Answered step by step

Verified Expert Solution

Question

1 Approved Answer

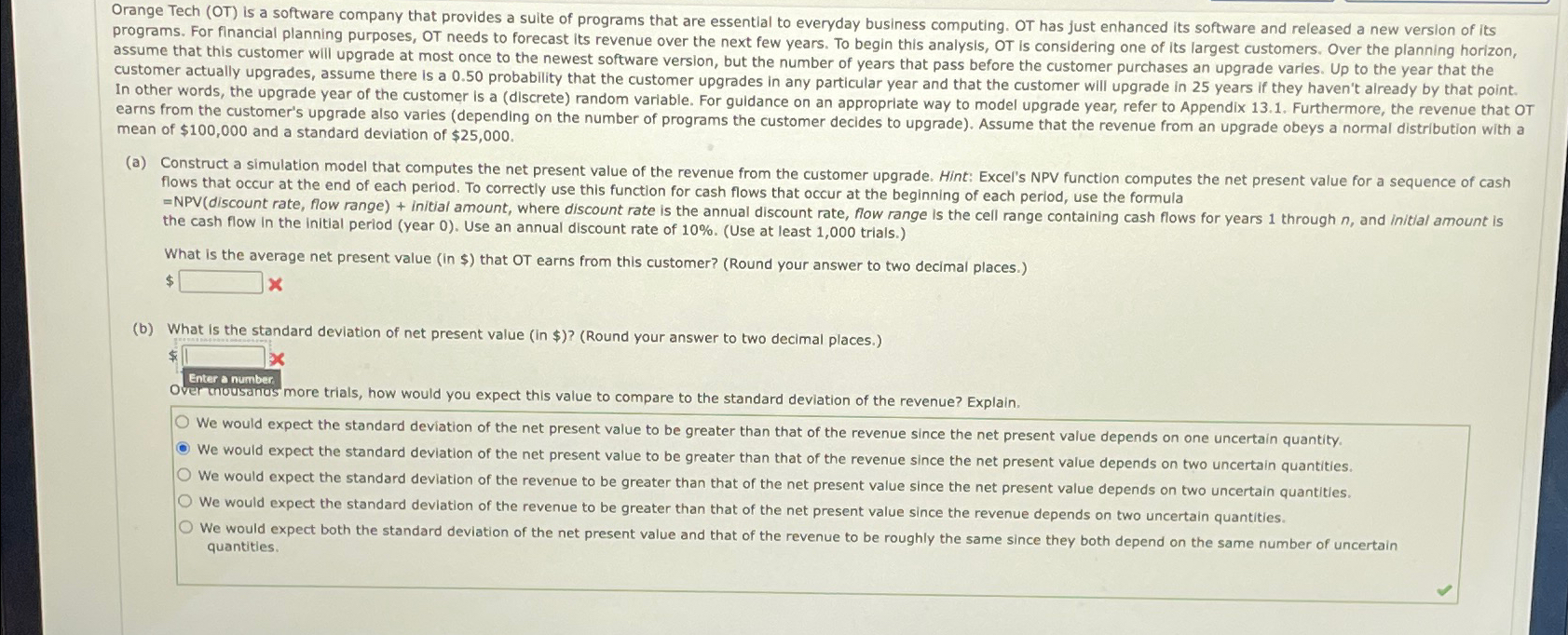

mean of $ 1 0 0 , 0 0 0 and a standard deviation of $ 2 5 , 0 0 0 . flows that

mean of $ and a standard deviation of $ flows that occur at the end of each period. To correctly use this function for cash flows that occur at the beginning of each period, use the formula the cash flow in the initial period year Use an annual discount rate of Use at least trials.

What is the average net present value in $ that OT earns from this customer? Round your answer to two decimal places.

b What is the standard deviation of net present value in $Round your answer to two decimal places.

Enter onumber Over tnousanus more trials, how would you expect this value to compare to the standard deviation of the revenue? Explain.

We would expect the standard deviation of the net present value to be greater than that of the revenue since the net present value depends on one uncertain quantity. We would expect the standard deviation of the net present value to be greater than that of the revenue since the net present value depends on two uncertain quantities. We would expect the standard deviation of the revenue to be greater than that of the net present value since the net present value depends on two uncertain quantitles. We would expect the standard deviation of the revenue to be greater than that of the net present value since the revenue depends on two uncertain quantities. We would expect both the standard deviation of the net present value and that of the revenue to be roughly the same since they both depend on the same number of uncertain quantities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started