Answered step by step

Verified Expert Solution

Question

1 Approved Answer

mcq 17. Five months ago, a customer signed a $123,500,5-month, 8% promissory note. On maturity, the customer must pay the amount borrowed plus acerued interest.

mcq

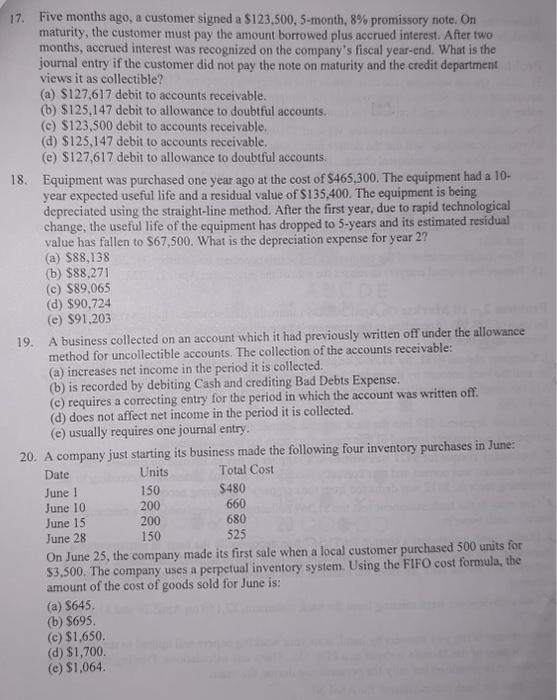

17. Five months ago, a customer signed a $123,500,5-month, 8% promissory note. On maturity, the customer must pay the amount borrowed plus acerued interest. After two months, accrued interest was recognized on the company's fiscal year-end. What is the journal entry if the customer did not pay the note on maturity and the credit department views it as collectible? (a) $127,617 debit to accounts receivable. (b) $125,147 debit to allowance to doubtful accounts. (c) $123,500 debit to accounts receivable. (d) $125,147 debit to accounts receivable. (e) $127,617 debit to allowance to doubtful accounts: 18. Equipment was purchased one year ago at the cost of $465,300. The equipment had a 10 year expected useful life and a residual value of $135,400. The equipment is being depreciated using the straight-line method. After the first year, due to rapid technological change, the useful life of the equipment has dropped to 5-years and its estimated residual value has fallen to $67,500. What is the depreciation expense for year 2 ? (a) $88,138 (b) $88,271 (c) $89,065 (d) $90,724 (e) $91,203 19. A business collected on an account which it had previously written off under the allowance method for uncollectible accounts. The collection of the accounts receivable: (a) increases net income in the period it is collected. (b) is recorded by debiting Cash and crediting Bad Debts Expense. (c) requires a correcting entry for the period in which the account was written off. (d) does not affect net income in the period it is collected. (e) usually requires one jourmal entry. 20. A company just starting its business made the following four inventory purchases in June: On June 25, the company made its first sale when a local customer purchased 500 units for $3,500. The company uses a perpetual inventory system. Using the FIFO cost formula, the amount of the cost of goods sold for June is: (a) $645 (b) $695 (c) $1,650. (d) $1,700. (c) $1,064

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started