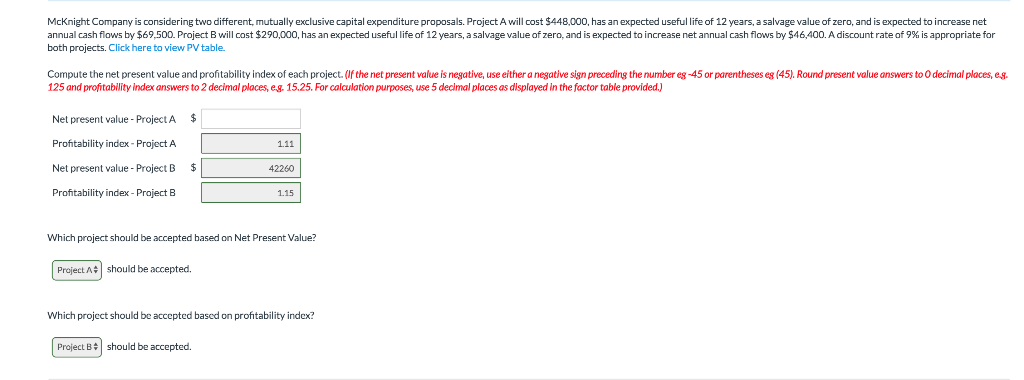

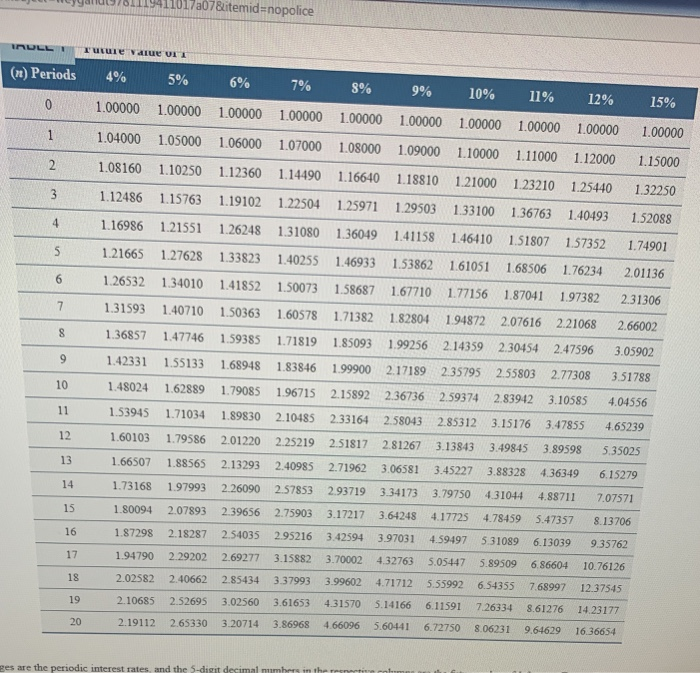

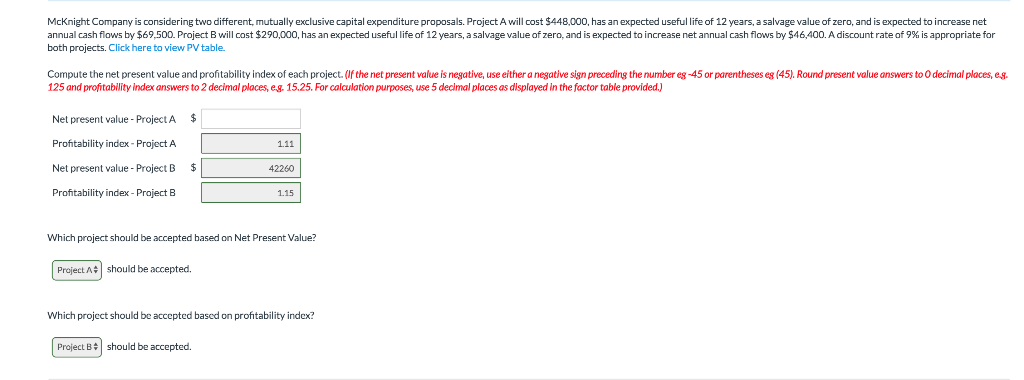

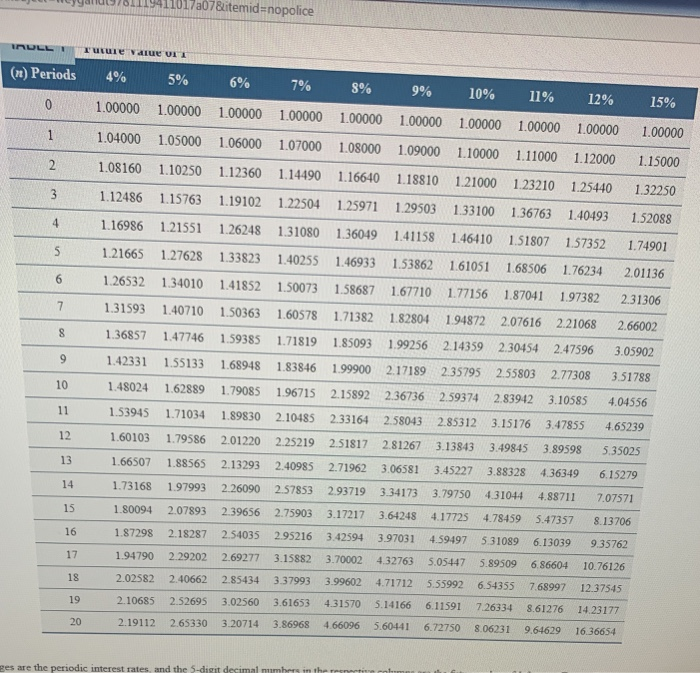

McKnight Company is considering two different, mutually exclusive capital expenditure proposals. Project A will cost $448,000, has an expected useful life of 12 years, a salvage value of zero, and is expected to increase net annual cash flows by $69,500. Project B will cost $290,000, has an expected useful life of 12 years, a salvage value of zero, and is expected to increase net annual cash flows by $46,400. A discount rate of 9% is appropriate for both projects. Click here to view PV table. Compute the net present value and profitability index of each project. (If the net present value is negative, use either a negative sign preceding the number eg -45 or parentheses eg (45). Round present value answers to O decimal places, eg. 125 and profitability Index answers to 2 decimal places, eg. 15.25. For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Net present value - Project A $ Profitability index - Project A 1.11 Net present value - Project B $ 42260 Profitability index - Project B 1.15 Which project should be accepted based on Net Present Value? Project At should be accepted. Which project should be accepted based on profitability index? Project B should be accepted. 017a078litemid=nopolice INULLE Turune Value UI (?!) Periods 4% 5% 6% 7% 8% 9% 10% 11% 0 12% 1.00000 1.00000 100000 1.00000 1.00000 1.00000 1.00000 1.00000 1.00000 15% 1 1.04000 1.05000 1.06000 1.07000 1.08000 1.09000 1.10000 1.11000 1.12000 1.00000 1.08160 1.10250 1.12360 1.15000 