mcq questions

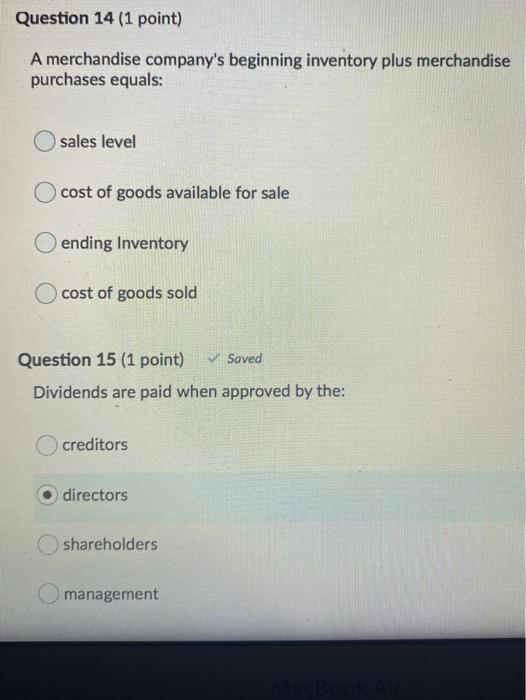

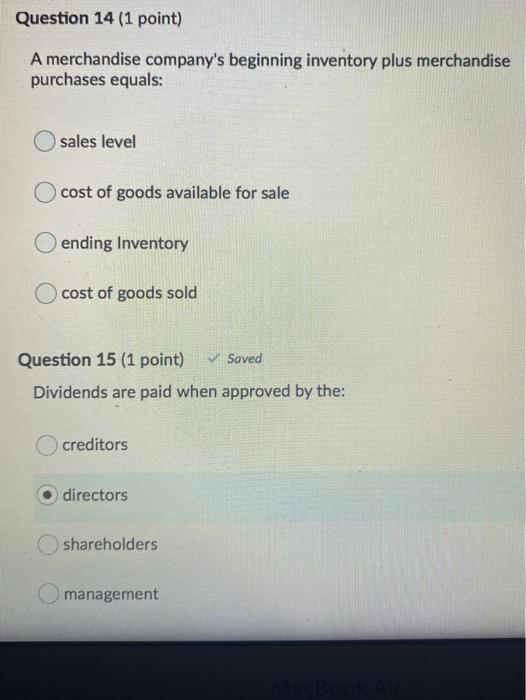

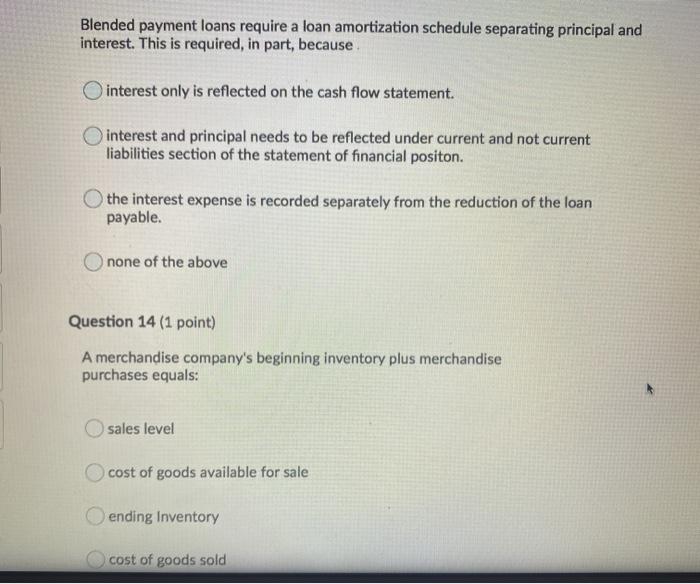

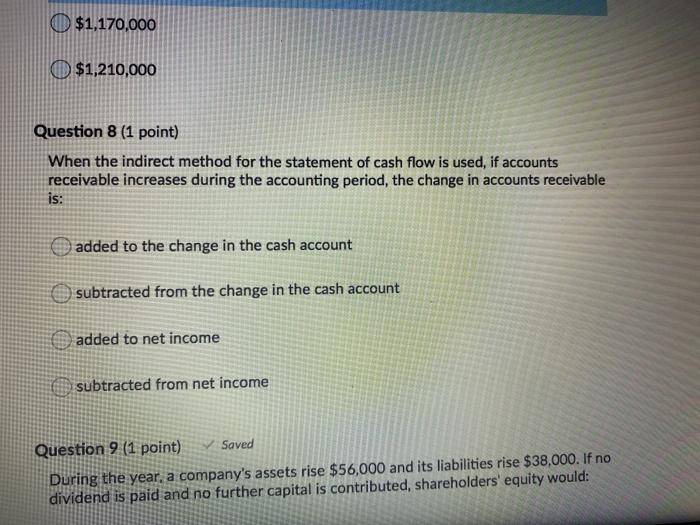

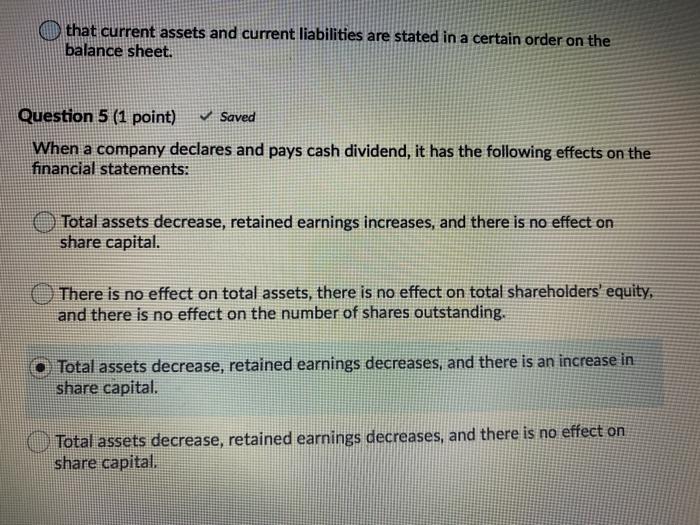

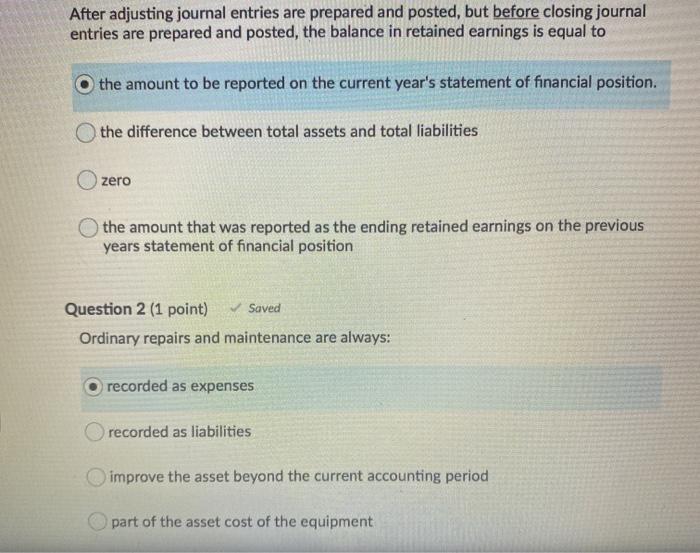

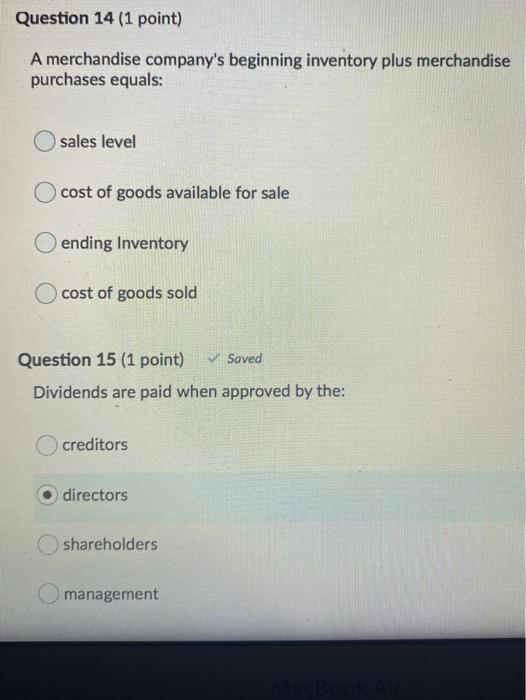

Question 14 (1 point) A merchandise company's beginning inventory plus merchandise purchases equals: sales level cost of goods available for sale ending Inventory cost of goods sold Question 15 (1 point) Saved Dividends are paid when approved by the: creditors directors shareholders management Blended payment loans require a loan amortization schedule separating principal and interest. This is required, in part, because interest only is reflected on the cash flow statement. interest and principal needs to be reflected under current and not current liabilities section of the statement of financial positon. the interest expense is recorded separately from the reduction of the loan payable. none of the above Question 14 (1 point) A merchandise company's beginning inventory plus merchandise purchases equals: sales level cost of goods available for sale ending Inventory cost of goods sold $1,170,000 $1,210,000 Question 8 (1 point) When the indirect method for the statement of cash flow is used, if accounts receivable increases during the accounting period, the change in accounts receivable is: added to the change in the cash account subtracted from the change in the cash account added to net income subtracted from net income Question 9 (1 point) Saved During the year, a company's assets rise $56,000 and its liabilities rise $38,000. If no dividend is paid and no further capital is contributed, shareholders' equity would: that current assets and current liabilities are stated in a certain order on the balance sheet. Question 5 (1 point) Saved When a company declares and pays cash dividend, it has the following effects on the financial statements: Total assets decrease, retained earnings increases, and there is no effect on share capital. There is no effect on total assets, there is no effect on total shareholders' equity, and there is no effect on the number of shares outstanding. Total assets decrease, retained earnings decreases, and there is an increase in share capital. Total assets decrease, retained earnings decreases, and there is no effect on share capital. After adjusting journal entries are prepared and posted, but before closing journal entries are prepared and posted, the balance in retained earnings is equal to the amount to be reported on the current year's statement of financial position. the difference between total assets and total liabilities zero the amount that was reported as the ending retained earnings on the previous years statement of financial position Saved Question 2 (1 point) Ordinary repairs and maintenance are always: recorded as expenses recorded as liabilities improve the asset beyond the current accounting period part of the asset cost of the equipment