Answered step by step

Verified Expert Solution

Question

1 Approved Answer

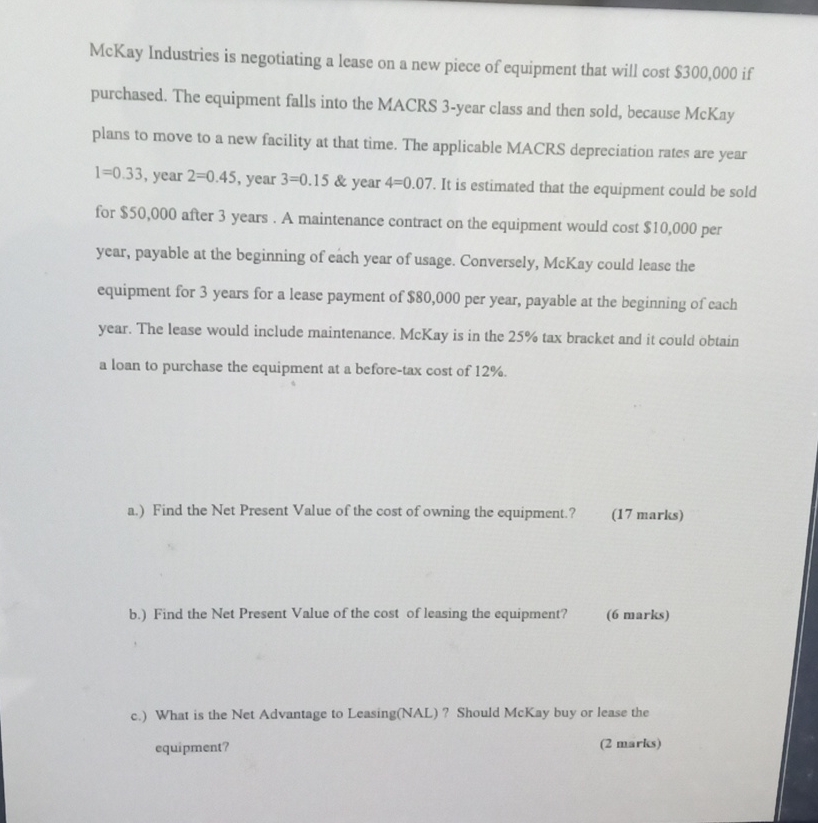

McKay Industries is negotiating a lease on a new piece of equipment that will cost $ 3 0 0 , 0 0 0 if purchased.

McKay Industries is negotiating a lease on a new piece of equipment that will cost $ if purchased. The equipment falls into the MACRS year class and then sold, because McKay plans to move to a new facility at that time. The applicable MACRS depreciation rates are year year year & year It is estimated that the equipment could be sold for $ after years. A maintenance contract on the equipment would cost $ per year, payable at the beginning of each year of usage. Conversely, McKay could lease the equipment for years for a lease payment of $ per year, payable at the beginning of each year. The lease would include maintenance. McKay is in the tax bracket and it could obtain a loan to purchase the equipment at a beforetax cost of

a Find the Net Present Value of the cost of owning the equipment.?

marks

b Find the Net Present Value of the cost of leasing the equipment? marks

c What is the Net Advantage to LeasingNAL Should McKay buy or lease the equipment?

marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started