Answered step by step

Verified Expert Solution

Question

1 Approved Answer

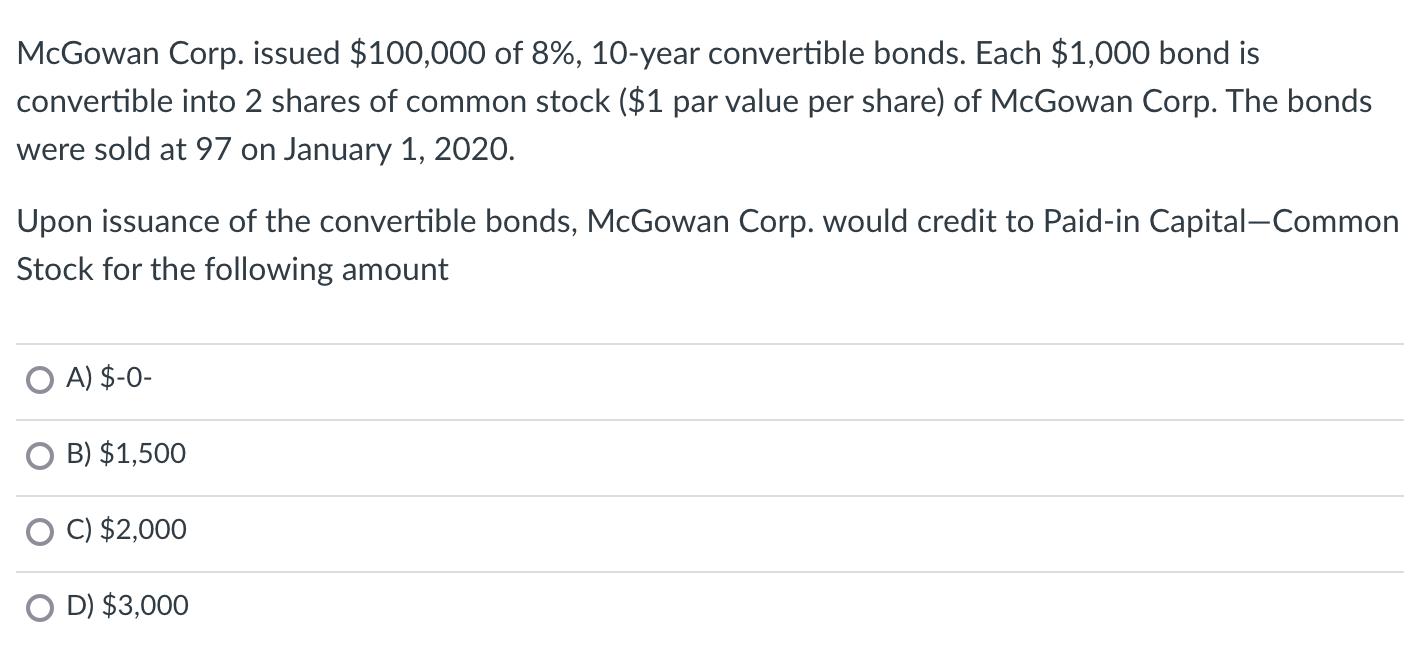

McGowan Corp. issued $100,000 of 8%, 10-year convertible bonds. Each $1,000 bond is convertible into 2 shares of common stock ($1 par value per

