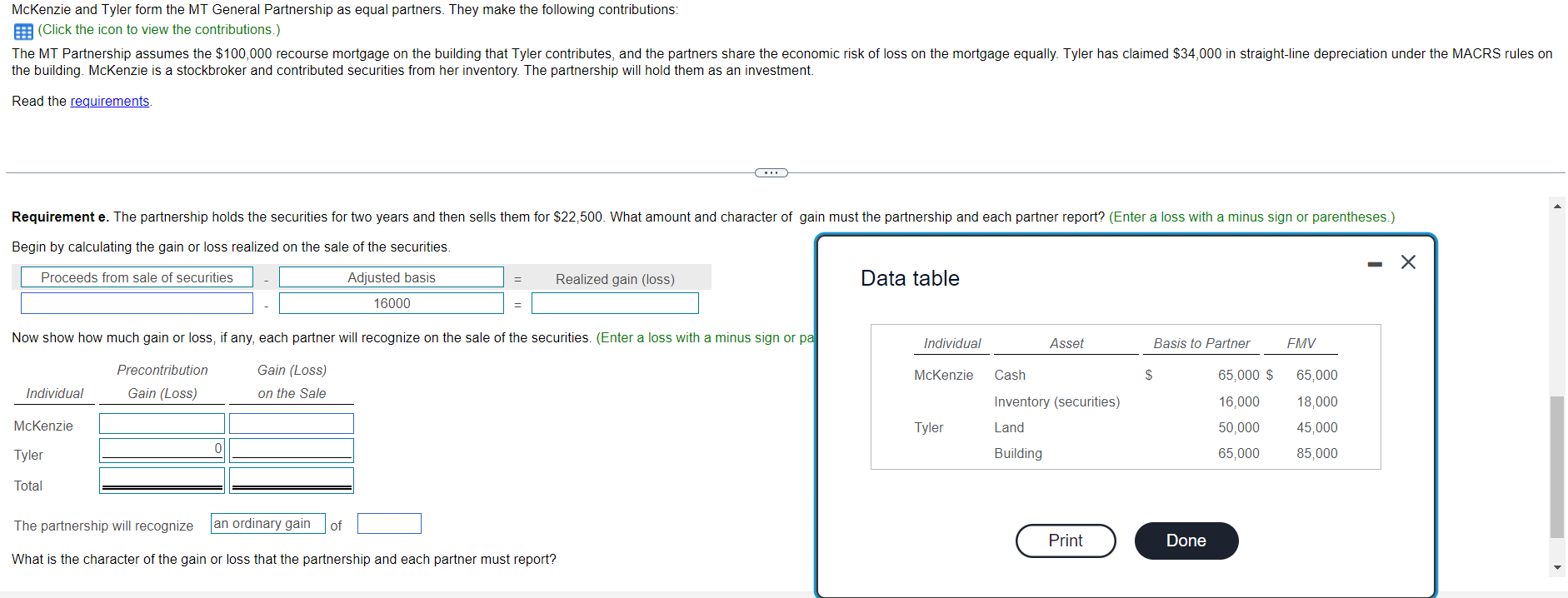

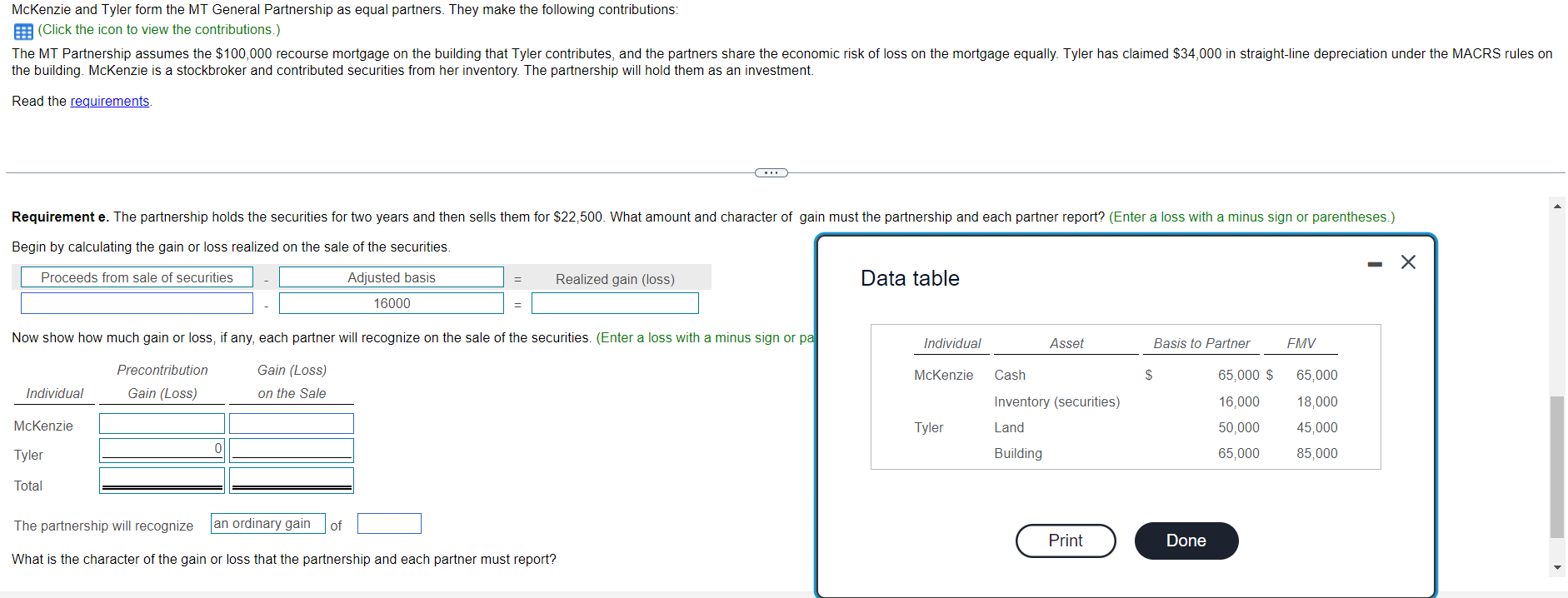

McKenzie and Tyler form the MT General Partnership as equal partners. They make the following contributions: E: (Click the icon to view the contributions.) The MT Partnership assumes the $100,000 recourse mortgage on the building that Tyler contributes, and the partners share the economic risk of loss on the mortgage equally. Tyler has claimed $34,000 in straight-line depreciation under the MACRS rules on the building. McKenzie is a stockbroker and contributed securities from her inventory. The partnership will hold them as an investment. Read the requirements. C.I. Requirement e. The partnership holds the securities for two years and then sells them for $22,500. What amount and character of gain must the partnership and each partner report? (Enter a loss with a minus sign or parentheses.) Begin by calculating the gain or loss realized on the sale of the securities. Proceeds from sale of securities Adjusted basis Realized gain (loss) Data table 16000 - = Now show how much gain or loss, if any, each partner will recognize on the sale of the securities. (Enter a loss with a minus sign or pa Individual Asset Basis to Partner FMV Gain (Loss) McKenzie Cash $ Precontribution Gain (Loss) 65,000 $ 65,000 Individual on the Sale 18,000 Inventory (securities) Land 16,000 50,000 Mckenzie Tyler 45,000 0 Tyler Building 65,000 85,000 Total The partnership will recognize an ordinary gain of Print Done What is the character of the gain or loss that the