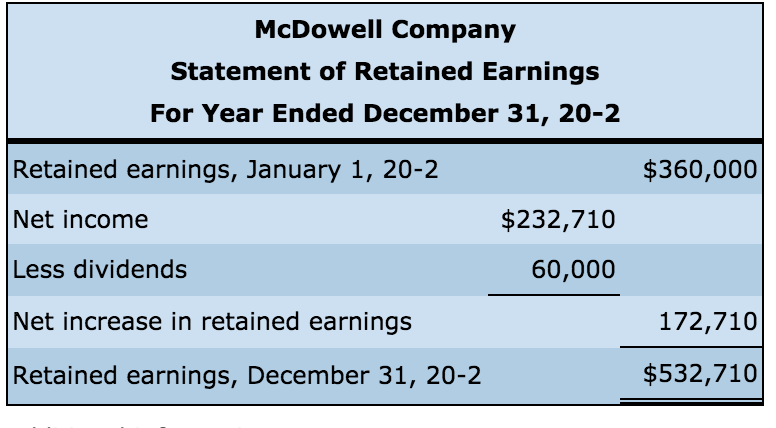

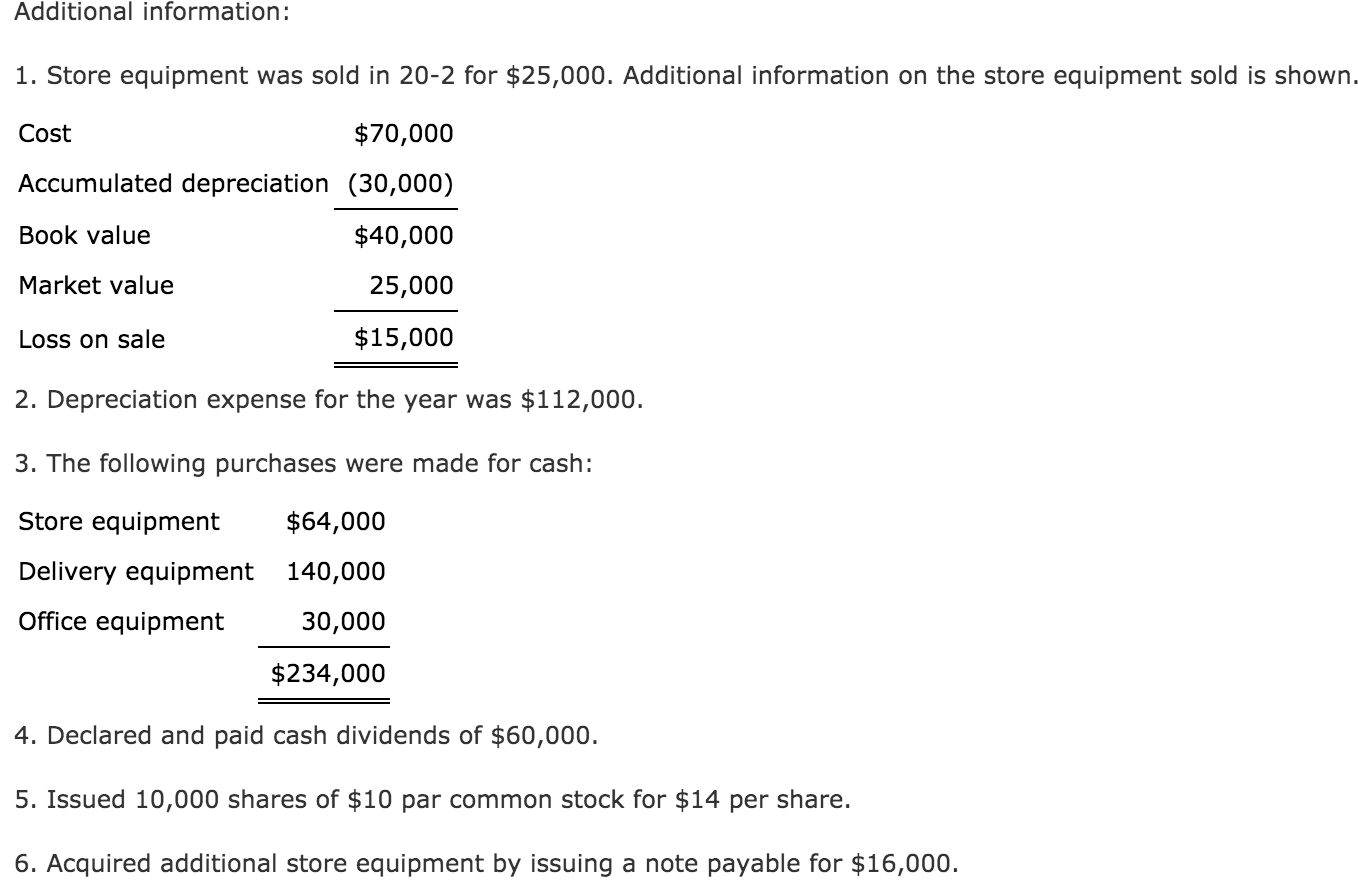

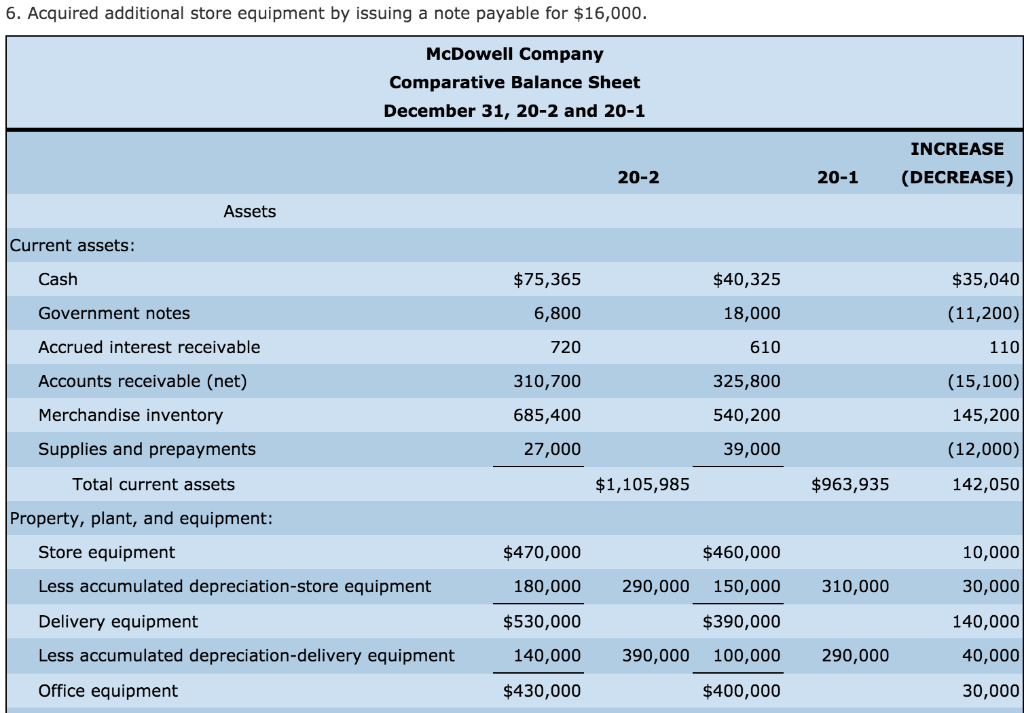

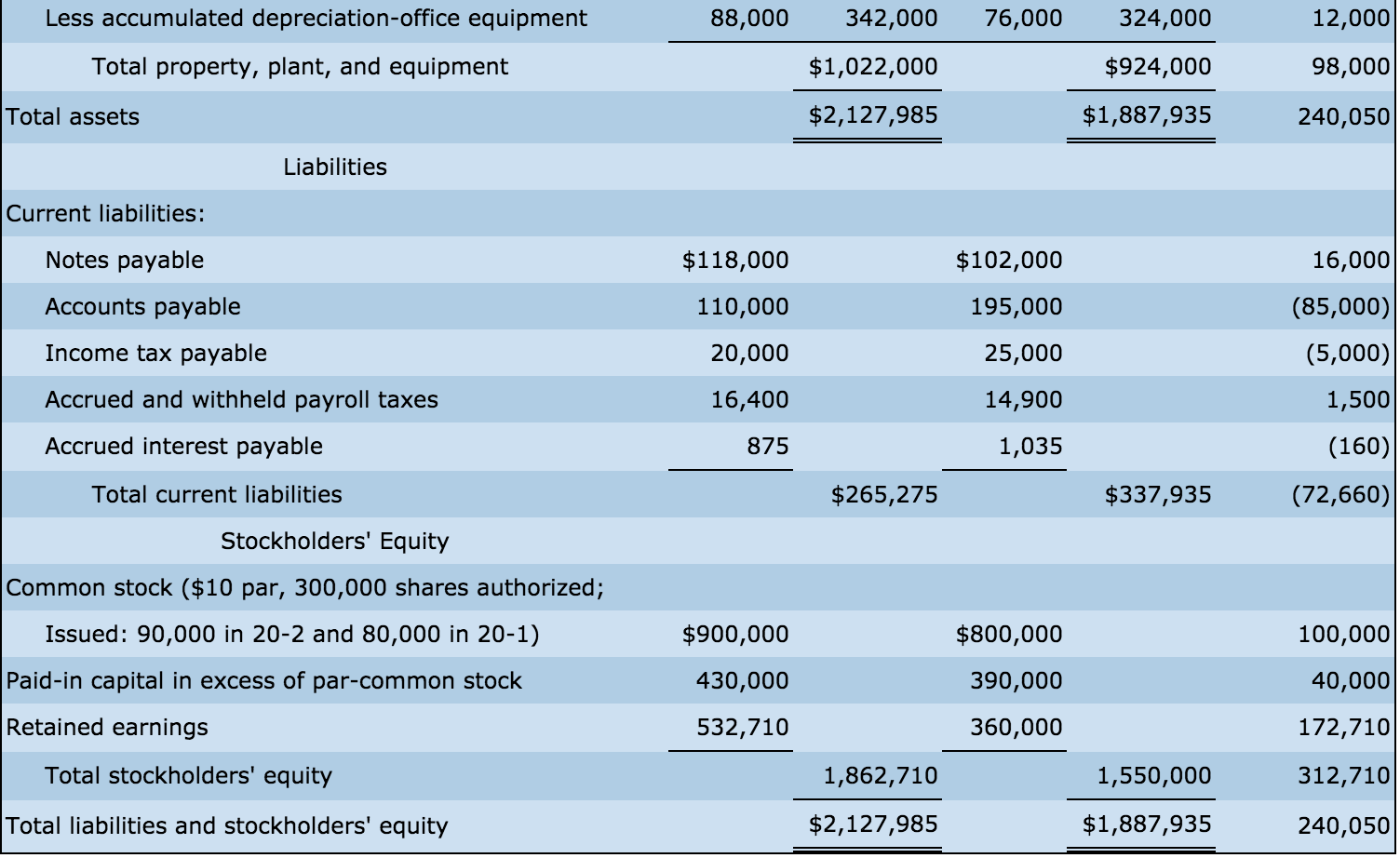

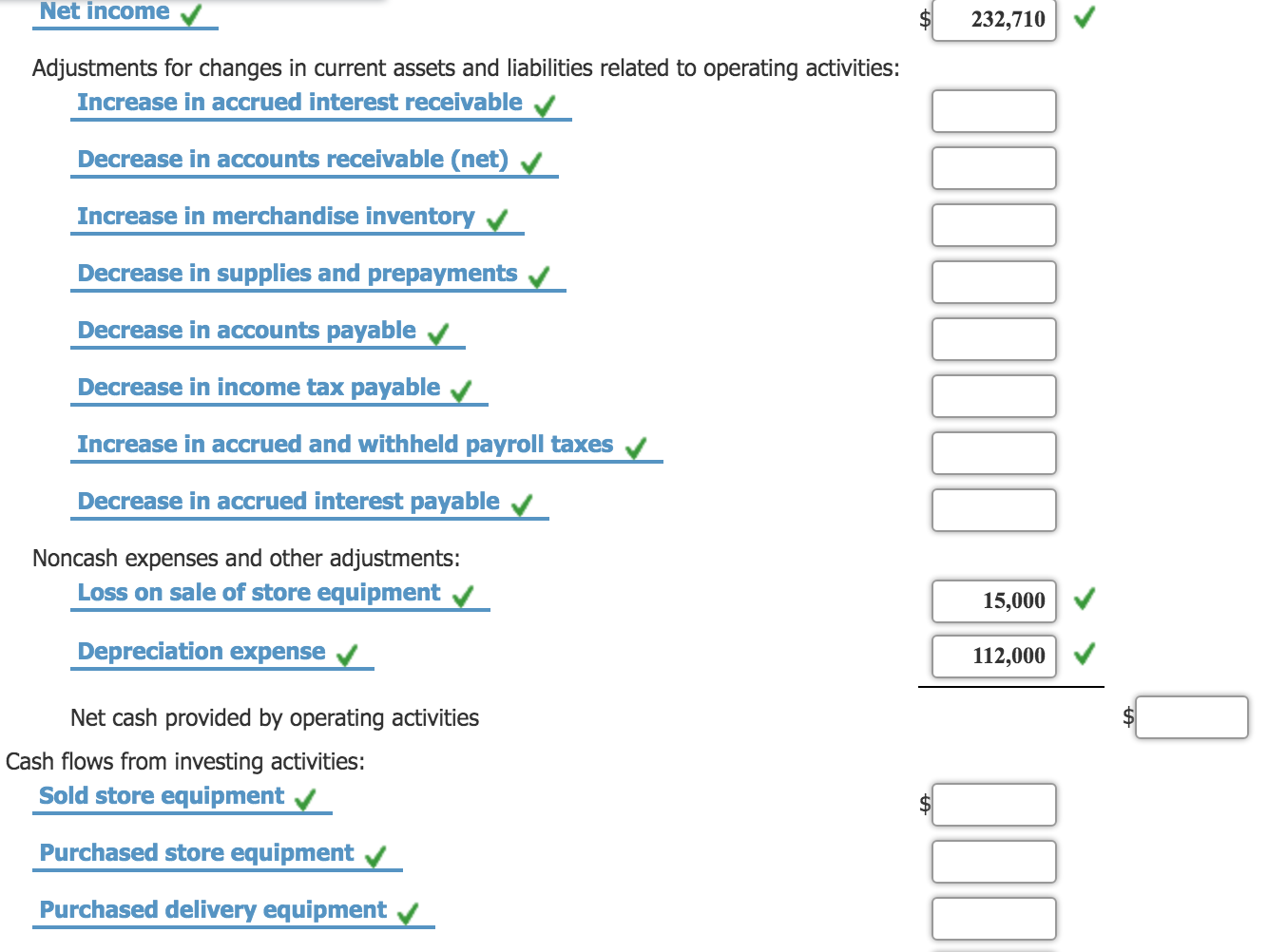

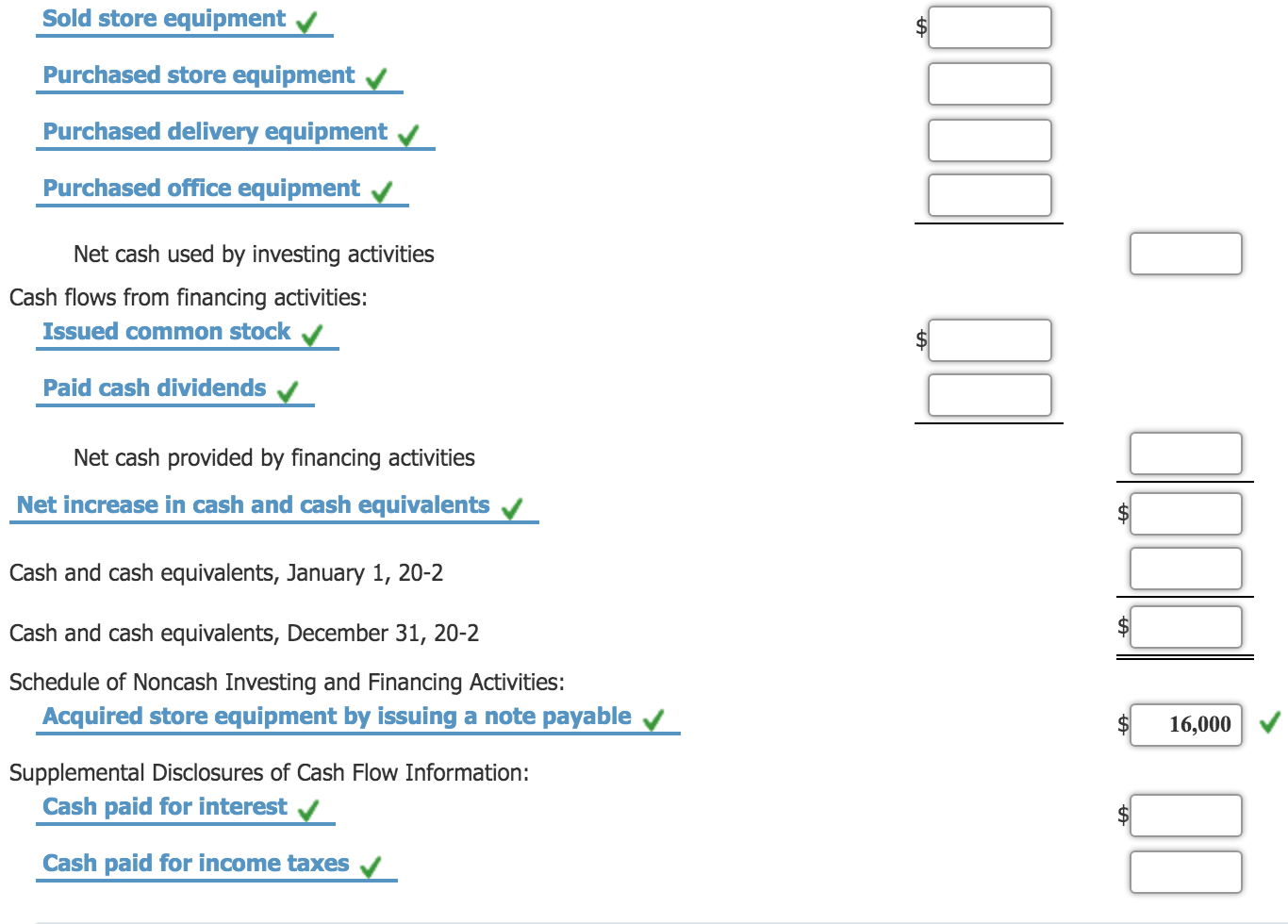

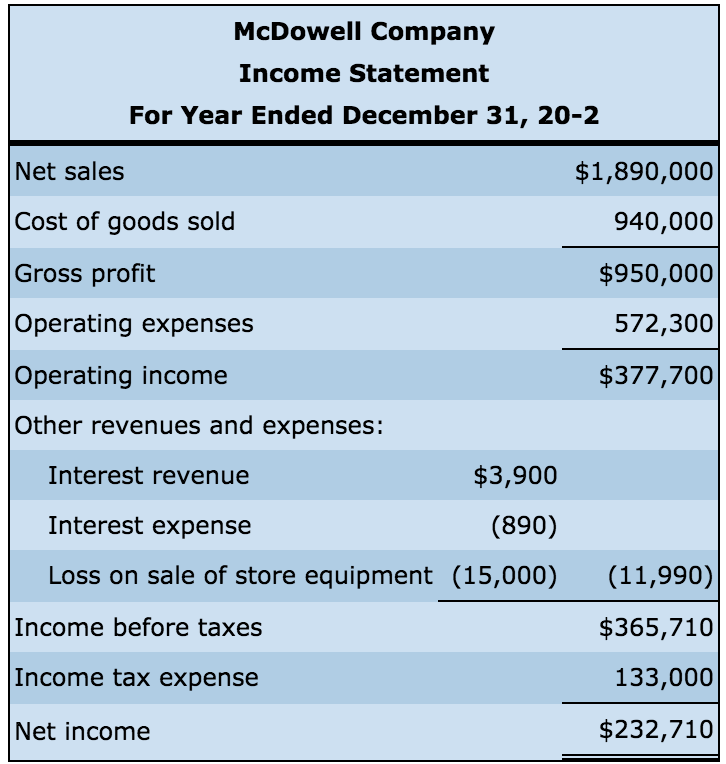

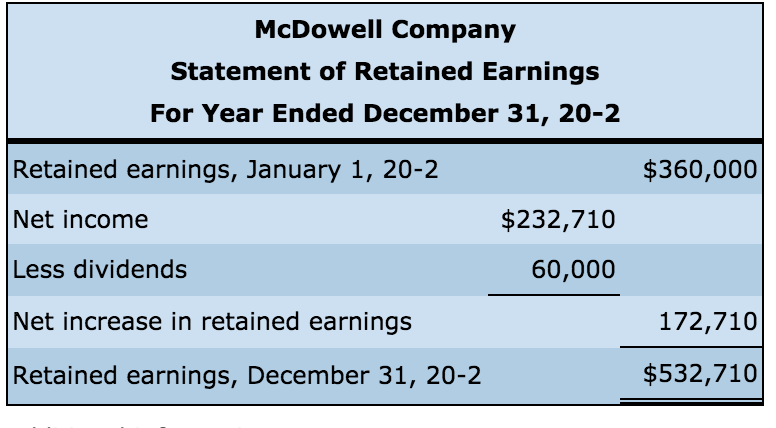

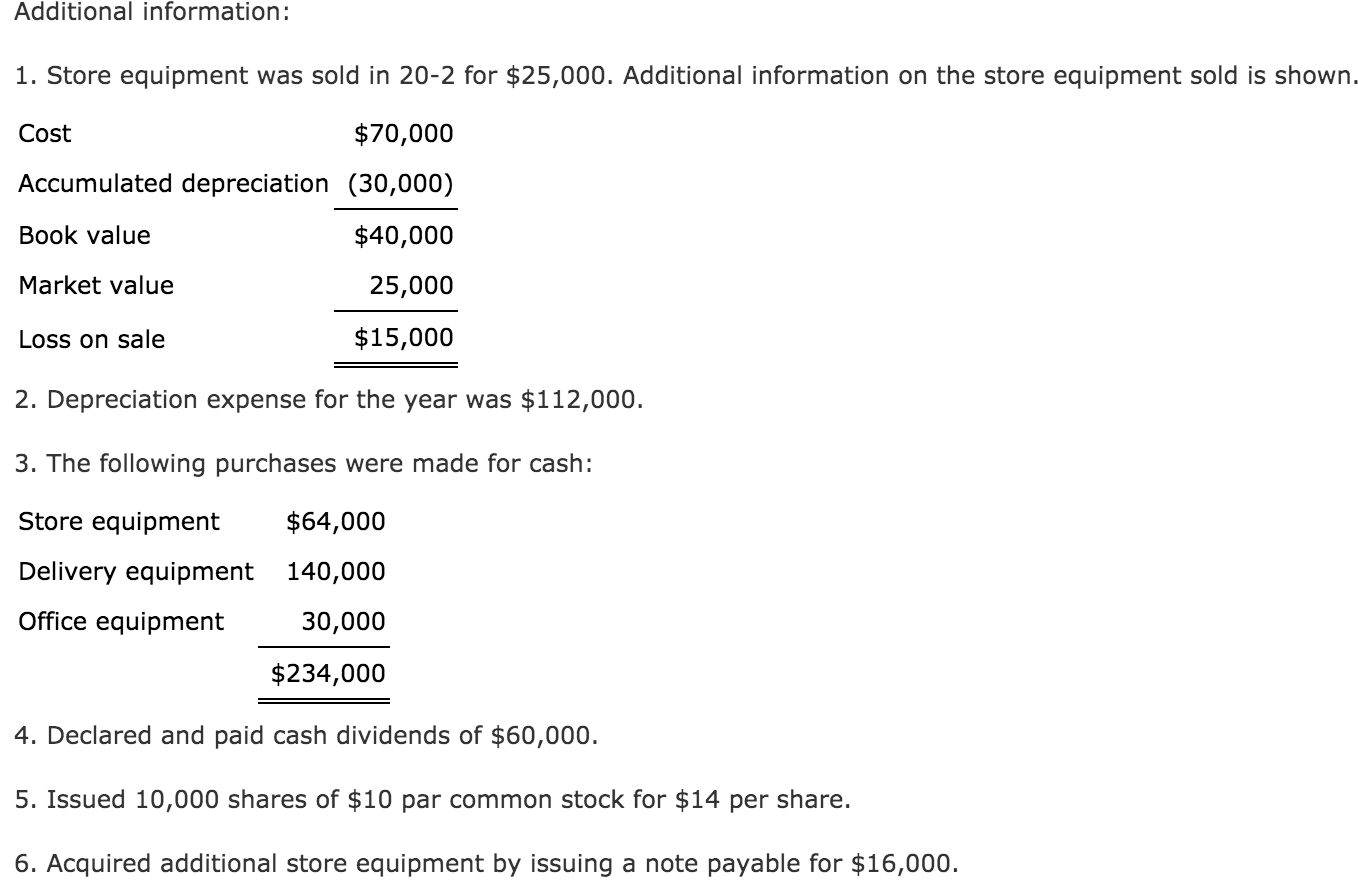

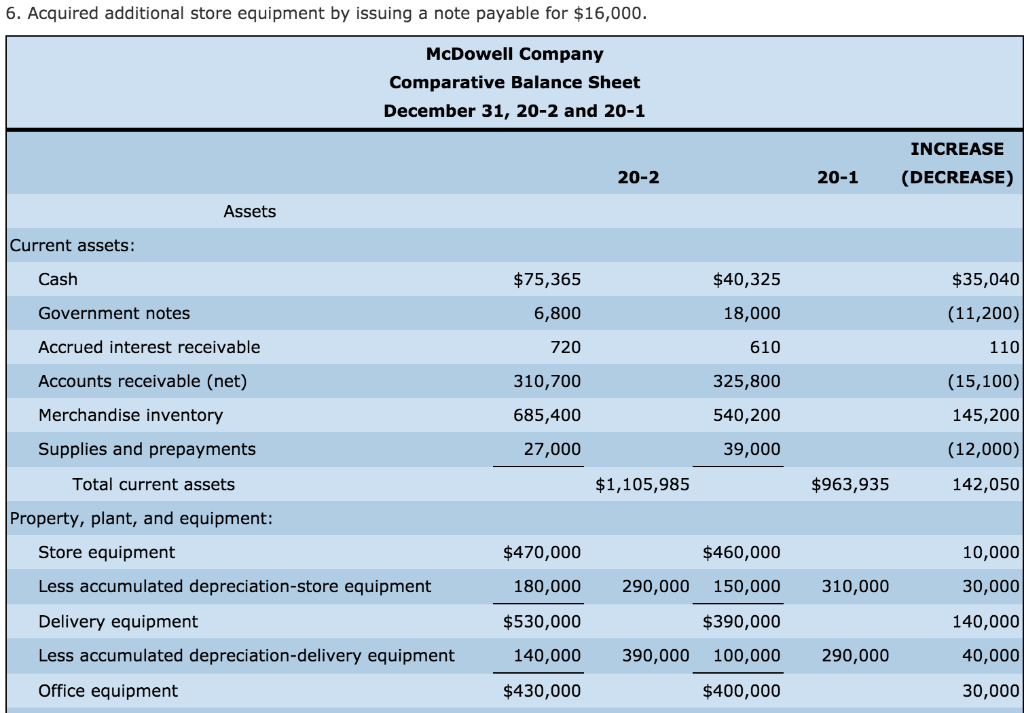

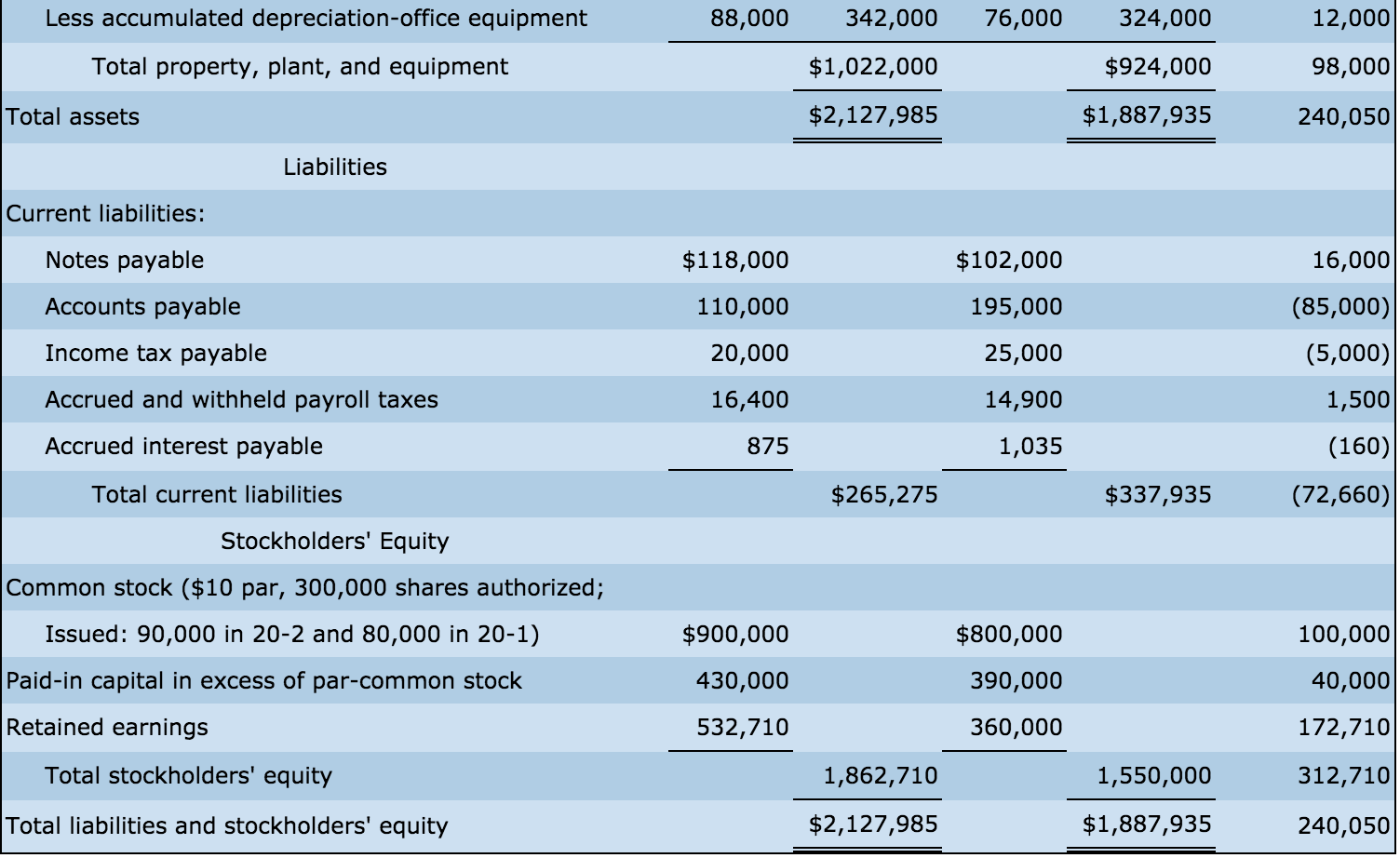

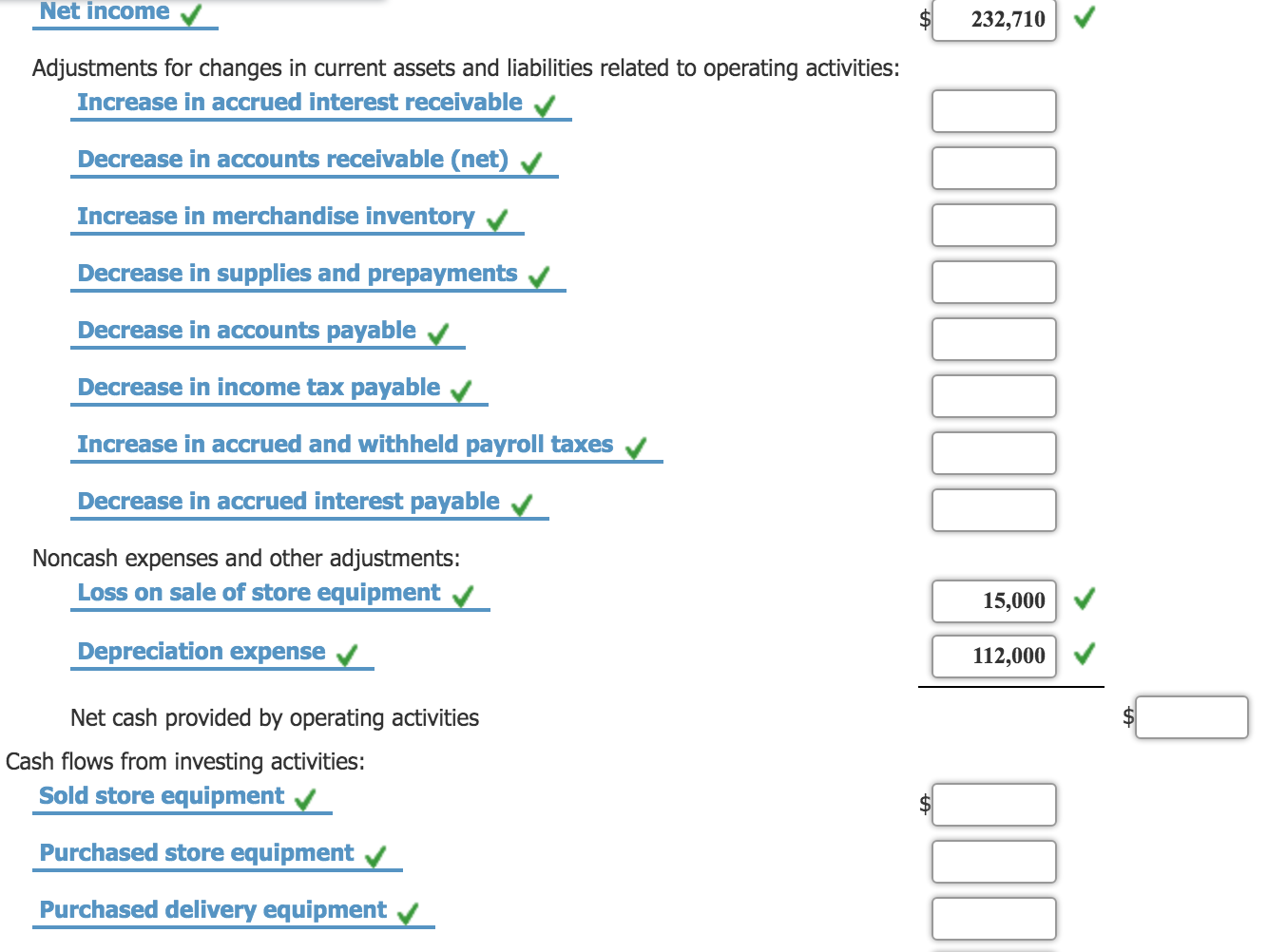

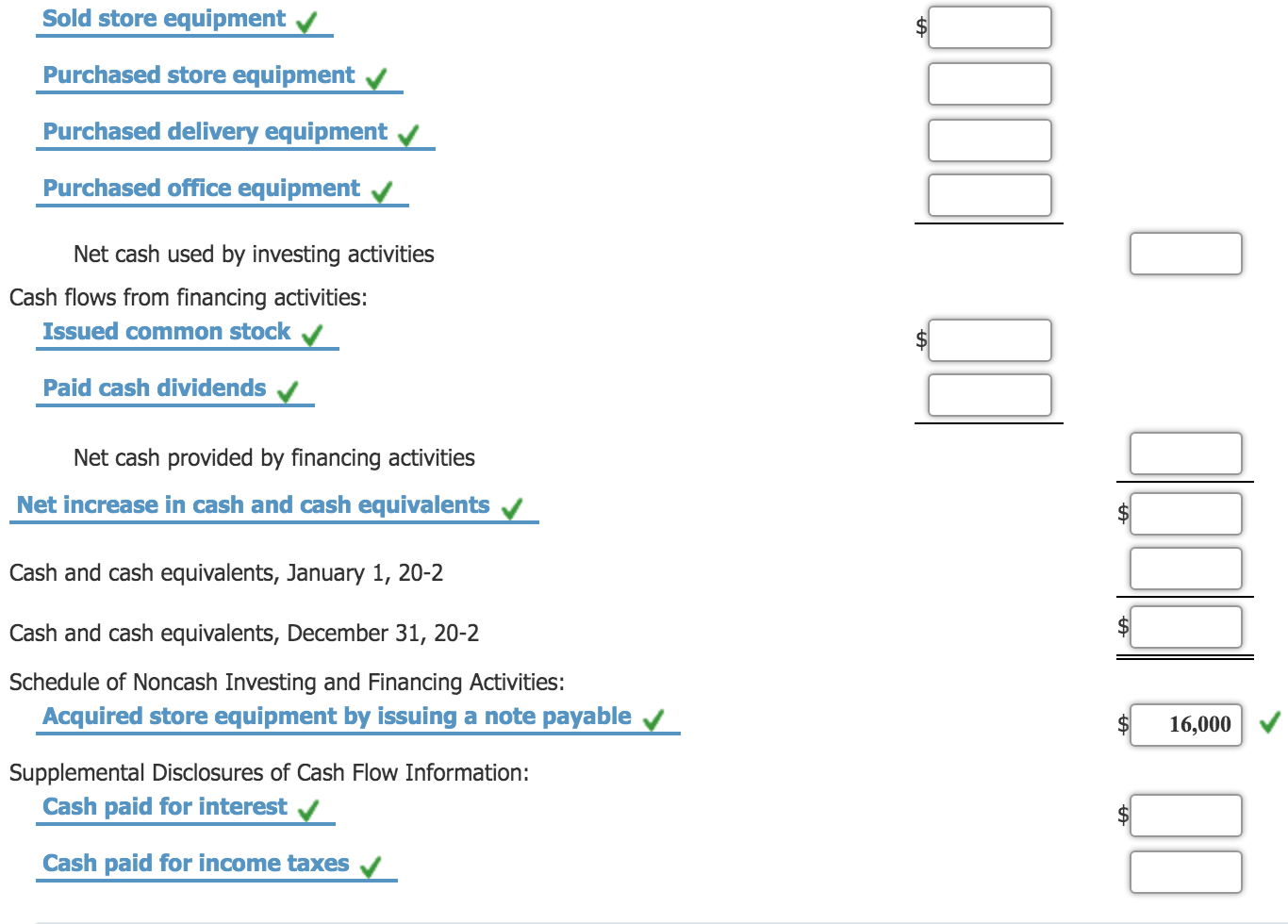