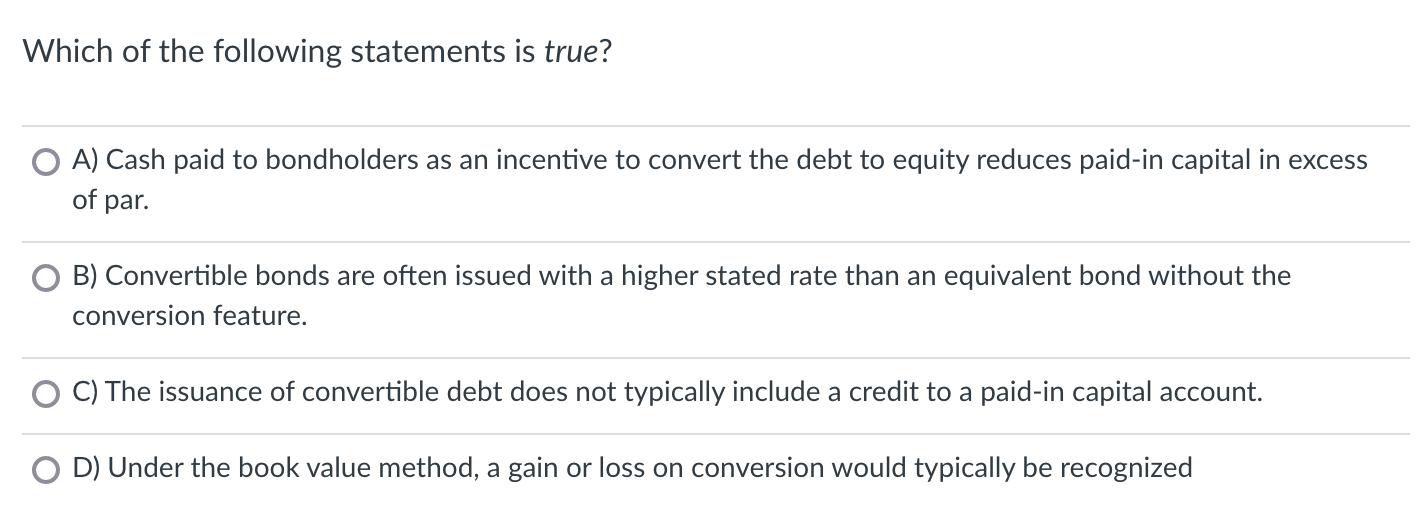

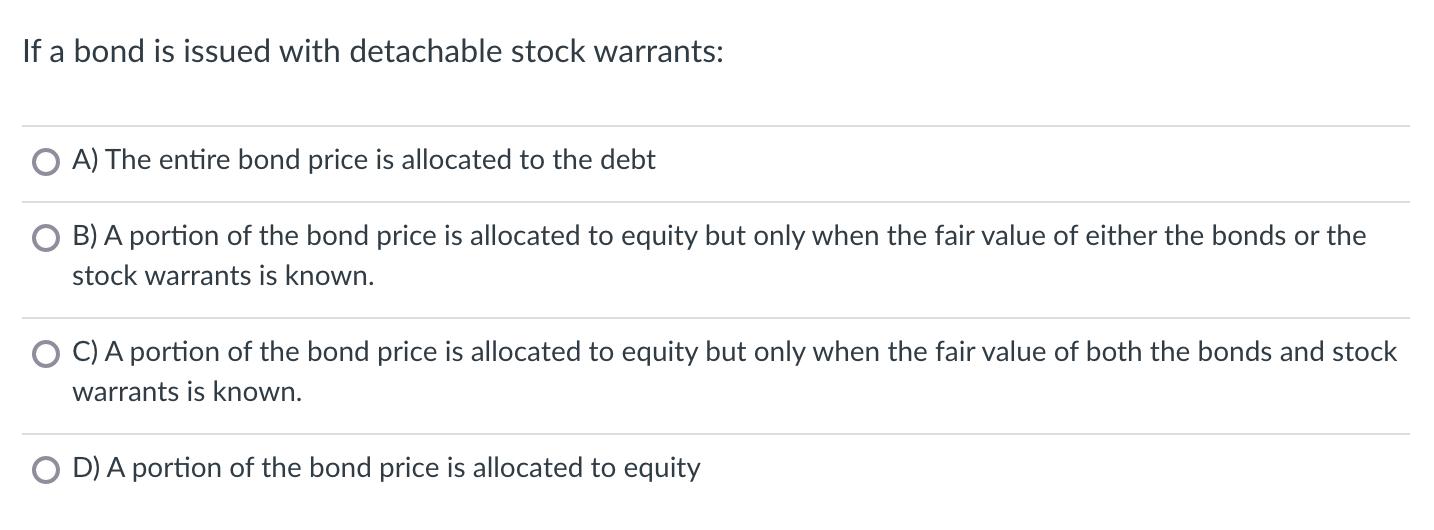

McGowan Corp. issued $100,000 of 8%, 10-year convertible bonds. Each $1,000 bond is convertible into 2 shares of common stock ($1 par value per share) of McGowan Corp. The bonds were sold at 97 on January 1, 2020. Upon issuance of the convertible bonds, McGowan Corp. would credit to Paid-in Capital-Common Stock for the following amount O A) $-0- B) $1,500 C) $2,000 D) $3,000 Which of the following statements is true? A) Cash paid to bondholders as an incentive to convert the debt to equity reduces paid-in capital in excess of par. O B) Convertible bonds are often issued with a higher stated rate than an equivalent bond without the conversion feature. C) The issuance of convertible debt does not typically include a credit to a paid-in capital account. D) Under the book value method, a gain or loss on conversion would typically be recognized If a bond is issued with detachable stock warrants: A) The entire bond price is allocated to the debt O B) A portion of the bond price is allocated to equity but only when the fair value of either the bonds or the stock warrants is known. C) A portion of the bond price is allocated to equity but only when the fair value of both the bonds and stock warrants is known. O D)A portion of the bond price is allocated to equity

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The answer is option A which is 0 On issuance there is no need to make any credit to paidin capita...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started