Answered step by step

Verified Expert Solution

Question

1 Approved Answer

mcq all information is there its an mcqs please post the ans 17. Working capital is: (a) non-current assets plus current assets (b) non-current assets

mcq all information is there

its an mcqs please post the ans

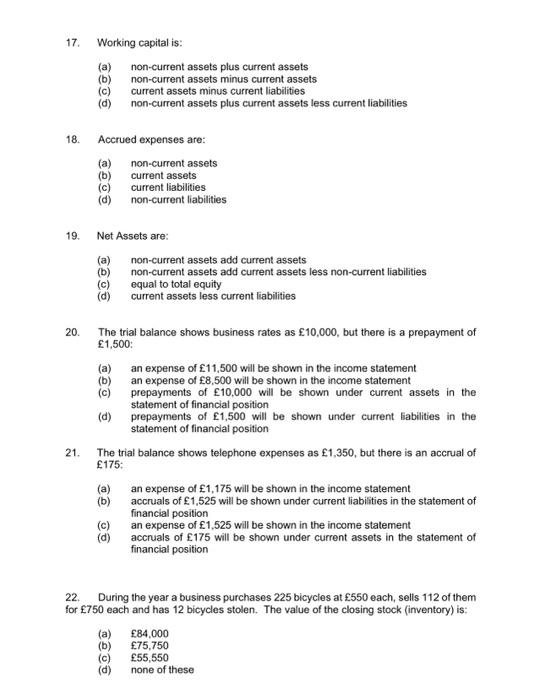

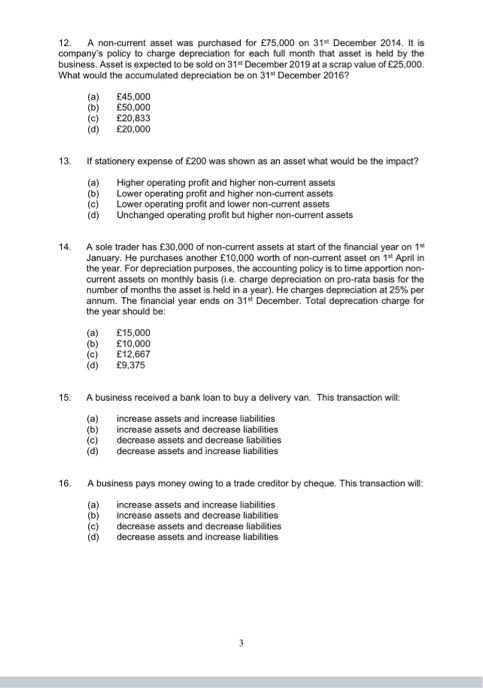

17. Working capital is: (a) non-current assets plus current assets (b) non-current assets minus current assets (c) current assets minus current liabilities (d) non-current assets plus current assets less current liabilities 18. Accrued expenses are: (a) non-current assets (b) current assets (c) current liabilities (d) non-current liabilities 19. Net Assets are: (a) non-current assets add current assets (b) non-current assets add current assets less non-current liabilities (c) equal to total equity (d) current assets less current liabilities 20. The trial balance shows business rates as 10,000, but there is a prepayment of 1,500: (a) an expense of 11,500 will be shown in the income statement (b) an expense of 8,500 will be shown in the income statement (c) prepayments of 10,000 will be shown under current assets in the statement of financial position (d) prepayments of 1,500 will be shown under current liabilities in the statement of financial position 21. The trial balance shows telephone expenses as 1,350, but there is an accrual of 175: (a) an expense of 1,175 will be shown in the income statement (b) accruals of 1,525 will be shown under current liabilities in the statement of financial position (c) an expense of 1,525 will be shown in the income statement (d) accruals of 175 will be shown under current assets in the statement of financial position 22. During the year a business purchases 225 bicycles at 550 each, sells 112 of them for 750 each and has 12 bicycles stolen. The value of the closing stock (inventory) is: (a) 84,000 (b) 75,750 (c) 55,550 (d) none of these 12. A non-current asset was purchased for 75,000 on 31 December 2014. It is company's policy to charge depreciation for each full month that asset is held by the business. Asset is expected to be sold on 31st December 2019 at a scrap value of c25,000. What would the accumulated depreciation be on 31s December 2016 ? (a) 45,000 (b) c50,000 (c) 220,833 (d) 200,000 13. If stationery expense of 200 was shown as an asset what would be the impact? (a) Higher operating profit and higher non-current assets (b) Lower operating profit and higher non-current assets (c) Lower operating profit and lower non-current assets (d) Unchanged operating profit but higher non-current assets 14. A sole trader has 30,000 of non-current assets at start of the financial year on 1 at January. He purchases another 10,000 worth of non-current asset on 1= April in the year. For depreciation purposes, the accounting policy is to time apportion noncurrent assets on monthy basis (i.e. charge depreciation on pro-rata basis tor the number of months the asset is held in a year). He charges depreciation at 25% per annum. The financial year ends on 31ti December. Total deprecation charge for the year should be: (a) 15,000 (b) 10,000 (c) 12,667 (d) \( \lcm{ 9,375} \) 15. A business received a bank loan to buy a delivery van. This transaction will: (a) increase assets and increase liabilities (b) increase assets and decrease liabilities (c) decrease assets and decrease liablities (d) decrease assets and increase liabilities 16. A business pays money owing to a trade creditor by cheque. This transaction will: (a) increase assets and increase liabilities (b) increase assets and decrease liabilities (c) decrease assets and decrease liabilities (d) decrease assets and increase liabilities Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started