partnership and each partner must report? McKenzie and Tyler form the MT General Partnership as equal partners. They make the following contributions: E: (Click the icon to view the contributions.) The MT Partnership assumes the $100,000 recourse mortgage on the building that Tyler contributes, and the partners share the economic risk of loss on the mortgage equally. Tyler has claimed $34,000 in straight-line depreciation under the MACRS rules on the building. McKenzie is a stockbroker and contributed securities from her inventory. The partnership will hold them as an investment. Read the requirements. C.I. Requirement e. The partnership holds the securities for two years and then sells them for $22,500. What amount and character of gain must the partnership and each partner report? (Enter a loss with a minus sign or parentheses.) Begin by calculating the gain or loss realized on the sale of the securities. Proceeds from sale of securities Adjusted basis Realized gain (loss) Data table 16000 - = Now show how much gain or loss, if any, each partner will recognize on the sale of the securities. (Enter a loss with a minus sign or pa Individual Asset Basis to Partner FMV Gain (Loss) McKenzie Cash $ Precontribution Gain (Loss) 65,000 $ 65,000 Individual on the Sale 18,000 Inventory (securities) Land 16,000 50,000 Mckenzie Tyler 45,000 0 Tyler Building 65,000 85,000 Total The partnership will recognize an ordinary gain of Print Done What is the character of the gain or loss that the partnership and each partner must report