Question

Measuring Cash Flows: 1. Use the information and template below to prepare a statement of cash flows: a. The corporation sold $27,000 of product to

Measuring Cash Flows: 1. Use the information and template below to prepare a statement of cash flows: a. The corporation sold $27,000 of product to a loyal customer but has not yet received payment. b. Anticipating an increase in demand for their product, the firm increased inventory by $20,000. c. Net income $40,000 d. Beginning cash $25,000 e. The firm hired a contractor to remodel their office space. The bill for the work was $17,000 and is due but not yet paid. f. The firm purchased a new printer for $3,000 on credit from their local Xerox representative. The printer is heavily used and the firm anticipates needing to replace it by the end of the year. g. Employees have submitted time sheets for work performed but have not yet been paid. In total these accrued wages add up to $8,000. h. The corporation took out a five year loan in the amount of $35,000 to finance their upcoming expansion. i. The company paid out $3,000 in dividends. j. There was no change in common stock k. The company spent $35,000 on new machinery l. Depreciation expense during the relevant time period was $12,000

Measuring Cash Flows: 1. Use the information and template below to prepare a statement of cash flows: a. The corporation sold $27,000 of product to a loyal customer but has not yet received payment. b. Anticipating an increase in demand for their product, the firm increased inventory by $20,000. c. Net income $40,000 d. Beginning cash $25,000 e. The firm hired a contractor to remodel their office space. The bill for the work was $17,000 and is due but not yet paid. f. The firm purchased a new printer for $3,000 on credit from their local Xerox representative. The printer is heavily used and the firm anticipates needing to replace it by the end of the year. g. Employees have submitted time sheets for work performed but have not yet been paid. In total these accrued wages add up to $8,000. h. The corporation took out a five year loan in the amount of $35,000 to finance their upcoming expansion. i. The company paid out $3,000 in dividends. j. There was no change in common stock k. The company spent $35,000 on new machinery l. Depreciation expense during the relevant time period was $12,000

Use the information and your calculations from the Balance Sheet and Statement of Cash Flows exercise posted on Canvas to answer the following questions:

34. The corporation had cash flow from operating activities of: A) $9,000 B) $21,000 C) $33,000 D) $59,000

35. The corporation had cash outflow from investing activities of: A) $38,000 B) $35,000 C) $3,000 D) $0

36. The corporation had cash flow from financing activities of: A) $35,000 B) $32,000 C) $3,000 D) $49,000 Page 8

37. The corporation's cash _______________ by __________________. A) increased, $30,000 B) increased, $18,000 C) decreased, $30,000 D) decreased $18,000

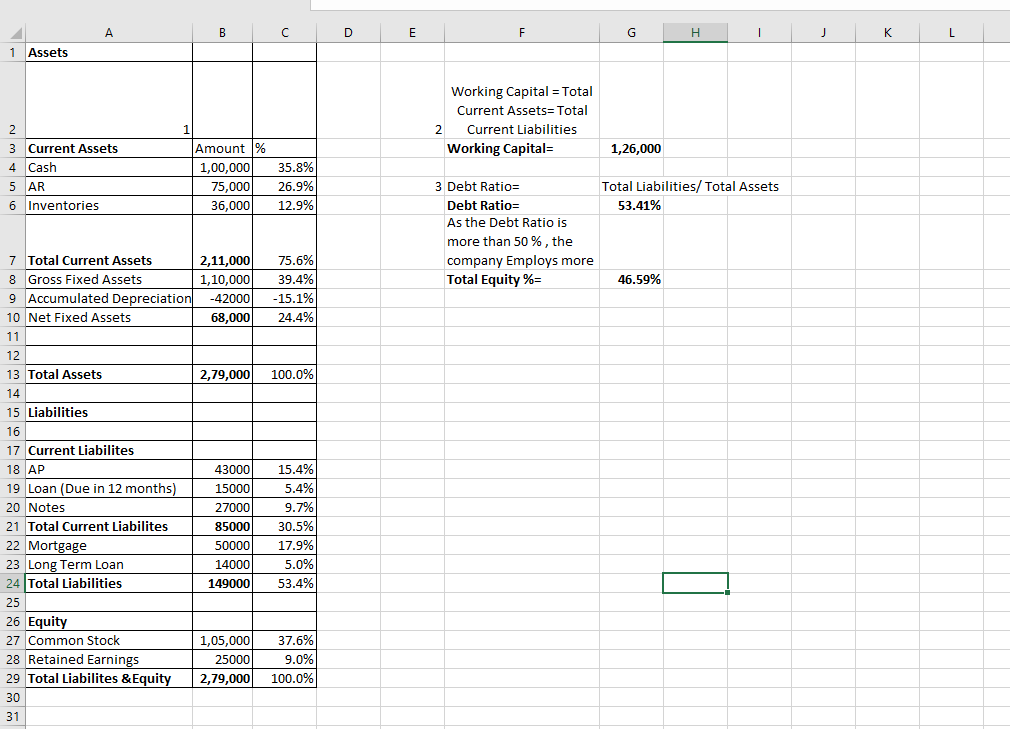

C D E F G H I J K L 1 Assets Working Capital = Total Current Assets= Total Current Liabilities Working Capital= 2 1,26,000 3 Current Assets 4 Cash 5 AR 6 Inventories Amount % 1,00,000 75,000 36,000 35.8% 26.9% 12.9% Total Liabilities/Total Assets 53.41% 3 Debt Ratio Debt Ratio= As the Debt Ratio is more than 50%, the company Employs more Total Equity %= 46.59% 2,11,000 1,10,000 - 42000 68,000 75.6% 39.4% -15.1% 24.4% 2,79,000 100.0% 7 Total Current Assets 8 Gross Fixed Assets 9 Accumulated Depreciation 10 Net Fixed Assets 11 12 13 Total Assets 14 15 Liabilities 16 17 Current Liabilites 18 AP 19 Loan (Due in 12 months) 20 Notes 21 Total Current Liabilites 22 Mortgage 23 Long Term Loan 24 Total Liabilities 43000 15000 27000 85000 50000 14000 149000 15.4% 5.4% 9.7% 30.5% 17.9% 5.0% 53.4% 25 26 Equity 27 Common Stock 28 Retained Earnings 29 Total Liabilites & Equity 1,05,000 25000 2,79,000 37.6% 9.0% 100.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started