Answered step by step

Verified Expert Solution

Question

1 Approved Answer

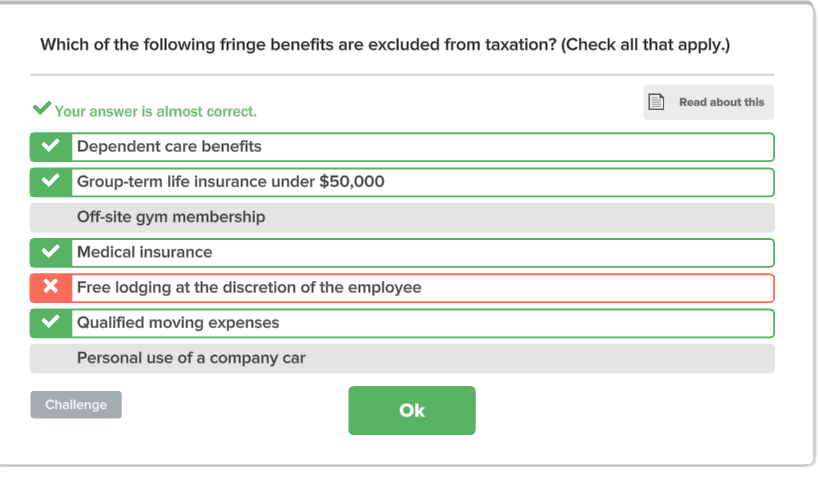

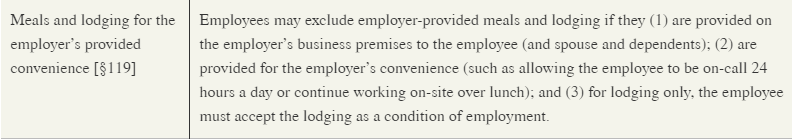

Meals and lodging for the employers provided convenience are Qualifying Fringe Benefits (excluded from employees gross income) I wonder why I am incorrect and what

Meals and lodging for the employers provided convenience are Qualifying Fringe Benefits (excluded from employees gross income)

I wonder why I am incorrect and what "discretion of employee" means.

Which of the following fringe benefits are excluded from taxation? (Check all that apply.) Read about this Your answer is almost correct Dependent care benefits Group-term life insurance under $50,000 Off-site gym membership Medical insuranc Free lodging at the discretion of the employee Qualified moving expenses Personal use of a company car Challenge OkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started