Answered step by step

Verified Expert Solution

Question

1 Approved Answer

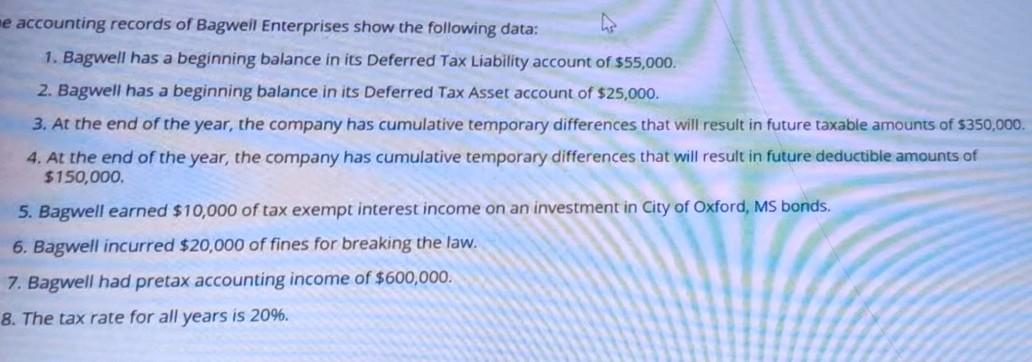

me accounting records of Bagweil Enterprises show the following data: 1. Bagwell has a beginning balance in its Deferred Tax Liability account of $55,000. 2.

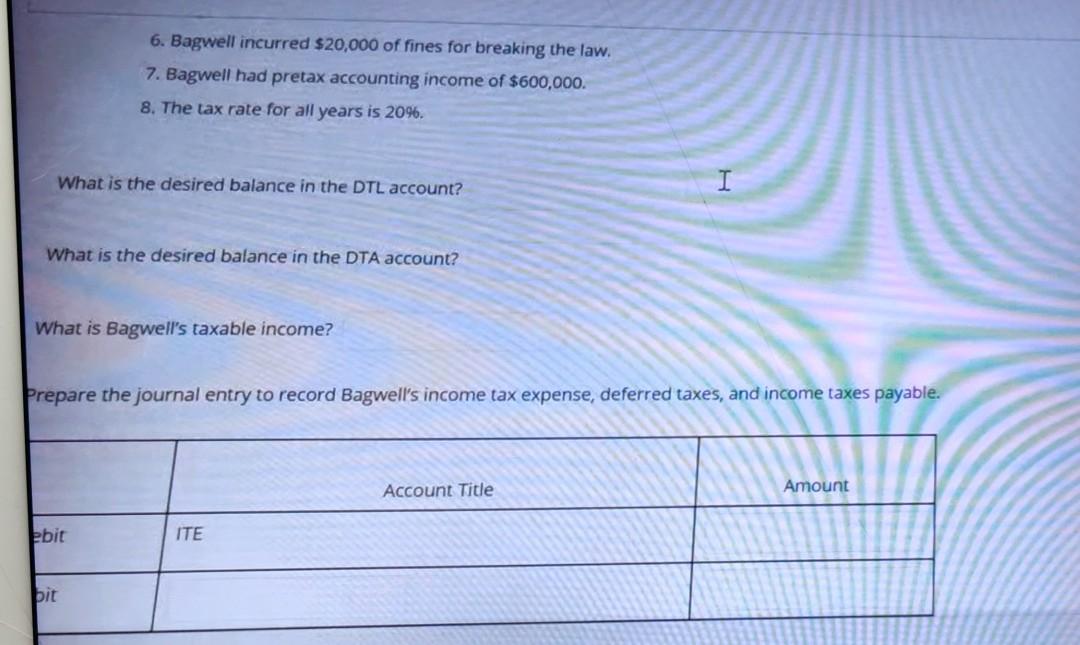

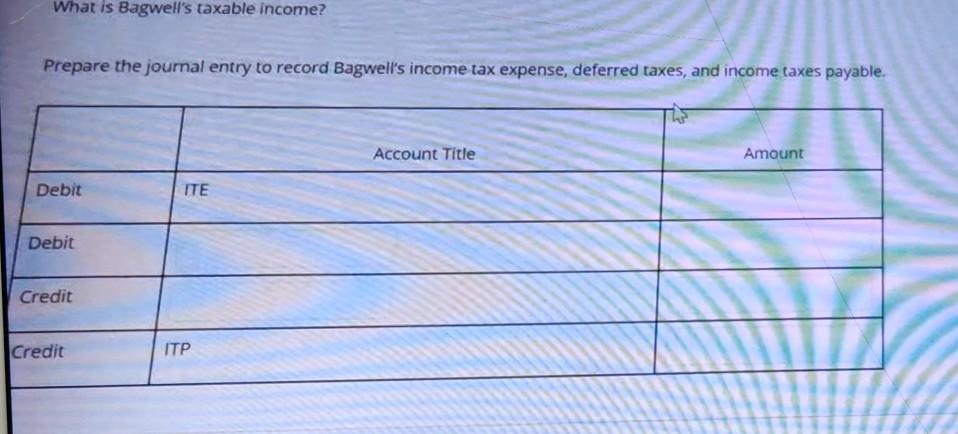

me accounting records of Bagweil Enterprises show the following data: 1. Bagwell has a beginning balance in its Deferred Tax Liability account of $55,000. 2. Bagwell has a beginning balance in its Deferred Tax Asset account of $25,000. 3. At the end of the year, the company has cumulative temporary differences that will result in future taxable amounts of $350,000 4. At the end of the year, the company has cumulative temporary differences that will result in future deductible amounts of $150,000. 5. Bagwell earned $10,000 of tax exempt interest income on an investment in City of Oxford, MS bonds. 6. Bagwell incurred $20,000 of fines for breaking the law. 7. Bagwell had pretax accounting income of $600,000. 8. The tax rate for all years is 20%. 6. Bagwell incurred $20,000 of fines for breaking the law. 7. Bagwell had pretax accounting income of $600,000. 8. The tax rate for all years is 20%. What is the desired balance in the DTL account? I What is the desired balance in the DTA account? What is Bagwell's taxable income? Prepare the journal entry to record Bagwell's income tax expense, deferred taxes, and income taxes payable. Account Title Amount Ebit ITE bit What is Bagwell's taxable income? Prepare the journal entry to record Bagwell's income tax expense, deferred taxes, and income taxes payable. Account Title Amount Debit ITE Debit Credit Credit ITP

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started