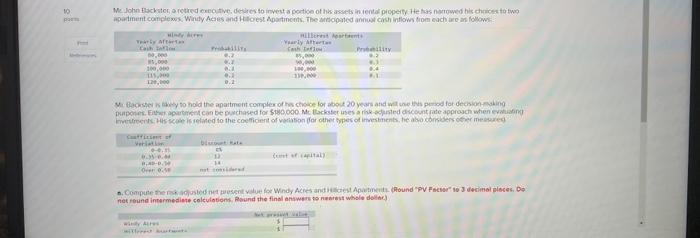

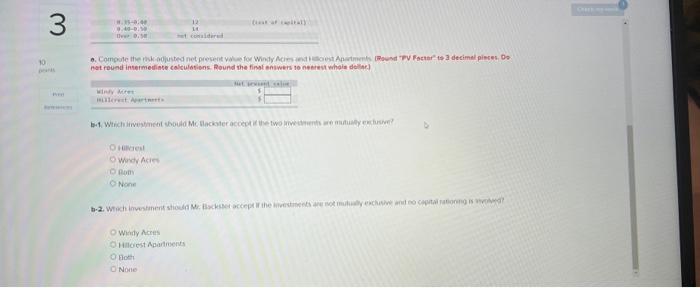

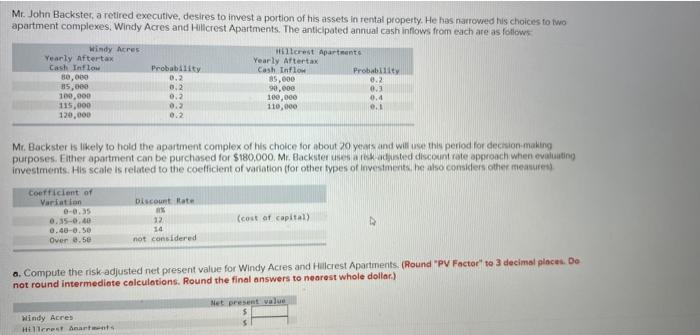

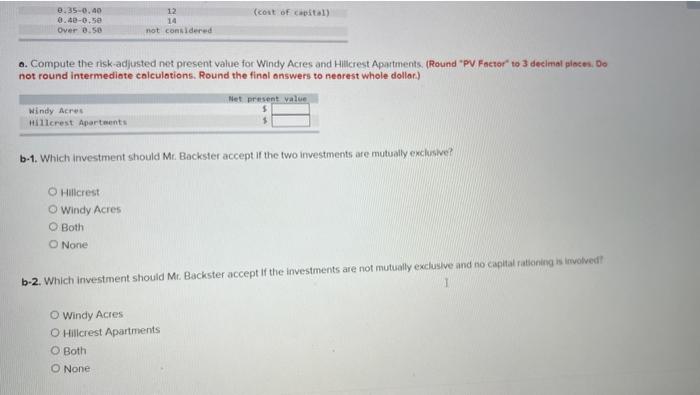

Me John tlickstor, a rethed exec tive, detires to invest a portion of has assets invental picperty He hats noriowed bis chaices ta two M. foomsiei k awey to hold the apartment compler of hes chace for about 20 yessi and wet une inds persod for dechiontiaking net feund intermediete colculotions, Rsund the findl answers ts neartsit whible dollac) ilivieis! Woidy Acies Ranin None Whity Arres. Hilloest Apartinents kisth None Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narroved his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows Mr. Backster is likely to hold the apartment complex of his choice for about 20 yeims and will use this period for decrion-making purposes. Either apartment can be purchased for $180,000. Mr. Backster uses a risk adjuted discount rate approach when evaliating? investments. His scale is related to the coefficient of vadiation (for other fypes of investments, he also consicfers other measures) a. Compute the risk-adjusted net present value for Windy Acres and Halciest Apartments, (Round "PV Factor" to 3 decimal places. De not round intermediote calculations. Round the final answers to nearest whole dollar.) 0. Compute the risk-adjusted net present value for Windy Acres and Hillicrest Apartments. IRound "PV Factor' to 3 decimat ploces, Do not round intermediate calculations. Round the final answers to nearest whole dollar) b-1. Which investment should Mr. Backster accept if the two investments are mutually exclusive? Hilicrest Windy Acres Both Norie b-2. Which investment should Mr. Backster accept if the investments are not mutually excluslve and no capltal rationicg is involvedi Windy Acres Hillcrest Apartments Both None Me John tlickstor, a rethed exec tive, detires to invest a portion of has assets invental picperty He hats noriowed bis chaices ta two M. foomsiei k awey to hold the apartment compler of hes chace for about 20 yessi and wet une inds persod for dechiontiaking net feund intermediete colculotions, Rsund the findl answers ts neartsit whible dollac) ilivieis! Woidy Acies Ranin None Whity Arres. Hilloest Apartinents kisth None Mr. John Backster, a retired executive, desires to invest a portion of his assets in rental property. He has narroved his choices to two apartment complexes, Windy Acres and Hillcrest Apartments. The anticipated annual cash inflows from each are as follows Mr. Backster is likely to hold the apartment complex of his choice for about 20 yeims and will use this period for decrion-making purposes. Either apartment can be purchased for $180,000. Mr. Backster uses a risk adjuted discount rate approach when evaliating? investments. His scale is related to the coefficient of vadiation (for other fypes of investments, he also consicfers other measures) a. Compute the risk-adjusted net present value for Windy Acres and Halciest Apartments, (Round "PV Factor" to 3 decimal places. De not round intermediote calculations. Round the final answers to nearest whole dollar.) 0. Compute the risk-adjusted net present value for Windy Acres and Hillicrest Apartments. IRound "PV Factor' to 3 decimat ploces, Do not round intermediate calculations. Round the final answers to nearest whole dollar) b-1. Which investment should Mr. Backster accept if the two investments are mutually exclusive? Hilicrest Windy Acres Both Norie b-2. Which investment should Mr. Backster accept if the investments are not mutually excluslve and no capltal rationicg is involvedi Windy Acres Hillcrest Apartments Both None