McDowell Company Income Statement For Year Ended December 31, 20-2 Net sales $1,890,000 Cost of goods sold 940,000 Gross profit $950,000 Operating expenses 572,300 Operating income $377,700 Other revenues and expenses: Interest revenue $3,900 Interest expense (890) Loss on sale of store equipment (15,000) (11,990) Income before taxes $365,710 Income tax expense 133,000 Net income $232,710 McDowell Company Statement of Retained Earnings For Year Ended December 31, 20-2 $360,000 Retained earnings, January 1, 20-2 Net income $232,710 60,000 Less dividends Net increase in retained earnings 172,710 Retained earnings, December 31, 20-2 $532,710 Additional information: 1. Store equipment was sold in 20-2 for $25,000. Additional information on the store equipment sold is shown. Cost $70,000 Accumulated depreciation (30,000) Book value $40,000 Market value 25,000 Loss on sale $15,000 2. Depreciation expense for the year was $112,000. 3. The following purchases were made for cash: Store equipment $64,000 Delivery equipment 140,000 Office equipment 30,000 $234,000 4. Declared and paid cash dividends of $60,000. 5. Issued 10,000 shares of $10 par common stock for $14 per share. 6. Acquired additional store equipment by issuing a note payable for $16,000. 6. Acquired additional store equipment by issuing a note payable for $16,000. McDowell Company Comparative Balance Sheet December 31, 20-2 and 20-1 20-2 20-1 INCREASE (DECREASE) | Assets Current assets: Cash $40,325 18,000 Government notes Accrued interest receivable 610 $75,365 6,800 720 310,700 685,400 27,000 Accounts receivable (net) Merchandise inventory Supplies and prepayments 325,800 540,200 39,000 $35,040 (11,200) 110 (15,100) 145,200 (12,000) 142,050 Total current assets $1,105,985 $963,935 Property, plant, and equipment: Store equipment Less accumulated depreciation-store