Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mediterranean Plc has an asset which cost 400,000 on 1 January 2020 is being depreciated on the straight-line method over 5 years with an

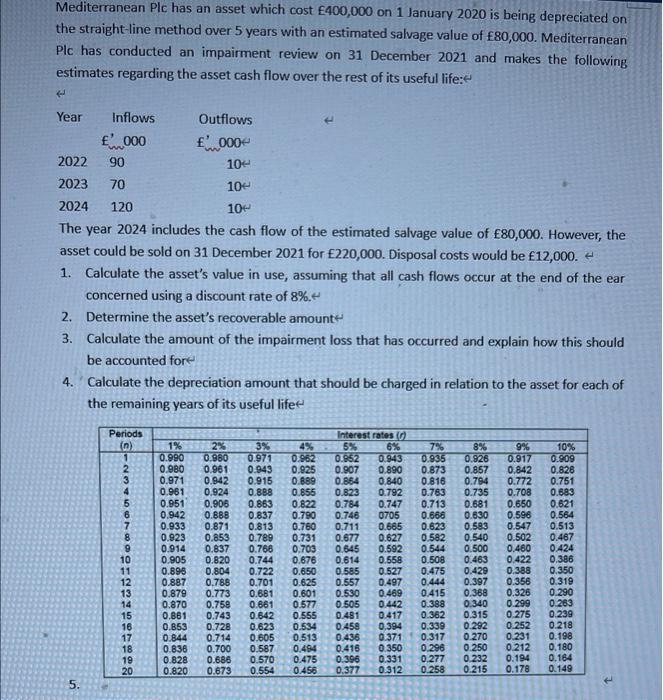

Mediterranean Plc has an asset which cost 400,000 on 1 January 2020 is being depreciated on the straight-line method over 5 years with an estimated salvage value of 80,000. Mediterranean Plc has conducted an impairment review on 31 December 2021 and makes the following estimates regarding the asset cash flow over the rest of its useful life: f Year Inflows 000 5. 2022 90 2023 70 10 2024 120 10 The year 2024 includes the cash flow the estimated salvage value of 80,000. However, the asset could be sold on 31 December 2021 for 220,000. Disposal costs would be 12,000. 1. Calculate the asset's value in use, assuming that all cash flows occur at the end of the ear concerned using a discount rate of 8%.+ 2. Determine the asset's recoverable amount 3. Calculate the amount of the impairment loss that has occurred and explain how this should be accounted for 4. Calculate the depreciation amount that should be charged in relation to the asset for each of the remaining years of its useful life Periods (n) 1 234 5 6 Outflows 000 10 11 12 13 14 15 16 17 18 19 20 10+ 8% Interest rates (6) 5% 6% 7% 0.952 0.943 0.935 0.926 0.907 0.890 0.873 0.857 1% 2% 3% 4% 0.990 0.980 0.971 0.962 0.980 0.961 0.943 0.925 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.942 0.888 0.837 0.790 0.746 0705 0.666 0.630 0.596 0.564 0.933 0.871 0.813 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.923 0.853 0.789 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.914 0.837 0.766 0,703 0.645 0.592 0.544 0.500 0.460 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.895 0.804 0.722 0.650 0.585 0.527 0.475 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.861 0.743 0.642 0.555 0.481 0.417 0.362 0.315 0.275 0.534 0.458 0,394 0.339 0.292 0.252 0.513 0.436 0.371 0.317 0.270 0.231 0.424 0.463 0.422 0.386 0.388 0.356 0.326 0.853 0.728 0.623 0.844 0.714 0.605 0.836 0.700 0.587 0.828 0.686 0.570 0,494 0.416 0.350 0.475 0.331 0.554 0.456 0.296 0.250 0.212 0.277 0.232 0.194 0.820 0.673 0.396 0.377 0.312 0.258 0.215 0.178 0.429 0.397 0.368 9% 10% 0.917 0.909 0,842 0.826 0.751 0.683 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 4

Step by Step Solution

★★★★★

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

ANSWERS 1 Value in use 790...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started