Question

McLennon Company has a plant capacity of 100,000 units per year, but its budget for this year indicates that only 60,000 units will be produced

McLennon Company has a plant capacity of 100,000 units per year, but its budget for this year indicates that only 60,000 units will be produced and sold. The entire budget for this year is as follows:

Sales (60,000 units at $4) $240,000

Lest cost of goods produced (based

on production of 60,000 units)

Direct materials (variable) $60,000

Direct labor (varialbe) $30,000

Variable overhead costs $45,000

Fixed overhead costs $75,000

Total Cost of goods produced $210,000

Gross Margin $30,000

Less selling for admin expenses

Selling(fixed) $24,000

Administrative (fixed) $36,000

Total selling and admin expenses $60,000

Operating income ($30,000)

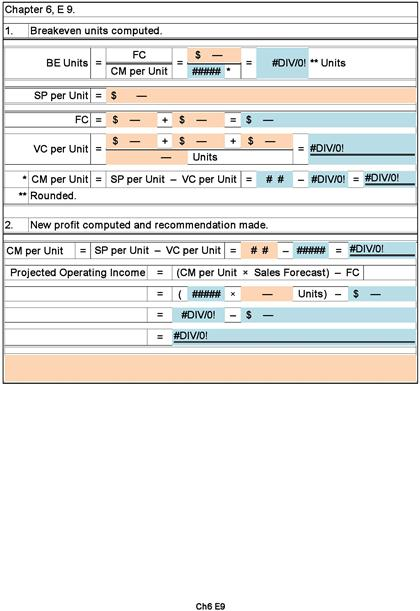

1. Given the budgeted selling price and cost data, how many units would McLennon have to sell to break even? (Hint:be sure to consider selling and admin expenses)

2. Market research indicates that if McLennon were to drop it's selling price to $3.80 per unit, it could sell 100,000 units. Would you recommend the drop in price? What would the new operating income or loss be?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started