equipment 290,000 310,000 Delivery equipment $470,000 180,000 $530,000 140,000 $430,000 $460,000 150,000 $390,000 100,000 $400,000 10,000 30,000 140,000 40,000 30,000 Less accumulated depreciation-delivery equipment 390,000 290,000 Office equipment 88,000 76,000 Less accumulated depreciation-office equipment Total property, plant, and equipment 342,000 $1,022,000 $2,127,985 324,000 $924,000 $1,887,935 12,000 98,000 240,050 Total assets Liabilities Current liabilities: $102,000 Notes payable Accounts payable Income tax payable Accrued and withheld payroll taxes Accrued interest payable $118,000 110,000 20,000 16,400 195,000 25,000 14,900 1,035 16,000 (85,000) (5,000) 1,500 (160) (72,660) 875 Total current liabilities $265,275 $337,935 Stockholders' Equity Common stock ($10 par, 300,000 shares authorized; Issued: 90,000 in 20-2 and 80,000 in 20-1) Paid-in capital in excess of par-common stock Retained earnings Total stockholders' equity $900,000 430,000 $800,000 390,000 532,710 360,000 100,000 40,000 172,710 312,710) 240,050 1,862,710 $2,127,985 1,550,000 $1,887,935 Total liabilities and stockholders' equity Net income 232,710 Adjustments for changes in current assets and liabilities related to operating activities: Increase in accrued interest receivable Decrease in accounts receivable (net) Increase in merchandise inventory Decrease in supplies and prepayments Decrease in accounts payable Decrease in income tax payable Increase in accrued and withheld payroll taxes Decrease in accrued interest payable Noncash expenses and other adjustments: Loss on sale of store equipment 15,000 Depreciation expense 112,000 Net cash provided by operating activities Cash flows from investing activities: Sold store equipment Purchased store equipment Purchased delivery equipment Sold store equipment Purchased store equipment Purchased delivery equipment Purchased office equipment Net cash used by investing activities Cash flows from financing activities: Issued common stock Paid cash dividends Net cash provided by financing activities Net increase in cash and cash equivalents Cash and cash equivalents, January 1, 20-2 Cash and cash equivalents, December 31, 20-2 Schedule of Noncash Investing and Financing Activities: Acquired store equipment by issuing a note payable 16,000 Supplemental Disclosures of Cash Flow Information: Cash paid for interest Cash paid for income taxes