Answered step by step

Verified Expert Solution

Question

1 Approved Answer

McKay operated a large farm on which he grew a variety of vegetables for commercial canners. He also grew a smaller quantity for sale

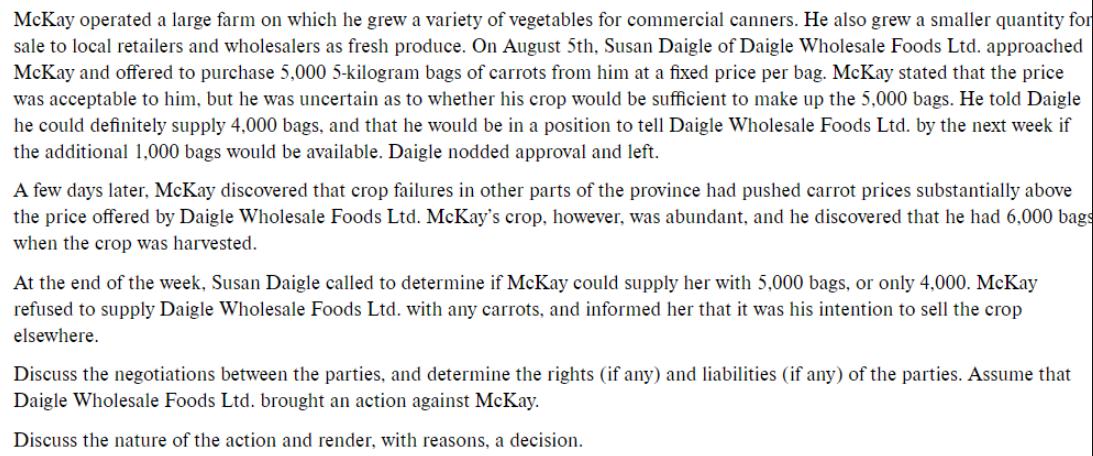

McKay operated a large farm on which he grew a variety of vegetables for commercial canners. He also grew a smaller quantity for sale to local retailers and wholesalers as fresh produce. On August 5th, Susan Daigle of Daigle Wholesale Foods Ltd. approached McKay and offered to purchase 5,000 5-kilogram bags of carrots from him at a fixed price per bag. McKay stated that the price was acceptable to him, but he was uncertain as to whether his crop would be sufficient to make up the 5,000 bags. He told Daigle he could definitely supply 4,000 bags, and that he would be in a position to tell Daigle Wholesale Foods Ltd. by the next week if the additional 1,000 bags would be available. Daigle nodded approval and left. A few days later, McKay discovered that crop failures in other parts of the province had pushed carrot prices substantially above the price offered by Daigle Wholesale Foods Ltd. McKay's crop, however, was abundant, and he discovered that he had 6,000 bags when the crop was harvested. At the end of the week, Susan Daigle called to determine if McKay could supply her with 5,000 bags, or only 4,000. McKay refused to supply Daigle Wholesale Foods Ltd. with any carrots, and informed her that it was his intention to sell the crop elsewhere. Discuss the negotiations between the parties, and determine the rights (if any) and liabilities (if any) of the parties. Assume that Daigle Wholesale Foods Ltd. brought an action against McKay. Discuss the nature of the action and render, with reasons, a decision.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The negotiations between McKay and Susan Daigle of Daigle Wholesale Foods Ltd involved an offer to purchase 5000 5kilogram bags of carrots from ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664325a377ea9_952187.pdf

180 KBs PDF File

664325a377ea9_952187.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started