1.14490 1.16640 1.18810 1.21000 1.23210 1.25440 3 1.12486 1.15763 1.191021.22504 1.25971 1.32250 1.29503 1.33100 1.36763 1.40493 4 1.16986 1.52088 1.21551 1.26248 1.31080 1.36049 1.41158 1.46410 1.51807 1.57352 5 1.21665 1.27628 1.74901 1.33823 1.40255 1.46933 1.53862 1.61051 1.68506 1.76234 6 2.01136 1.26532 1.34010 1.41852 1.50073 1.58687 1.67710 1.77156 1.87041 1.97382 2.31306 7 1.31593 1.40710 1.50363 1.60578 1.71382 1.82804 194872 2.07616 2.21068 2.66002 8 1.36857 1.47746 1.59385 1.71819 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902 9 1.42331 1.55133 1.68948 1.83846 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 10 1.48024 1.62889 1.79085 1.96715 2.15892 2.36736 2.59374 2.83942 3.10585 4.04556 11 1.53945 1.71034 1.89830 2.10485 2.33164 2.58043 2.85312 3.15176 3.47855 4.65239 12 1.60103 1.79586 2.01220 2.25219 2.51817 2.81267 3.13843 3.49845 3.89598 5.35025 13 1.66507 1.88565 2.13293 2.40985 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279 14 1.73168 1.97993 2.26090 2.57853 2.93719 3.34173 3.79750 4.31044 4.88711 7.07571 15 1.80094 2.07893 2.39656 2.75903 3.17217 3.64248 4.17725 4.78459 5.47357 8.13706 16 1.87298 2.18287 2.54035 2.95216 3.42594 3.97031 4.59497 5.31089 6.13039 9.35762 17 1.94790 2.29202 2.69277 3.15882 3.70002 4.32763 5.05447 5.89509 6.86604 10.76126 18 2.02582 2.40662 2.85434 3.37993 3.99602 4.71712 5.55992 6.54355 7.68997 12.37545 19 2.10685 2.52695 3.02560 3.61653 4.31570 5.14166 6.11591 7.26334 8.61276 14.23177 20 2.19112 2.65330 3.20714 3.86968 4.66096 5.60-141 6.72750 8.06231 9.64629 16.36654 ges are the periodic interest rates, and the S-digit decimal numbers th