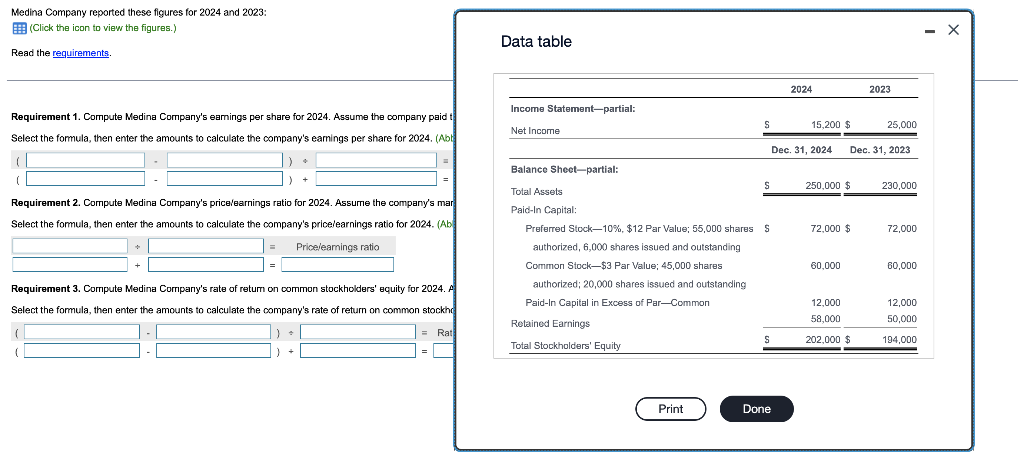

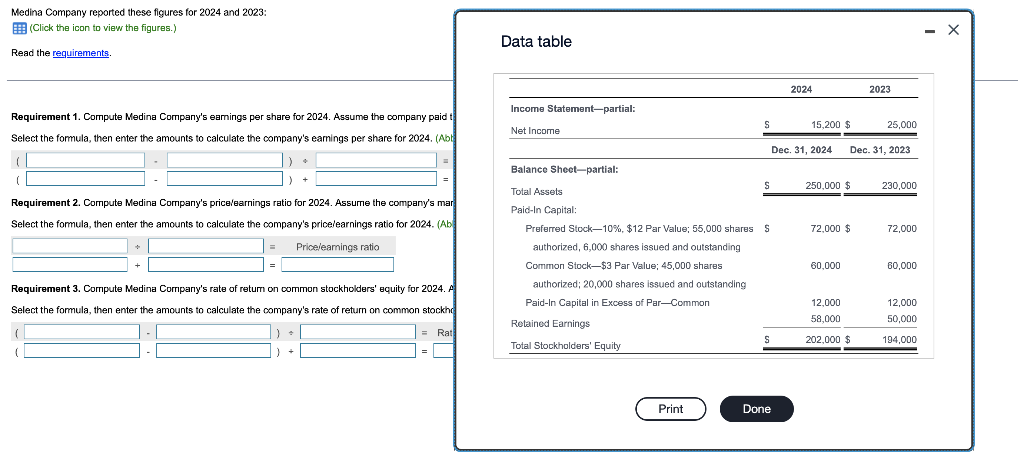

Medina Company reported these figures for 2024 and 2023: (Click the icon to view the figures.) Data table Read the Requirement 1. Compute Medina Company's eamings per share for 2024. Assume the company paid t Select the formula, then enter the amounts to calculate the company's earnings per share for 2024. (Abt) Requirement 2. Compute Medina Company's pricelearnings ratio for 2024. Assume the company's mar Select the formula, then enter the amounts to calculate the company's pricelearnings ratio for 2024. (Ab) =Priceleamingsratio= Requirement 3. Compute Medina Company's rate of retum on common stockholders' equity for 2024. A Select the formula, then enter the amounts to calculate the company's rate of return on common stockh (1(1+))+=Rat= Medina Company reported these figures for 2024 and 2023: Click the icon to view the figures.) Read the Requirement 1. Compute Medina Company's eamings per share for 2024. Assume the company paid the minimum preferred dividend during 2024. Round to the nearest cent. Select the formula, then enter the amounts to calculate the company's earnings per share for 2024. (Abbrevlations used: Ave, = average, OS = outstanding, SE = stockholders' equity, shrs = shares.) Requirement 2. Compute Medina Company's pricelearnings ratio for 2024. Assume the company's market price per share of common stock is \$4. Round to two decimals. Select the formula, then enter the amounts to calculate the company's pricelearnings ratio for 2024. (Abbreviations used: Ave, = average, OS = outstanding, SE = stockholders' equity, shrs = shares.) =Priceleamingsratio= y=+=RateofreturnoncommonSE= Medina Company reported these figures for 2024 and 2023: (Click the icon to view the figures.) Data table Read the Requirement 1. Compute Medina Company's eamings per share for 2024. Assume the company paid t Select the formula, then enter the amounts to calculate the company's earnings per share for 2024. (Abt) Requirement 2. Compute Medina Company's pricelearnings ratio for 2024. Assume the company's mar Select the formula, then enter the amounts to calculate the company's pricelearnings ratio for 2024. (Ab) =Priceleamingsratio= Requirement 3. Compute Medina Company's rate of retum on common stockholders' equity for 2024. A Select the formula, then enter the amounts to calculate the company's rate of return on common stockh (1(1+))+=Rat= Medina Company reported these figures for 2024 and 2023: Click the icon to view the figures.) Read the Requirement 1. Compute Medina Company's eamings per share for 2024. Assume the company paid the minimum preferred dividend during 2024. Round to the nearest cent. Select the formula, then enter the amounts to calculate the company's earnings per share for 2024. (Abbrevlations used: Ave, = average, OS = outstanding, SE = stockholders' equity, shrs = shares.) Requirement 2. Compute Medina Company's pricelearnings ratio for 2024. Assume the company's market price per share of common stock is \$4. Round to two decimals. Select the formula, then enter the amounts to calculate the company's pricelearnings ratio for 2024. (Abbreviations used: Ave, = average, OS = outstanding, SE = stockholders' equity, shrs = shares.) =Priceleamingsratio= y=+=RateofreturnoncommonSE=