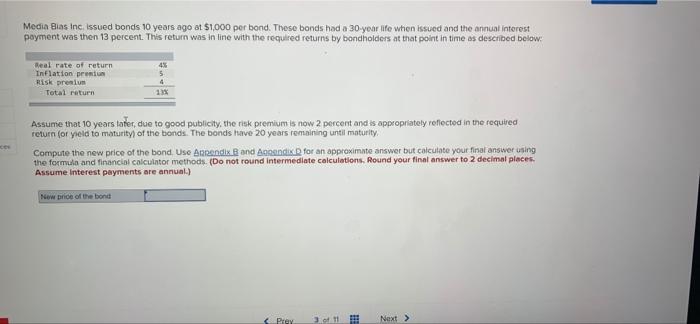

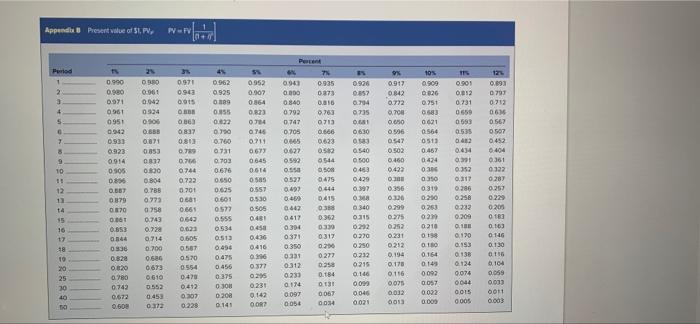

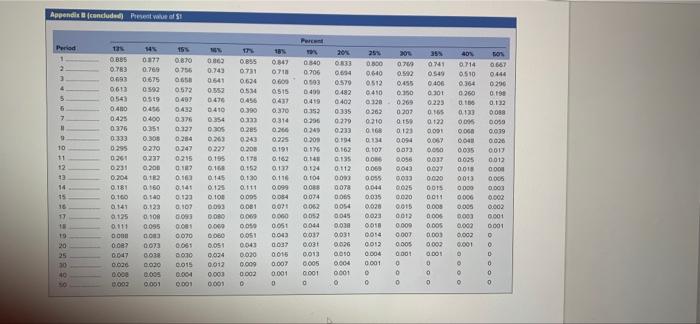

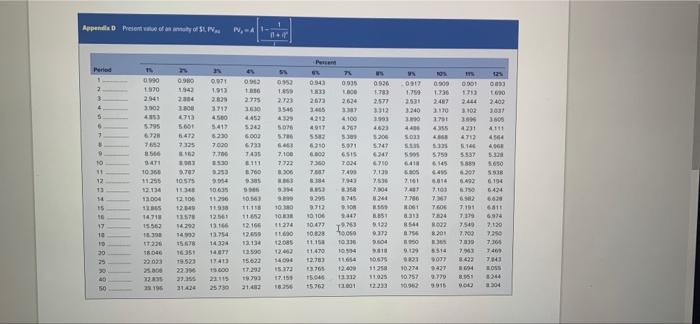

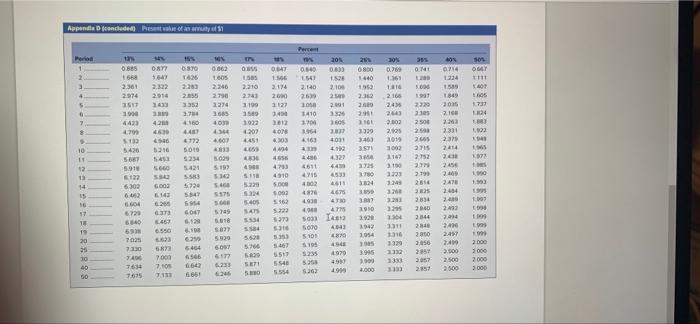

Media Bias Inc issued bonds 10 years ago at $1,000 per bond. These bonds had a 30-year life when issued and the annual interest payment was then 13 percent. This return was in line with the required returns by bondholders at that point in time as described below: 4% Real rate of return Inflation preni Risk premium Total return Assume that 10 years later, due to good publicity, the risk premium is now 2 percent and is appropriately reflected in the required return for yield to maturity of the bonds. The bonds have 20 years remaining until maturity Compute the new price of the bond Use Appendix Band Apandix for an approximate answer but calculate your final answer using the formule and financial calculator methods. (Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume interest payments are annual) Now price of the bond 40 50 TE OREO NO 106 LBS TI 9442 T.53 7606 74 2002 8.200 COTI CLOE RS 2.1 14 . 09004 LES 0.56) 1113 11852 12.16 2.650 12134 250 15:23 11.25 793 21.02 BESS 10.110 9.00 42 7.191 7179 7.549 7.700 7830 7.93 8.422 164 3.951 CH 100 12 10 12 12243 1409 15.373 17.157 1.250 HOL 102 11.15 11470 12.733 3765 5.04 CIPEL SCHOU 1635 19.523 22 22.155 3142 ECES 2203 . 3514 ON 9427 7:46 1400 3843 BOSS 344 1304 12.000 15000 23:15 25730 11258 11025 1024 10.257 WEE CEI 23 at TELE 6.651 cors 1.675 2357 566 000 S 000 5554 5540 SD SEP 19 TES 7.100 HE 3 000 2.000 3.000 50 40 10 2.500 DE 5263 49 CERE LEE DEE DELE 021 SS SEES 7496 6177 7003 6 SEE KISS LOTS 6464 2009 LNS OCEL 44 out 50 OC 2857 2056 2010 21 24 2.497 240 5766 5520 101 S101 5070 7025 SC SEE 535) 1914 5920 6.19 LES 0999 EN IEE CE PES 5467 640 69 9 BE PC 2020 CHEY CHEIOS SU NO VO ret CE SICS Cits CES 955 LED 2140 47 LO 163 003 ET SO 62 SE 6604 E SE 4675 Ort NE NES 54 5.00 ET 09 QUE CE RE RE OBE HE WE 19 TE 17 16 15 14 13 12 11 10 WS OS DES CT COCO LES 2.470 13 25 279 4802 415 00 co 016 5.53 HEE WE 4533 44 4327 3100 4233 5.199 5.914 5660 173 RUS 2752 2715 119 ET BE UIT COOL SCOS CE RES HES GIOS CLE 2014 5.426 3.571 3:43 US 99 2019 401 4.602 POTY COC NO CELS SEE IECE CREE WE E 4163 1954 COS TE 4201 ES 2500 216 1012 GERT E 16 E WE OLVE 42 7 44 160 27 4433 CE KE 14 216 SEE DE TO SUSE GE SE GORE E 51 E ZEE 100 LISE EE SEO 308 EYE 0 5 + 3127 2.000 tos 2166 2 2055 CS SOLE 2.140 PIC Ditt 2.974 2.361 CARE 1274 2.790 2246 1.805 0.862 1849 1589 1.324 74 DIE 1961 2.914 2.322 1647 1.52 1:16 1991 2 11 OGAY son ONI 0.69 160 0800 25 COWO 0.840 LO SED STO 0.85 SOP VIC SOE 205 Period Pere Appende francese